9 Reasons Why CIF Shipping Is Too Good to Be True!

What is CIF shipping?

Cost, insurance, and freight (CIF) or CIF shipping is an international trade term that represents a contract where the seller will cover the goods’ transport to the port of origin, main carriage, and minimum insurance. Easy-peasy, right?

I understand that the temptation to buy on a Cost, Insurance & Freight (CIF) basis is very hard to resist. After all, isn’t it so much easier? When you don’t have to coordinate with a freight forwarder and don’t have to negotiate freight rates, all you have to do is to wait for the vessel or airplane to arrive, right? It’s almost too good to be true! Well, actually, it is absolutely too good to be true.

Why?

#1: Duties and Fees on Ocean Transportation and Insurance Costs

Commercial Invoices will understandably show the agreed-upon CIF costs. Unfortunately, that means the ocean transportation and insurance costs have been included in the sales price and are subject to duties and fees.

For example, if your product is subject to a 3% tariff and the ocean freight cost included in the CIF price is $4,000 then you will pay an additional $120.

In years past, many suppliers showed the cost of ocean transport on the invoice in order to avoid this situation, but Customs now expects rated Ocean/Air Bills of Lading as proof to substantiate any deductions to dutiable merchandise value.

#2: CIF Pricing Hidden Costs

VERY frequently, CIF pricing includes hidden supplier profits on transportation. These profits inflate your overall cost of goods unnecessarily.

#3: Maintaining Control of Your Cargo

You will have a nearly complete lack of control of your precious cargo. If your supplier is arranging the freight, they will understandably select the carrier whose vessel/plane will meet the contractual requirements but at the cheapest possible rate. In a situation where you need to select a faster or unique routing, your hands are tied.

#4: CIF Transit Times Aren’t Always What They Seem

Often times your contracts are based on departure dates from the port of origin. While this fact seems inconsequential, the transit time between carriers can be significant – especially if the supplier selected carrier is using a transshipment ocean service.

When you are expecting a 24-day transit to the East Coast and it takes 36 days, for example, the impact to your operation and cash flow are more than significant. To make matters worse, you usually learn of the delayed arrival after the vessel has departed and it is too late to arrange for a premium service.

#5: DTHC Costs Aren’t Always Included in CIF Shipment Pricing

CIF shipments are frequently quoted without the Destination Handling Charge (DTHC) noted in the quotation. While this meets the requirements of the terms of sale, it does not give the importer the full picture of the total cost.

Many CIF importers are unpleasantly surprised by substantial charges upon freight arrival. When you control your cargo through FOB terms, you can readily accumulate the TOTAL cost of freight for your goods.

#6: DTHC Charges Are Often Inflated

There is a “dirty little secret” in the shipping business. Frequently, the “invisible” DTHC charges noted in item 5 above are also charged well above market rates to transfer freight cost obligations from shipper to consignee (from supplier to buyer).

If you were the freight forwarder being paid by the shipper, who would you be more eager to please when shipping CIF goods? The supplier, correct.

#7: Not All Cargo Insurance is the Same

Are you actually well protected by the cargo insurance provided by your supplier?

First of all, who is listed as the beneficiary on the insurance? In most situations, the company which arranges the insurance is also the beneficiary; therefore, your supplier will receive the payment if your product is damaged. And, since the damage is usually discovered when the freight is unloaded at your warehouse, you probably have already made the final payment on the shipment and now have to hope your supplier will reimburse you from the insurance payment they receive.

#8: Cargo Insurance Costs Don’t Always Cover All of Your Costs

Unfortunately, the problems with insurance do not end with item 7 above.

Even if you require that the supplier list your company as the beneficiary, what costs does their insurance cover? It might only cover the CIF price and now you are left “holding the bag” for Customs Entry, Duties, and the inland transportation from the CIF seaport/airport. And, who pays for the office time, opportunity costs, and therapy sessions? Nobody.

#9: ISF Filing and CIF Shipping

The last major concern is the Importer Security Filing (ISF) Filing

On a CIF shipment, you are relying on your supplier to provide the ISF information to you for the filing. The problem is that as the US Importer of Record, you are held accountable for its accuracy and timeliness.

If your supplier is late with the information, you will be held accountable. ISF penalties start at $5,000 per event with a maximum of $10,000, and who wants to explain to senior management why this fine has to be paid?

Need Shipping Help? Contact Shapiro

About now, I suspect that if you are buying on a CIF basis, you have a sick feeling in your stomach. Don’t worry, this won’t require a doctor’s visit…we’ve got the prescription.

Know of more reasons to love FOB? Have you done the switch and have advice to share with others?

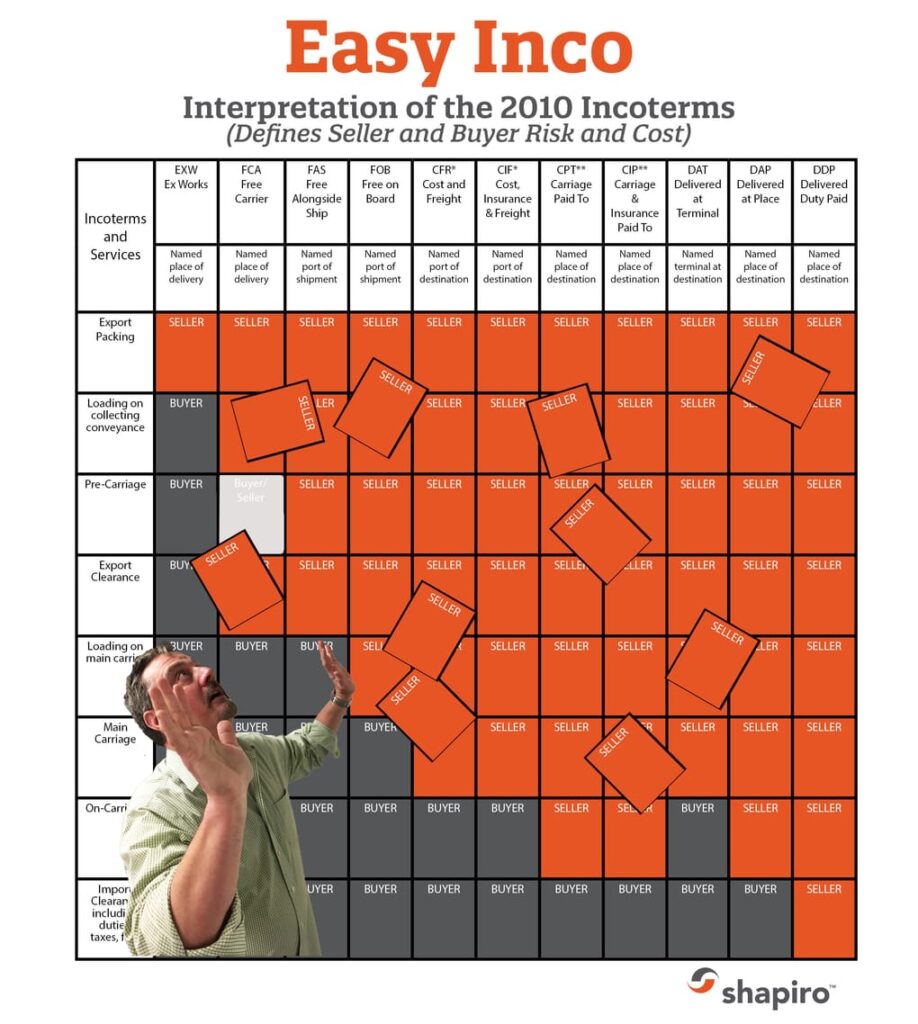

p.s. While you’re here, also check out our handy (and printable) 2010 Incoterms/terms of sale handout and learn about 4 most common cargo insurance misconceptions.

MYRILDA SLOCUM says:

Dear Jeff,

Your points are spot-on. I would like to comment on your #2. While we know that the supplier almost always makes money on freight, our company has to consider the fact that if we chose F.O.B., our invoice prices would likely rise. The seller wants to make his money, and if we can keep him happy with the extra amount he makes on freight, he may be unwilling to increase the cost of the goods. This is a fine line we walk.

Jeff Knapp says:

Dear Myrilda,

Thank you so much for the feedback! You are certainly not alone, and many other importers face the same dilemma.

We recommend that you ask for product quotations based on BOTH CIF and FOB terms.

When the unit price per product increases under FOB terms, you are well within rights to indicate that you are not pleased to see that freight profit is such a key part of their pricing. A likely “excuse” will be that your cargo is part of their overall volume pledged to a carrier. Please note that this is only possibly true if the cargo is moving directly on an ocean carrier contract (and not through a freight forwarder). Your Customs broker will be able to confirm this based on how cargo release occurs here in USA.

Two more points to consider: a) please don’t forget that you may be paying duty on your freight under CIF terms and b) there are reputable forwarders out here (some with names beginning with ‘S’) who will be happy to give you the freight quotes necessary to fully compare your manufacturers’ CIF and FOB pricing options. Maybe the supplier signed a contract with a steamship line, but does that really give them the right to make profit on freight?

We have to acknowledge that our suggestions above are much more likely to succeed when you have more than one sourcing option, of course!

Thank you again for broadening this conversation.

Jeff Knapp

Logistics Problem Solver

Dale says:

Well, people choose CIF knowing the convenience going to cost more. That’s the cost of doing business. What’s the big deal?

Jeff Knapp says:

Hello Dale!

The trade-off between convenience and the dollar cost is part of the FOB vs. CIF decision. However, the problem is that many importers only look at the rate quote difference and fail to calculate the additional potential issues listed in the blog. Comparing apples to apples, instead of to starfruit.

If a company is fully aware of the all the potential costs and feels that this is still the best option, then they have made an informed decision.

Thanks for taking time to comment!

Jeff Knapp

Logistics Problem Solver

Eric says:

Hello Jeff,

Thank you for your information. One of my concerns is being able to locate a good, inexpensive and reputable freight forwarder abroad. I am working at shipping goods between two foreign countries and I feel that CIF is the best bet. Although, it doesn’t hurt as you mentioned to ask for the FOB price, so you can see how much you are paying for shipping and see if it sounds reasonable.

Although, if you find 10 companies abroad that you are interested in importing from and you have ask them all to quote you in CIF, then you should be fine right? I mean in this aspect you are comparing apples to apples. Do you happen to know if insurance on CIF typically covers food spoilage, in case that happens. I was provided with a CFR quote (no insurance), I thought this was good, because I can buy this on my own and as you mentioned pick my coverage and name myself as the beneficiary.

Eric Ramos says:

Sorry, I just wrote the message above and I wanted to ask you about your thoughts on under invoicing. I know this happens, but as I am new to this business and I wanted another persons view on this. Also, I don’t know how this would work with insurance, as I’m sure a policy would only cover the listed value, plus maybe some other costs as you mentioned, like tariff, DTHC and possibly some other smaller expenses.

Shapiro says:

Hello Eric,

Thank you for writing in.

Apples are not always apples. We would still recommend asking for FOB pricing because one apple is not necessarily the same quality as another apple. One could simply pad more profit into shipping while using cheaper materials, so what you’re really getting is a watermelon to orange comparison. Take care in this regard to ensure you are receiving the quality product you are looking for.

To answer your insurance questions, not all policies are the same. Unfortunately there isn’t one answer since different cargo insurance policies may have their own specific conditions. You should take care to read the fine print of any maritime insurance policy. Specifically, search for one that covers foreign-to-foreign shipments.

Also be attentive to the method of shipping & packing (dry ice vs. reefer container as the example) – food spoilage may or may not be covered. In other words, it really depends on what caused the spoilage in relationship to the insuring conditions.

Maritime insurance policies also vary in coverage from a value perspective. You should look for additional coverage provided beyond the carrier’s insurance that would cover 110% of your CIF value to be properly protected.

We hope that was able to assist you and we wish you the best of luck in your new venture!

John Craig says:

Jeff,

I’m very new to the shipping industry so still unaware of its many intricacies. For this reason I’m slightly confused by some of the above text discussing freight premiums that will be added to contracts purchased under the CIF terms. Does the selling company add a premium higher than their freight charges the majority of the time in the final invoice of the material?

Sunday Palane says:

Guys between CIF an FOB which u believe is de most beneficial to business?

Ghislain Viau says:

My manufacturer in China shipped a cargo CIF but didn’t do the ISF filing and sent me the paperwork 2 days after shipping occured. The ISF filing needs to be done 24-72 hours BEFORE shipment leaves the port. So now, I’ve got a shipment coming to me which will get a penalty of $5,000. This would have been avoided if I had used freight forwarder and used FOB. So I agree with this posting on using FOB instead of CIF.

Shapiro says:

Hi Ghislain,

We appreciate your support on this issue!

We’re sorry to hear about the issue with your late ISF filing. That is one of the risks associated with shipping CIF, and we would recommend that you ship FOB moving forward to alleviate similar issues.

If you need any assistance with future shipments, please don’t hesitate to reach out.

Fatima says:

I completely agree with you

It’s important to check on both Quotes FOB and CIF but it doesn’t solve the problem especially if you dealing with a rogue entity

What if the Supplier doesn’t insure the consignment even though it’s CIF

How can one guarantee to get the insurance as per the contract

Then we have the supplier doing cartwheels to run away from the problem and costs us money in wasted costs . Investment etc

Most disappointing if the Supplier is from the UK and the Government Trading Authorities shield the offending supplier from any legal action

I was to,d by the UKTI head of Dept to Stop contacting them about the derelict supplier else he will complain about me to the government

I believe this attitude is giving the supplier free reign to ROB overseas clients

We all must ensure all suppliers are forced to be ethical in their business else we must name and shame them and make them pay with penalties

So who knows which department in the UK can assist when a UK supplier cheats his buyer in an international deal

Please let us know urgently

Thanks

Shapiro says:

Hi Fatima,

We’re sorry to hear about the supplier related issues you are facing.

We recommend that you require the supplier provide you a copy of the Insurance Certificate with the CIF Price as the insured amount at a bare minimum. Also, request that you , as the buyer, be listed as the payee on the Insurance Certificate.

In reading your concerns about “rogue” suppliers, if you have little trust in them meeting the insurance requirements as required in the contract, one solution may be to switch to CFR and insure the shipment yourself or even switch to FOB. Even the cost of paying more on a FOB shipment in the short term might be a wise investment in terms of time lost and unpaid claims in the long term.

Please don’t hesitate to reach out if you need anything at all.

jignesh says:

sir,

we importing machinery from china. delivery CIF Nhavasheva.

now confusion is which charges we have to pay At here Nahavsheva.

cz …freight , insurance has payed by consignee.

Please try to clarify

Corey Wagner says:

Hi Jignesh,

Thank you for reaching out to us about your shipment.

If the goods were shipped CIF, the shipper is responsible for the freight and insurance, not the consignee.

Please check out our Incoterms resource that covers the responsibility over the cargo and charges as this may help to clarify what charges you should have to cover for the shipment.

Incoterms 2010: http://www.shapiro.com/shapiro-u/resources/incoterms-2010/

Rajesh says:

Hi Jeff,

Thanks for the great article! Quick question, why not go one step ahead and choose EXW instead of FOB? That way further monies can be saved right since that closes all doors on the seller to make money on the freight right?

Shapiro says:

Hi Rajesh,

We’re glad you enjoyed the blog!

There are many factors to consider when choosing EXW or FOB for a shipment. Depending on the country of origin, the relationship with the supplier, or the size of the manufacturer, sometimes it can be cheaper and easier for an importer to let the supplier handle the container drayage to the port. Other importers prefer to have total control of the supply chain once production is completed and therefore choose to ship EXW.

Diane says:

I sort of get the difference and benefit of going FOB instead of CIF, but now I just read about FOB collect and FOB ppd?? Totally confused. seems like FOB either one now takes the term to CNF/CIF???

Diane says:

or does FOB shipping pt/FOB destination only effect title of goods but not the transportation fees?? Going from one to the other does not or does change the incoterms?

Mike says:

Hi,

I am very new to the shipping industry but I bought an item from China (of course!) for personal use on a CIF basis.

The cost of the item is $2,480 plus I paid them $145 for shipping. The bill of Lading doesn’t show shipping costs it says “prepaid as a arranged”.

The question is do I need to file an ISF (The limit being $2,500)?

Please advise.

Thank you.

Shapiro says:

Hi Mike,

On a CIF shipment, you are responsible for the ISF filing and making sure it is filed timely and accurately. Even though the total cost may only require an informal entry, ISF will need to be filed. We recommend that you contact your broker to ensure they have all the necessary information to handle the ISF. .

Please let us know if you have any other questions.

Thanks!

Shapiro says:

Hi Diane,

Shipping FOB indicates that the responsibility for the goods is transferred to the buyer once the cargo is loaded onto the vessel. The payment terms (prepaid or collect) an importer has with their supplier does not change the Incoterm used for a shipment.

Please let us know if this helps clarify the difference between CIF/CNF and FOB.

Agnes says:

Hi all.

I am waiting for my shipment from china. Chosen CIF.

Shipment is going into London and transfer to Southampton and not Felixstowe and Southampton.

My freight forwarder is claiming I will need to pay additional £127 for handling fee and inland clearance, does that sound right ? He only let me know 2 days before the shipment arrives so don’t have a choice really

Shapiro says:

Hi Agnes,

We’re sorry to hear about the confusion related to the shipping charges.

Since the CIF Incoterm was chosen, any clearance fees or charges related to moving the freight once it arrives at the destination port are the responsibility of the importer. Your forwarder/broker should have let you know what the charges would be well before the shipment arrived, but you can ask for for an itemized invoice to see exactly what services are being provided.

Please let us know if you have any other questions.

Rutul says:

Hi, just an out of the context question!

What if the importer has forgot to cover the insurance also did not have any freight certificate to prove the freight paid by him, as per CIF?

How will custom react in the case ?

Shapiro says:

Hi Rutul,

Thanks for reaching out!

If the Incoterm used was CIF, the responsibility to pay for insurance and freight charges falls on the seller. The seller should have also provided all shipping documents to the importer for customs clearance.

The importer can choose to purchase additional insurance if needed, but the seller is required to insure the cargo as well as pay for the freight charges based on CIF.

Please let us know if you have any other questions.

Robyn Mohr says:

Who is responsible for paying for the ISF filing and the handling / forwarder fees after arrival to the port of destination an LCL shipment that is CIF? Appreciate the clarification.

Laurie says:

Hi

I am looking at buying a small excavator from China and having it shipped to Sydney Australia and have no experience in this area. I’m not sure after reading the above what would be the best for me CIF or FOB? the company who is supplying the machine has quoted the same cost for either option, which would I be better off doing given my situation.

Shapiro says:

Hi Robyn,

You would be responsible for the ISF filing as well as any charges once the shipment arrives at the port of destination. Under the CIF Incoterm, the supplier is only responsible for the freight and insurance charges.

We hope this clarification helps!

Shapiro says:

Hi Laurie,

Many options should be considered when importing for the first time. For instance, you may be able to get better transportation rates or want to purchase additional insurance if you elect to ship FOB. If you do not want to handle purchasing insurance or dealing with the freight rates, CIF may be the better option. It all depends on how hands-on you would like to be on the shipment.

Good luck with your shipment!

Laurie says:

Thank you .

Bruno says:

jeff,

I have some products that are in CFR, and some consultants say it is more profitable to go to CIF. What is the difference between the two? And the advantages and disadvantages of making this transition?

Shapiro says:

Hi Bruno,

Thanks for reaching out!

The main difference between CFR and CIF is the supplier pays for insurance as well as the freight charges when a container is shipped CIF. Your supplier may be able to offer cheaper insurance rates, but you need to make sure that your goods are adequately covered in case of damage, stolen or lost items, or any other issues with the shipment.

Please let us know if you have any other questions!

Anish Nair says:

Hello Jeff,

Above was very useful and informative. Need to have one clarification. We have import LCL shipments coming from China on C&F terms. However after arriving the shipment here in Dubai, the agent over here charges us the BAF & ISPS, saying that there is an instruction to collect it from the destination. Can you clarify under C&F terms, these charges to be paid by who… consignor or consignee….. Please assist…

Shapiro says:

Hi Anish,

We’re glad to hear you liked the blog.

Contact your agent and supplier to ensure what charges should have been included since C&F terms were used fro the shipment. We have seen instances in the past similar to your situation.

Cost and Freight means that the seller delivers when the goods are loaded on board a vessel at the named port of shipment. The seller must pay the costs and freight necessary to bring the goods to the named port of destination BUT the risk of loss of or damage to the goods, as well as any additional costs due to events occurring after the time of delivery, are transferred from the seller to the buyer when the goods are loaded onto the vessel.

We hope this additional information helps!

Raniel Padua says:

Hello Jeff,

We have a shipment coming from S. Korea on CIF Jeddah KSA terms. The ship arrived in Jeddah Port but was not able to discharge our goods due to shipping lines fault. It left the Jeddah port (with our goods) heading to the next destination. Shipping lines will try to arrange discharge of goods on that next port of destination and load it on another vessel to Jeddah. If it does not work, the goods will return to S. Korea. From there shipment will be re-arranged.

In this scenario, when does the transfer of title on goods happen?

Thank you for your input.

jabu says:

I’m about to import a car from Japan to Swaziland for the first time in my life. The car cost $1500 on FOB and $1820 on CIF. I’m promised it will be delivered to my clearing agent without any extra cost if I choose CIF. Is that true?

i

Shapiro says:

Hi Raniel,

We’re sorry to hear about the issues you have experienced with this shipment.

Based on the CIF term, the seller must pay the costs and freight necessary to bring the goods to the named port of destination BUT the risk of loss of or damage to the goods, as well as any additional costs due to events occurring after the time of delivery, are transferred from the seller to the buyer when the goods are loaded onto the vessel.

This means that the seller could argue that they have no responsibility for the goods missing the correct port of unlading because the steamship line failed to unload the cargo.

We recommend that you contact your broker and the steamship line to see what steps need to be taken to ensure the goods will arrive in Jeddah with no other issues.

Shapiro says:

Hi Jabu,

Thanks for reaching out to us!

Although the shipper may promise that there will be no additional charges if it is shipped CIF, there is no guarantee that this will be the case. For instance, the insurance they provide might not adequately cover the shipment in the event of an accident or damage to the goods. Also, the supplier may not account for destination terminal handling fees, the customs entry, duties, or in the worst case scenario, an exam.

We recommend that you confirm what charges will be paid by the shipper, there is adequate insurance coverage if you allow the supplier to arrange the insurance, and get in touch with your broker to determine what additional fees will apply once the shipment arrives in the U.S.

Good luck with the shipment and please let us know if you have any other questions.

Good luck

Marlin says:

Would like to clarify, is the difference of FOB and CIF only in the freight cost?

Since under both incoterms buyer still need to pay for the local clearance charge.

For FOB, does the local export custom clearance covered by shipper? For FOB, At which point do we inform the forwarder to take over?

Thank you

Marlin

Hamza says:

Hi,

I’m about to order from China with delivery to Geneva, Switzerland. It’s noted as CIF to Switzerland. Switzerland not having a seaport it will most probably have to be transported by land until Switzerland. Will the charge of transport by land be at my cost or the suppliers? If the charge is at my cost, how can I know how much I’m supposed to pay?

Thank you

Shapiro says:

Hi Hamza,

Thanks for reaching out to us!

You should confirm with your supplier what the final destination will be under the CIF term and if they will only be responsible for the ocean freight charges. Once you confirm the final destination in the supplier’s eyes, then you can make the decision of whether or not to change the Incoterm to encompass the delivery to your location or possibly even taking control of the cargo sooner in the supply chain process.

Please let us know if you have any other questions.

Shapiro says:

Hi Marlin,

Thanks for contacting us!

Under the CIF term, the seller is not only responsible for the freight charges but also the insurance. Under both CIF and FOB terms, the buyer is responsible for the final delivery and any charges related to the customs clearance or exam charges.

If FOB term is used, the seller handles the export clearance and the transfer of goods takes place to the seller once the shipment is loaded onto the vessel.

We hope this information helps and please reach out if you have any other questions.

David says:

I want to order a ton of copper from Ukraine. The company says they will send product CIF. I live in Wisconsin. Is the cost I was given by the supplier the total cost(s) I will have to pay? Also, is the cost including ground shipping from port to final destination?

vijayanathan v says:

Sir, we received a inquiry order from china , on the basis is of CIF payment mode. its is a good for exporter, because we are the new exporter .

kindly advise regarding this

thanking you

vijayanathan .v

Shapiro says:

Hi David,

Thanks for reading our blog!

Under the CIF term, you are responsible for the customs clearance and final delivery. If you would like for them to handle the final delivery or customs clearance, you will need to choose an Incoterm that places those responsibilities on the supplier.

For more information on Incoterms, check out our resource: http://www.shapiro.com/commercial-cargo/quick-facts/incoterms-2010/

Don’t hesitate to reach out with any other questions.

Shapiro says:

Hi Vijayanathan,

Thanks for reaching out!

The Incoterm you and your customer decide to use should reflect what responsibilities are required by both parties and the time at which the transfer of goods occurs. It solely depends on how much control you want to have on the shipment. If you do not feel comfortable handling the freight and insurance on the shipment, you will need renegotiate the Incoterm used for this shipment to transfer those responsibilities to your customer.

For more information on Incoterms, check out our resource: http://www.shapiro.com/commercial-cargo/quick-facts/incoterms-2010/

Good luck and please let us know if you have any other questions.

MR Samuel says:

Hi,thanks for the information I was ask to export frozen goods like fresh meat from Lagos Nigeria to Haiphong sea port Vietnam but confused because the buy put his payments terms on cif pls advice me which terms to chose as a beginner in shipping industry.

Shapiro says:

Hi Samuel,

Thanks for checking out our blog!

Cost, Insurance & Freight means that the seller delivers when the goods are loaded on board a vessel at the named port of shipment. The seller must pay the costs and freight necessary to bring the goods to the named port of destination BUT the risk of loss of or damage to the goods, as well as any additional costs due to events occurring after the time of delivery, are transferred from the seller to the buyer when the goods are loaded onto the vessel. The CIF term requires the seller to clear the goods for export and to provide minimum insurance coverage.

If you do not feel comfortable arranging the shipment in this manner, you can ask the buyer to accept another Incoterm that would transfer the responsibility for the shipment to them earlier in the supply chain process.

I have included a link to our Incoterms page so you can determine which Incoterm may be best for you: http://www.shapiro.com/commercial-cargo/quick-facts/incoterms-2010/

Ton says:

HI Guys

I Produce my products in Malaysia and I plan to send an

LCL (8c3) to my distributor in Spain for the first time. My Factory in

Malaysia has his own Freight forward line and the Freight with them is

just usd7/c3 while the Spanish Forwarder is asking to my distributor

85usd per Cubic meter. So we were thinking to use CIF to reduce the cost

of the Freight.

When my Distributor mentioned to the Spanish

forwarder that he planned to change from FOB to CIF they mention that

the arrival and clearance cost could increase much but they don’t give

any info to specify and reply the following;

*In that case (using

CIF), the offer we provide you would not be valid since it is quoted

considering that we would be talking about a Port Klang FOB, and the

expenses that appear in it, would be the agreements that we have with

the shipping companies to realize the shipments

However, if it

was another company that brings the goods to Spain, we would have to ask

for the arrival expenses to the associate agent that company has in

Spain, and we can not know them until the B / L is available, since we

will have to ask for them and we would not control them until the

arrival of the merchandise to Spain, when the agent facilitates them.*

Is there any way to obtain a quote of the clearing cost when using CIF?

Thanks and regards

Annie Sung says:

Hi ,

If we do CIF delivered to customer door, who will be responsible for the custom exam and any demurrage charge happened in discharge port ?

Thank you

Mazura Mohamed Noor says:

Hi Sir,

Good morning..

I will have one import ( machine ) shipment from China.

Shipment term is : CIF Penang ,Malaysi Port.

Understand For CIF ,shipper have to bear for the freight and insurance.

But in my situtaion is, shipper have indicate Freight and insurance cost in our contract .

Thus shipper have indicate the CIF ( cost of machine + insurance + freight ) amount into the commercial invoice for the shipment.

Does this correct ? It looks like i’m a buyer have to bear for the insurance and freight not a shipper?

Pls advise.

Thanks.

Rgds,

Zura

Shapiro says:

Hi Ton,

Thank you for reaching out to us!

A CIF quote typically includes Customs clearance and arrival charges. So, in the scenario you describe above, your Malaysian factory should provide you with the costs associated with clearing the goods as well. If they are unwilling are unable to do so, then this would not be a true CIF shipment. Hence, you should go back to your factory and inquire about what their forwarder would charge for Customs clearance in Spain.

We hope this information is helpful and please don’t hesitate to reach out with any further questions.

Shapiro says:

Hi Zura,

Thank you for checking out our blog!

As our blog mentions, commercial invoices will show the agreed upon CIF costs. Your supplier is correct to have listed these costs on your invoice. Unfortunately, that means the ocean transportation and insurance costs have been included in the sales price and are subject to duties and fees, which is one of the many reasons you should consider changing your terms of sale for future shipments to FOB.

For more information on Incoterms, check out our resource:

http://www.shapiro.com/commercial-cargo/quick-facts/incoterms-2010/

We wish you the best of luck and please feel free to reach out to us with any more questions.

Shapiro says:

Hi Annie,

Thank you for reaching out!

In the case of CIF terms, the seller’s responsibilities end once the goods are delivered at the buyer’s port of choice. Thus, any exam or demurrage charges would be the buyer’s responsibility.

We hope this is helpful and please let us know if we can be of any further assistance.

Issac Sapinski says:

This is one of the finest posts I’ve come across in a while. It’s nicely composed and thought out.

SG says:

Great post, thank you. I agree that FOB shipments are better overall. Most importers are not aware that CIF shipment costs add up and they are unprepared when their broker bills them.

One thing I encounter frequently with CIF shipments is the customs broker asking for the amount of the insurance and/or “ex works” pricing so they can assess duties based on that amount instead of the commercial invoice amount. Are sellers required to provide that? For ex: I’m referencing a clearly defined CIF Los Angeles port shipment with the buyer being responsible for customs clearance, fees and inland delivery. In this scenario the broker contacted the seller and asked for the ex works cost. They also advised the buyer that they don’t have to pay duties against the CIF invoice prices.

Merritt Trigg says:

Hi Shea,

Thanks so much for checking out our content!

I would require a few more details to fully answer your question. Please feel free to contact us at [email protected] to further discuss.

Allen Gatan says:

Dear Shapiro,

I have a client that is asking for a CIF Price. I am used of submitting price proposals to clients that equipments can only bought locally. Now there was certain equipment that i have to import abroad and client is asking for CIF price. The thing is, i am not a registered importer. Please help.

Allen Gatan, Davao City

Merritt Trigg says:

Hi Allen,

Firstly, thank you very much for reading our blog. We would be more than happy to assist you, but would need more information in order to do so. Please contact us at [email protected]

Yuliya says:

Hello – thank you for the helpful info! We received goods from China purchased on Ali Baba that were shipped CIF. The goods arrived damaged, the delivery report states that the product was not properly packaged. The seller is refusing to refund shipping citing CIF, however there is no evidence as to where the damage occurred- prior to loading on the vessel or after (since the product was not properly packaged). The insurance company is in China and would probably be a pain to deal with. Additionally, Ali Baba Trade Assurance terms cover “damaged packages”. What are the best next steps- thanks so much!

Maura Perry says:

Hi Yuliya,

Thanks for reaching out. If you have contact with Ali Baba, you may be able to file a trade insurance claim to open an investigation. However, we recommend contacting your Customs and Trade Attorney for further assistance. Please don’t hesitate to reach out to us if you have any other questions!

Nirav says:

Hi Shapiro

We are considering of buying Metal from India.

Now the biggest concern here we have is whether to go CIF or FOB.

My choice is FOB but my boss wants CIF –

We are not located at port of destination but inland 1000 miles from port of discharge (Vancouver).

what compelling argument can i give him to change it to FOB.

Is there any requirement on shipping line containers if they book CIF Vancouver then container must be emptied and returned in Vancouver ? (means it can not go to Calgary)

Maura Perry says:

Hi Nirav,

Thanks for reaching out! As a buyer, choosing to ship FOB may be less expensive than CIF, since you don’t need to pay a broker or forwarder to assist your import. However, you also bear the responsibility of the entire shipment once it leaves the port of loading. If you choose to ship FOB, beware that additional costs could still be incurred at the port of entry, etc. depending. It is up to you and your boss to decide how much responsibility you would like to assume as an importer with your shipment. Please reach out to us if you have any additional import questions.

eddie says:

I have a shipment from Alexandria to Rotterdam. I was given both FOB & CIF quotes.

I leaning toward CIF.

My question is, when is payment to the supplier usually due?

Lastly, what are your strongest services?

Respectfully,

eddieS

Maura Perry says:

Hi Eddie,

Thank you for contacting Shapiro. Payment to the supplier would be due based on whatever was negotiated with your supplier – there is no standard time frame. It could be due before receipt/production, due upon receipt, or even due 90 days after receipt.

To learn more information about Shapiro’s capabilities, please visit our service pages or reach out to [email protected] . Thank you!

ARC worlswide ltd says:

Freight forwarding blog was useful. Thanks for his!

Ivy says:

We have bought a parcel on cif from uk which trans ship in Munich to us. The shipper has advised due to the prolong issue (as the shipper did not do the correct paper work from the start), the basic insurance which the supplier paid needs to be changed to standard refundable insurance coverage policy otherwise the parcel is bring hold up again.

As a buyer what are the implications for us now?

Maura Perry says:

Hi Ivy,

Thank you for reaching out to Shapiro. With the limited knowledge we have of your shipment, under CIF terms the supplier is responsible for all insurance, however we’ve never encountered a specific situation that has required a change such as this. If you would like to reach out to [email protected] with more information, we can try to be of additional assistance. Thanks!

Vinko says:

Hello, we are looking for customs broker in EU who can offer us

customs clearance for goods imported outside of EU, such as China, UAE

If you can provide me DDP service, please let me know

Vinko

Maura Perry says:

Hi Vinko,

Thanks for contacting Shapiro. We ask that you please click HERE to fill out a contact form on our website with additional information about your shipment, in order for our team to determine whether or not Shapiro can assist. Please let us know if you have additional questions. Thanks again!