Get the Right HTS, HS, or Schedule B Code—Before It Costs You:

When it comes to HTS codes and product classification, the smallest details can make a world of difference.

These aren’t loopholes—they’re the fine lines that define compliance. Knowing where your product fits can mean the difference between staying profitable and paying penalties.

When Every Detail Changes the Duty

Each variation tells a different story to customs officials—and the wrong one can lead to overpaid duties, compliance flags, or delayed shipments.

- A garment that extends below the hips can be classified as a coat instead of a jacket—and that distinction can mean a 10–15% difference in duty rates.

- A scale model aircraft intended for hobbyists may be duty-free, while a similar “toy plane” designed for children can be 6.8% or more.

- Importing a tool kit preassembled vs. shipping individual tools separately can trigger different classifications.

- Juices and soft drinks are classified based on sugar levels. Below 10% sugar? 0–5%. Above 10%? Up to 29% in duties.

Stop guessing which tariff code fits your product.

Our licensed customs brokers will analyze your product details, verify the correct classification, and email you the exact HTS, HS, or Schedule B code along with the corresponding duty rate—typically within one business day.

HTS Builder

Need expert help from our Compliance staff for HTS classification?

What Are HTS, HS, and Schedule B Codes? — Breaking Down the Basics

Let’s start simple. The HS (Harmonized System) is a standardized global classification system developed by the World Customs Organization. Every product shipped across borders has an HS code, usually six digits long.

From there, the HTS (Harmonized Tariff Schedule) adds more detail—typically up to 10 digits—and is used primarily by U.S. importers. The Schedule B code is used for exports from the U.S. and managed by the U.S. Census Bureau.

In short:

- HS Code: Global base classification (first six digits).

- HTS Code: U.S.-specific import code.

- Schedule B Code: U.S.-specific export code.

HTS Codes: The U.S. Edition of the Trade Playbook

While HS codes form the global foundation, HTS (Harmonized Tariff Schedule) codes add four more digits for U.S. import specifically. Managed by the U.S. International Trade Commission (ITC), HTS codes determine the exact duties payable on imported goods.

The Difference Between HS and HTS Codes

| Code Type | Digits | Purpose | Managed By |

| HS Code | 6 | Global trade classification | World Customs Organization |

| HTS Code | 10 | U.S. import classification | U.S. International Trade Commission |

| Schedule B Code | 10 | U.S. export classification | U.S. Census Bureau |

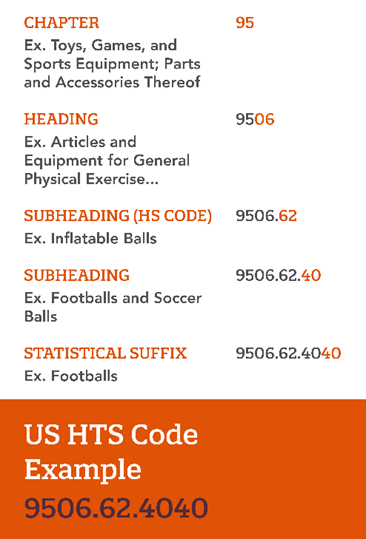

HTS Code Breakdown: Understanding the 10 Digits

1. Chapter (2 Digits): Broad Category

2. Heading (2 Digits): Specific Class

3. Subheading (2 Digits): Detailed Subcategory

4. National Subheading (2 Digits): U.S.-Specific Detail

5. Statistical Suffix (2 Digits): For Tracking and Reporting

How to Search for HTS Codes Using CROSS

The Customs Rulings Online Search System (CROSS) lets you look up historical classification rulings. You can find prior decisions, duty rates, and CBP interpretations—helping you make informed, compliant choices.

Schedule B Codes: The Export Counterpart to HTS

While importers deal with HTS, exporters use Schedule B codes. Both share the same first six digits (the HS portion), but the final four digits may differ depending on U.S. Census classifications.

How Schedule B Numbers Differ from HTS Codes

- Used only for exports

- Managed by the U.S. Census Bureau

- Critical for accurate AES (Automated Export System) filings

How to Find Your Schedule B Code (and Why It Matters)

You can use the Schedule B Search Engine or contact Shapiro’s experts to ensure you’re filing the right code—and avoiding costly AES rejections or penalties.

How Classification Codes Affect Tariffs, Duties, and Compliance

Each code ties directly to a specific tariff rate, tax, or trade restriction. Choosing the wrong one can mean paying higher duties, losing out on preferential trade benefits, or even facing penalties for misrepresentation. The stakes are high—and getting it wrong can cost thousands.

Common Mistakes Businesses Make When Classifying Products

1. Using outdated codes from previous shipments.

2. Copying competitors’ codes without verification.

3. Misunderstanding product composition or function.

4. Failing to check government updates to the tariff schedule.

Why It’s So Hard to Get the Correct HTS, HS, and Schedule B Codes

Constant Changes in Global Tariff Schedules

The World Customs Organization updates the HS system every five years, and individual countries update their own schedules even more often. Staying compliant means staying current—something many small businesses struggle to do.

Lack of Product Knowledge and Technical Descriptions

Customs officials and importers rely heavily on accurate technical descriptions. If you don’t fully understand your own product’s composition or intended use, classification becomes guesswork.

The Challenge of Multi-Component or Custom Products

Products with multiple functions or custom-made parts are the hardest to classify. For example, a machine that both cuts and engraves might fit under multiple tariff lines—making professional assistance essential.

Inconsistent Guidance Across Countries and Databases

Different countries interpret tariff rules differently. A product classified one way in the U.S. may fall under a different code in Canada or the EU, creating confusion for exporters.

Tariff Engineering: Turning Product Design into Duty Savings

Real-Life Example: Felt Soles That Saved a Fortune

One company cleverly added felt to the soles of shoes, classifying them as slippers instead of regular footwear. That small design tweak cut tariffs from 37.5% to under 12%.

That’s tariff engineering at its finest—strategic, legal, and compliant.

Ethical Tariff Optimization: How to Stay Compliant While Saving

CBP encourages importers to classify accurately but doesn’t forbid legal design changes that alter classification. By engaging experts early, you can balance creativity with compliance.

FAQs About HS, HTS, and Schedule B Codes

Check our HTS glossary (https://www.shapiro.com/harmonized-tariff-schedule-hts/) — or let our experts analyze your product specs.

In U.S. law, the Importer of Record bears full responsibility for accurate HTS classification. Relying solely on supplier-provided codes can expose you to CBP penalties, retroactive duty bills, or seizure for misclassification.

Not legally. Each distinct product must be classified under one code based on its essential character and composition. However, variants (e.g., different materials or designs) can legitimately fall under different codes—even if they share a base description.

Updates occur several times per year via Presidential Proclamations, USTR actions (e.g., Section 301, 232, IEEPA), and ITC modifications. Exporters also see regular Schedule B updates to align with global HS amendments. A periodic classification review—at least annually—is best practice.

U.S. Customs may issue a CF-28 Request for Information or CF-29 Notice of Action. Penalties range from monetary fines to cargo seizure or loss of preferential treatment (e.g., USMCA, GSP). Under 19 U.S.C. §1592, negligent misclassification can cost up to 2× the duty loss or 20% of declared value.

FTAs like USMCA, CAFTA-DR, and KORUS rely on HS chapter headings to define rules of origin. Misclassification can disqualify goods from preferential duty rates. Always confirm that your product meets the correct tariff-shift or regional-value-content rule for its HTS heading.

Not accurately enough. Always consult a licensed customs broker or compliance specialist.