Secure Your Shipments with Comprehensive Cargo Insurance Services

Newsflash: That so-called standard “coverage” often leaves your precious cargo more exposed than a sunbather at high noon. Don’t wait until you’re shipwrecked by hidden exclusions—get yourself some actual cargo insurance and sail smoothly into the safe harbor of full protection.

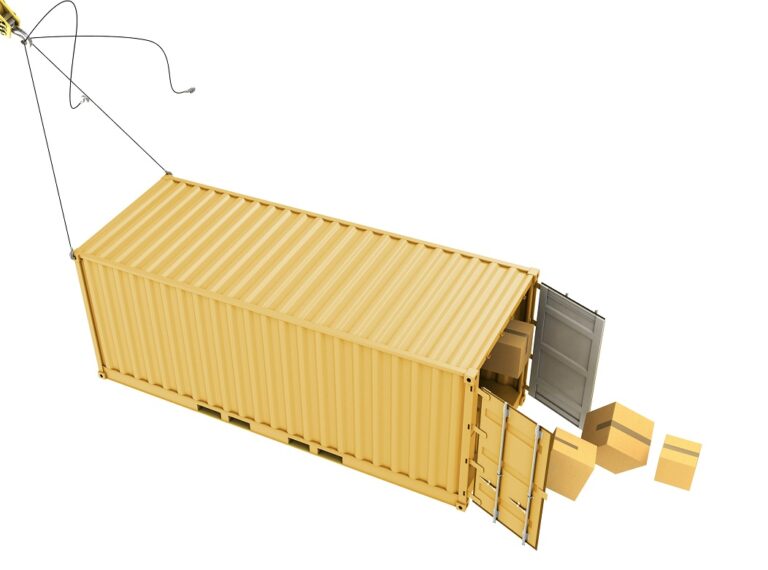

Keep from Freight Falling!

There are two dirty secrets in the world of cargo insurance and tons of horror stories faced by importers and exporters like you.

Unfortunately, only shipping experts

ever hear about them...

Dirty Secret #1

Steamships, airlines, truckers, NVOCCs, and ports are not liable for much.

When you’re feeling brave, read the back of your bill of lading for international or domestic transportation. Rather than feeling reassured, you will quickly notice the lack of coverage. Liabilities are somewhat nebulously stated and are limited in ways that are even more vague. In some cases, an entire ocean container is covered for only $500, and this is only if the carrier is held liable for the loss!

Dirty Secret #2

Carriers don't like to talk about General Average, but it can devastate a shipper's business.

You’ve placed your first order for a new product – it’s the best thing since sliced bread. But lo and behold, your cargo has gone down with the ship and the ocean carrier declares General Average. This is a phrase that many shippers rarely hear, but we guarantee that if you haven’t insured your goods, you will never forget it.

When General Average is declared, ocean carriers are not liable for loss or damage to cargo, and every cargo owner (that’s you!) is responsible, in part, for the cargo of others, as well as the ship itself. General Average claims can be in the millions of dollars, take years to process, and can ruin your budding eCommerce business if you don’t protect yourself.

These two little secrets have led to some big

misconceptions when it comes to cargo insurance!

Misconception #1:

My cargo is covered under the carrier’s insurance policy and there is no need for any additional insurance coverage.

Facts:

- ALL carriers limit their liability, even if the loss is their fault. In most instances the limited liability amounts will not cover the value of the customer’s shipment.

- Shipped via ocean, the carrier will only pay $500 per package or customary freight unit.

- Shipped via air, the carrier will only pay $20.00 per kilo (actual weight).

- Shipped domestic, the carrier will only pay $0.50 per pound (actual weight) or $50 per shipment. Note: Not all domestic carriers provide limited liability coverage; they are not required to do so by law.

- None of the carriers will pay for a loss under their limited liability coverage until the customer can prove the following:

- What the loss is (i.e. the cause of loss and the dollar amount). In some cases the customer would be required to hire a surveyor (at their own expense) to make this determination.

- The loss occurred while the goods were in the carrier’s possession.

- The loss was a direct result of the carrier’s negligence.

- None of the carriers will pay for a loss, unless they are notified within the strict timeframes outlined below:

Ocean

Immediately

3 Days (from date of delivery)

Legal action must be filed within 1 year from the date of delivery

Air

7 Days (from date of delivery)

14 Days (from date of delivery)

120 Days (from date of delivery)

Legal action must be filed within 2 years from date of delivery

Misconception #2:

If there is a loss or damage, and the carrier is at fault, the carrier will not assess the transportation charges or expect to be paid the full amount.

Facts:

- All freight charges are fully earned (or due) once cargo is received for transit. Even when carriers damage or lose your cargo, they are entitled to collect ALL freight charges.

Misconception #3:

The buyer or supplier (CIF Terms) is providing the insurance coverage.

Facts:

- Their coverage may cover certain risks and leave you wide open to others; they are only obligated to provide minimal coverage without regard to your needs or complete coverage.

- If there were a claim, you would be required to file and coordinate the claim with an overseas insurance agency and most likely will not have reliable representation in the U.S. It can be particularly frustrating to communicate across time zones.

Misconception #4:

Our company possesses a blanket policy; therefore, everything will be covered in the event of a loss.

Facts:

- While this may certainly be the case, shippers are encouraged to verify the type of coverage, even when it’s within their own company. There may be limitations which will prevent ALL losses being covered, as an example many policies do not pay for the additional freight to re-ship cargo when necessary.

General Average Explained: What Shippers Need to Know

Check out our blog to learn more about General Average and how cargo insurance can play a crucial role in protecting yourself and your business.