When Congress stalls, containers crawl.

It’s been nearly four weeks since Washington hit pause on large portions of the federal government, and while this isn’t breaking news, the ripple effects are still rolling in. Over the past month, our team has fielded a steady stream of questions from importers, exporters, and logistics partners wondering what the shutdown really means for their cargo.

So, we decided to chart the waters—answering the most common “what now?” questions with a forwarder’s eye and a freight-friendly compass.

For shippers, a government shutdown isn’t just political theater; it’s a logistical cliffhanger. Each furlough, closed office, or frozen approval is another ripple that can slow global commerce to a crawl.

Let’s unpack how this bureaucratic bottleneck is reshaping the supply-chain forecast—and what smart shippers can do to stay in motion when D.C. stands still.

Customs, Cargo, and Coffee Breaks: Who’s Actually Working?

The good news: your cargo isn’t stranded at sea. The bad news: the paperwork might be.

Agencies like U.S. Customs and Border Protection (CBP) and the Coast Guard are still operating, since their funding sources are separate from Congress’s purse strings. That means ports remain open, inspectors are inspecting, and shipments are still clearing…for now.

But here’s the catch: many of CBP’s partner agencies—including the Federal Maritime Commission (FMC), certain divisions of the USDA, EPA, and BIS—are running skeleton crews or furloughed altogether. Those “secondary signatures” that make your compliance checklist complete? They’re sitting in inbox limbo.

Think of it like a ship still sailing… with half the crew asleep below deck.

Delays on Deck: Where Bottlenecks Start to Brew

It starts small—a delayed license here, a missed inspection there—but soon, cargo queues begin to lengthen.

During the 2018-2019 shutdown, average dwell times at major U.S. ports swelled by more than 15%. Analysts are already warning that, if the current freeze lingers, we could see similar slowdowns as inspection and classification backlogs pile up.

For forwarders and BCOs (beneficial cargo owners), that means it’s time to factor in new buffer days and communicate early with customers about potential clearance lags. When one government cog stops turning, the entire supply-chain gear train grinds slower.

Air and Ground: Still Rolling, but Feeling the Bumps

On the roads and in the skies, it’s business as usual…almost.

The Federal Motor Carrier Safety Administration (FMCSA) stays funded via the Highway Trust Fund, keeping truckers on the move. But new driver authorizations and safety audits that rely on inter-agency data may hit pause.

Meanwhile, at airports, TSA screeners are working without pay—which, historically, leads to absentee spikes and potential screening delays.

In other words, the freight lanes are open… but there’s a faint rattle in the engine.

From D.C. to the Docks: The Global Ripple Effect

The U.S. supply chain doesn’t exist in a vacuum—it’s a hub in the global logistics wheel.

When U.S. approvals or port workflows slow, it doesn’t just affect domestic importers. European and Asian exporters routing through U.S. gateways can feel the knock-on effects in the form of longer transshipment cycles, container shortages, and imbalanced returns.

As one economist put it, “When Washington sneezes, Rotterdam and Singapore catch a cold.”

Shutdown Scenarios: How Long Before the Tide Turns?

So, what happens if this lasts weeks…or months?

Economists paint three scenarios:

- Short-term (1–2 weeks): manageable slowdowns; mild approval delays.

- Moderate (3–6 weeks): mounting port dwell times, deferred licensing, and temporary trade-data blind spots.

- Extended (6 + weeks): widespread disruption to cargo clearance, export licensing, and market forecasting.

Even worse, when key data sources like the Bureau of Labor Statistics or Census Bureau pause reporting, logistics models lose visibility—meaning supply-chain planners are sailing without radar.

Keep Calm and Cargo On: What Forwarders and Shippers Can Do Now

Now’s the time to channel your inner logistics yogi: stay flexible, stay balanced.

- Audit your shipment mix. Flag goods that rely on special government oversight (food, pharma, tech, defense-sensitive). Those are your high-risk moves.

- Add buffer time. Build in a few extra days for clearance and routing—even if things look normal today.

- Double down on communication. Keep customers, partners, and carriers in the loop. Transparency beats apology every time.

- Stay data-savvy. Track updates from CBP and port authorities; don’t rely on national headlines alone.

- And most importantly: Lean on your forwarding partners who live and breathe this process daily.

Final Manifest: Finding Opportunity in the Standstill

Every slowdown is a stress test—and a showcase.

The forwarders who shine during shutdowns aren’t the ones with magic access; they’re the ones who forecast, communicate, and adapt.

At Shapiro, we’ve weathered more than a century of trade turbulence: wars, recessions, pandemics, and yes, plenty of political gridlock. Through it all, we’ve learned that the best logistics strategy isn’t panic or passivity; it’s preparation with personality.

So, while Washington takes a coffee break, we’ll keep the cargo moving—one clearance, one call, and one creative workaround at a time.

In logistics, the forecast can flip quickly. One moment, your long-term contracts are the rain jacket shielding you from volatile spot swings. The next, FAK (Freight All Kinds) spot rates plunge below contracted levels, leaving importers and exporters wondering if they dressed for the wrong weather.

When FAK undercuts contracts, it’s more than an awkward price gap — it’s a clear barometer of oversupply, shifting demand, and brewing turbulence in shipper–carrier relationships. Let’s check the freight radar, aka “freight-ar,” together.

When Spot Rates Dip Below the Contract Clouds

For importers and exporters, the first raindrop felt is often rate regret. Watching competitors scoop up bargain spot rates while you pay sky-high contract premiums feels like being caught in a downpour without a raincoat.

But the forecast affects more than just costs:

- Carrier credibility gets soaked. Long-term contracts, supposedly built on trust and volume, lose value fast when spot deals undercut them. For some carriers, honoring contracts while selling cheaper FAK space creates a perception of unfairness that can erode loyalty.

- Market turbulence. Forwarders and BCOs start pushing for index-linked adjustments, midterm renegotiations, or even rerouting cargo to cheaper carriers. A retailer shipping furniture ahead of peak season, for instance, may divert discretionary containers away from contracted lines in search of immediate savings.

- Opportunistic forecasting. Shippers begin reallocating discretionary freight to the spot market, reserving contracts only for space guarantees. This weakens volume commitments, which in turn disrupts carriers’ network planning.

- Budgeting headaches. Finance teams that built annual cost projections on fixed rates now face pressure to justify why they’re paying above-market prices.

When FAK dips, both sides of the table can feel the change in pressure—and both must quickly decide whether to hold firm or bend with the weather.

Stormy Conditions on the Freight Rate Horizon

Like most weather systems, a freight rate drop doesn’t appear out of nowhere. The barometer often falls in response to a mix of these conditions:

- Overcapacity floods the market. New megaships or sudden capacity shifts outpace demand. Empty slots = fire-sale FAK rates.

- Demand cools off. Seasonal lulls, macroeconomic dips, or cautious inventory strategies leave carriers competing harder for cargo. Think of big-box importers pulling back Q4 orders, the ripple hits the entire market.

- Rate wars erupt. Alliances chasing market share bring the thunder; FAK becomes the weapon, undercutting contract floors to lure volume.

- Blank sailings misfire. Cutting capacity to push rates higher sometimes backfires. If demand doesn’t return, carriers are left discounting heavily, with spot rates falling even lower than before.

- Shifting trade currents. Tariffs, geopolitical changes, or new sourcing patterns reroute flows, leaving traditional lanes oversupplied. A shift from China to Southeast Asia, for example, can suddenly leave Transpacific contracts looking mismatched.

- Contract psychology. Once enough shippers feel burned, the pressure builds for rebates, future concessions, or loyalty credits—which further complicates negotiations.

Each of these fronts lowers the pressure in the freight market; and when the pressure drops, so do FAK rates.

A Look Back: Historical Freight Forecasts

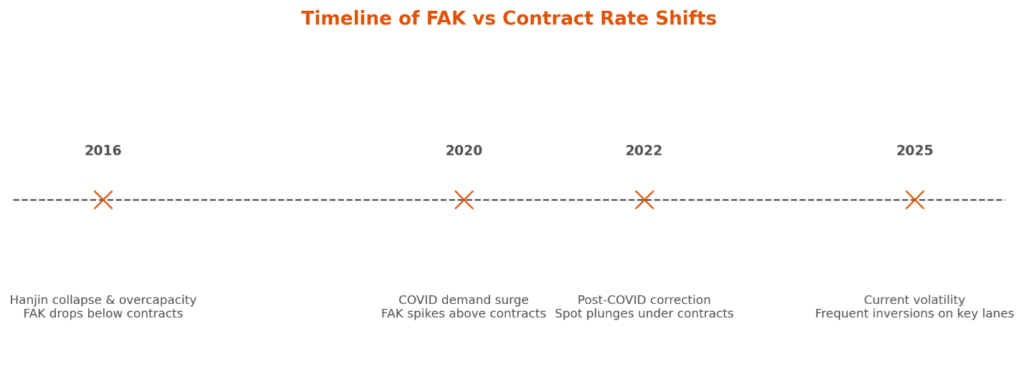

Rate inversions between FAK and contract levels aren’t new. In fact, they’re considered regular weather systems in ocean freight. Here’s a few notable milestones in recent years:

- Hanjin Collapse & Overcapacity (2016): A glut of megaships met soft demand; Hanjin’s bankruptcy highlighted how quickly contracts can look overpriced as spot (FAK) sinks.

- COVID Demand Surge (2020): An unprecedented consumer boom pushed FAK far above contracts; carriers favored spot liftings.

- Post-COVID Correction (2022): The pendulum swung back; spot crashed under expensive annual contracts, fueling “rate regret.”

- Current Volatility (2025): Frequent, lane-specific inversions keep both sides balancing stability vs. flexibility.

How to Stay Dry in Shifting Shipping Conditions

No shipper can stop the rain, but you can gear up for it:

- Pack a rain jacket with vents. Contracts bring stability, but clauses for rate reviews, floating index ties, or “escape hatches” can keep you from overheating when markets fall.

- Mix your wardrobe. Balance long-term contracts with flexible spot bookings. Think of it as layering—a solid jacket with boots ready for puddles. Some shippers hedge by committing 60–70% of cargo under contracts while leaving the rest flexible.

- Check the radar often. Monitor carrier announcements, blank sailing schedules, and alliance strategies. These are your market barometers, showing when storms are forming.

- Factor in hidden weather. Lower spot rates may look sunny, but they can come with rolled cargo, reduced service levels, or higher detention/demurrage exposure. Stability has its own value.

Most importantly, remember: strong partnerships with forwarders like Shapiro are like weather alerts—they’ll give you the earliest signals and the flexibility to respond quickly.

Be sure to sign up for our free subscriptions to stay in the loop with the latest news!

Keep an Eye on the Freight Rate Radar

When FAK rates slide under contracted levels, it’s not just drizzle, it’s a market signal flashing oversupply and soft demand. Frustrating? Absolutely. But it’s also a chance to reposition.

Shippers who balance contract stability with spot-market agility, while keeping one eye on the rate radar, are the ones best positioned to capture savings and keep their supply chains steady through the squalls.

Want a clearer forecast without chasing every cloud? Check out Shapiro’s Shipping Rate Trends page—your real-time rate barometer, minus the stormy spreadsheets.

Importing steel or aluminum products—or goods that simply contain them—can feel like a high-stakes card game. The challenge isn’t just getting goods across the table; it’s making sure you’re not betting more than you owe.

Too often, importers misapply Section 232 and IEEPA tariffs, stacking duties where they don’t belong. What should be a straightforward shuffle of percentages turns into an expensive misplay—and Uncle Sam always collects the pot.

The good news? With the right strategy, you can cut the deck cleanly, avoid overpaying, and keep more chips in your hand.

The Hidden Cost of Misclassification

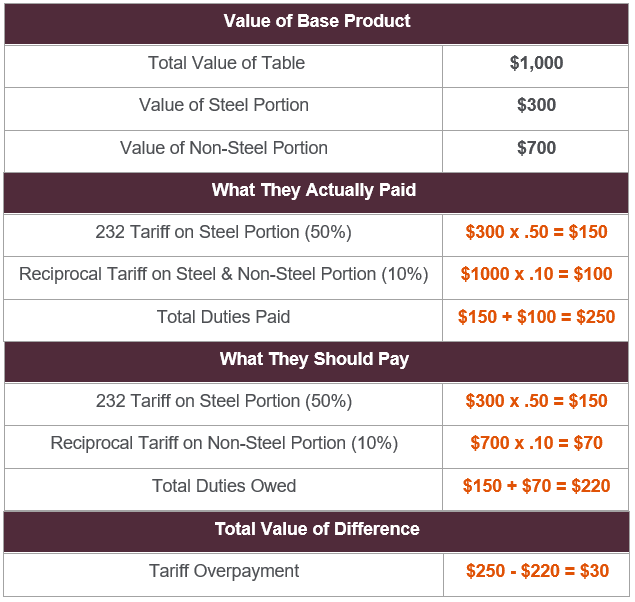

One of the most common ways importers overpay is by stacking tariffs across the entire value of a product instead of just the steel or aluminum portion.

Take a steel table valued at $1,000. Of that, only $300 is the steel frame, while the rest is wood, glass, and other materials.

Unfortunately, like many importers, your company incorrectly applies both a 50% Section 232 tariff on the steel portion and a 10% IEEPA tariff on the entire $1,000 value. That mistake inflates the duty bill to $250 when the correct amount should be just $220.

Here’s how it breaks down when played correctly:

Now imagine a shipment of 1,000 tables—that’s $30,000 ($30 x 1000) paid out unnecessarily. What looks like a minor misstep at the entry line can quickly snowball into a serious drain on your stack.

Derivative HTS Codes and the Surprise Draw

Some products don’t look like obvious tariff risks, but classification rules can slip extra cards into the deck. Derivative HTS codes are one of the most common traps.

Take a shipment of aluminum patio chairs. The importer assumes only raw aluminum products are covered by Section 232. But when the chairs are classified under HTS 9403 (metal furniture), they trigger the duty. What felt like a safe play suddenly comes with a surprise tariff.

Other codes that routinely catch importers include:

- 7610 – Aluminum structures and parts.

- 8306 – Bells, gongs, statuettes of base metal.

- 9403 – Other metal furniture.

- 7326 – Other steel articles.

- 7616 – Other aluminum articles.

These derivative codes are like hidden cards—you don’t realize they’re in play until they take a chunk out of your stack. A proactive classification review is your best bet to avoid losing chips on every hand.

Executive Order 14257: Clarifying Dealer’s Duties

Executive Order 14257 reshuffled the deck by clarifying how Section 232 and reciprocal tariffs should apply—and when they shouldn’t overlap.

Picture an importer bringing in toolkits made up of steel tools and plastic casings. If they file the whole kit as one line, they end up paying both Section 232 and reciprocal tariffs on the full value. That’s tariff stacking at its worst.

EO 14257 changes the game. It directs importers to split duties by content:

- Steel portion → Section 232 duties only.

- Non-steel portion → Reciprocal tariffs only (HTS 9903.01.25).

By filing toolkits this way, importers pay duties on each component correctly instead of stacking tariffs on the whole shipment. For companies moving high volumes, the savings can be substantial.

The rule isn’t a loophole—it’s the dealer spelling out how to play the hand. Those who follow it keep far more chips on their side of the table.

When to Split the Hand on Entry Summaries

The way you file an entry summary is the final move that determines whether you pay too much or just enough. Two common scenarios show the difference between betting blind and playing with strategy.

Scenario 1: Aluminum Value = Total Entered Value (or unknown)

- A cookware importer doesn’t know the aluminum portion of their product and files everything under one line.

- Additional Duties:

- Reciprocal: IEEPA do NOT apply.

- Section 232: Applies to the entire value.

It’s quick and simple—but costly. You’ve essentially bet the whole pot when only part of it was at stake.

Scenario 2: Aluminum Value < Total Value

- A sharper importer of the cookware splits the entry into two separate lines.

- Line 1: Non-Aluminum Content

- HTS Code: Same as aluminum.

- Entered Value: Total value minus aluminum portion.

- Additional Duties:

- Reciprocal: Apply IEEPA, AD/CVD as needed.

- Section 232: Do NOT apply.

- Line 2: Aluminum Content

- HTS Code: Same as Line 1.

- Entered Value: Aluminum value only.

- Additional Duties:

- Reciprocal: IEEPA do NOT apply.

- Section 232: Applies only to this line.

- Report quantity in kg under Chapter 99 HTS.

By filing this way, the duties fall exactly where they belong. Instead of stacking tariffs across the full shipment, the importer pays only what’s owed, keeping thousands in play across multiple entries.

The difference is strategy. Reporting isn’t just compliance—it’s knowing when to split the hand, so you don’t over-bet.

Bottom Line: Play Your Hand Wisely

Section 232 and related tariffs don’t have to be a gamble. Misclassification, derivative codes, and entry line errors are the kinds of missteps that stack the deck against importers. But with careful classification, smart reporting, and an eye on Executive Order 14257, you can keep from over-betting and protect your stack.

The real takeaway? Customs compliance isn’t about luck—it’s about strategy. The importers who win are the ones who know the rules, split their values correctly, and double-check the fine print before they lay their cards down.

Don’t let tariff stacking drain your chips. Review your entries, audit your HTS codes, and make sure you’re paying only what you owe—no more, no less. With the right approach, you’ll always have a stronger hand at the customs table.

Need help auditing your entries or reviewing your HTS codes? A proactive classification review could be the easiest money you save all year. Explore Shapiro’s Classification Advisory Module (CAM) or Connect with our team to see what might be in the cards for you.

Welcome to Mission: Logistics Possible.

Back in 2015, supply chains were still flying blind. Real-time tracking was a novelty, warehouse robotics belonged in sci-fi, and digital collaboration was in its infancy. But the seeds of a revolution were being planted. Shapiro and other early adopters were starting to create smarter, more connected logistics.

Fast forward to 2025, and we’re operating in a whole new theater. Today’s logistics professionals are no longer just movers of goods—they’re mission commanders. The tools? AI-powered dashboards, autonomous freight, smart warehouses, and full-spectrum visibility platforms like Shapiro 360°.

In this mission briefing, we’ll explore the technologies rewriting the rules of freight—tools that help importers see farther, move faster, and make smarter decisions with total control.

AI in Logistics: Intelligence Unlocked

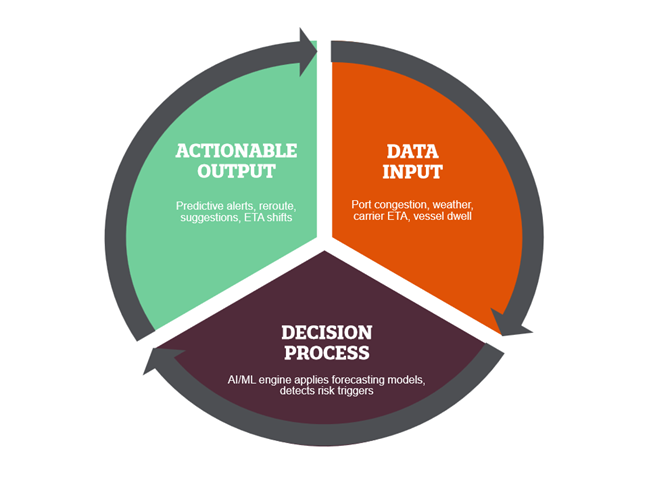

Artificial intelligence has gone from novelty to necessity. In 2025, AI systems don’t just track cargo—they analyze port congestion, predict disruptions, optimize routes, and flag risks before they happen. It’s not just data—it’s mission intel.

AI-powered platforms ingest massive datasets, from weather models and vessel dwell times to geopolitical developments and turn them into actionable insights. This shift from reactive scrambling to proactive strategy helps shippers stay ahead of uncertainty.

How AI Powers Predictive Logistics

At Shapiro, we like to think of AI as your always-on mission analyst, anticipating your next move before you even request it.

Smart Warehousing Tactics for Modern Missions

Warehouse automation has gone tactical. Today, co-bots, automated storage systems, and AI-driven inventory tools execute fulfillment around the clock with military-grade precision. What once required an army of staff now runs seamlessly behind the scenes.

These smart warehouses connect directly with transportation systems to ensure synchronized picking, packing, and shipping. If your pallets are self-guided and your scanners send automated dispatches, congratulations—you’re already in the field.

Need strategic support? Shapiro helps importers deploy scalable tech without triggering budget blowback.

Cracking the Clearance Code with Digital Customs

Manual customs processes? Consider them compromised. Today’s digital clearance tools leverage AI, machine learning, and blockchain to reduce filing errors, simplify classification, and accelerate cargo movement.

Shapiro’s Classification Advisory Module helps importers stay audit-ready while uncovering potential duty savings. We decode shifting tariff structures and regulatory shifts so you can stay clear of compliance traps.

In the world of international trade, regulatory missteps are the enemy. Let us be your encryption key.

Autonomous Freight and Smart Ports in the Field

Driverless trucks and automated cranes are no longer top-secret prototypes—they’re standard issue. In 2025, autonomous freight dominates long-haul inland routes, while smart ports rely on guided vehicles and AI systems to streamline container movement.

These technologies tackle labor shortages, reduce risk, and increase throughput. Shapiro works with importers to assess how these tools impact drayage operations, transit timelines, and last-mile reliability.

Think of it as real-time logistics reconnaissance—so you always know your next move.

Sustainable Logistics Tech for High-Impact Ops

Sustainability is now a mission-critical directive. With ESG regulations tightening, importers must balance environmental goals with operational performance.

Electric trucks, carbon dashboards, route optimization tools, and smarter consolidation strategies are redefining how freight moves without increasing emissions. Green logistics isn’t just the ethical path—it’s the strategic one.

At Shapiro, we help you align your logistics footprint with long-term objectives. It’s sustainability with stealth.

Shapiro 360°: Your Command Center for Freight Visibility

Cutting-edge tools are only valuable if you can command them. That’s where Shapiro 360° steps in.

This mission-ready digital platform gives importers total visibility and control over their supply chains. From predictive alerts to customizable dashboards, Shapiro 360° is your centralized intelligence hub.

Key features:

- Real-time tracking across ocean, air, and inland freight

- Custom dashboards by PO, SKU, supplier, and mode

- Classification advisory tools built in

- Vendor collaboration tools in a shared ecosystem

Excel had a long run, but it’s no match for a fully integrated logistics console.

The Future of Logistics Starts Now

Mission Briefing Complete.

If your current tools leave you guessing, you’re already a step behind. But with Shapiro 360° and a team of logistics operatives behind every container, you’re equipped for any scenario: trade shifts, rate surges, compliance crackdowns, or supply chain slowdowns.

Ready to take control of your mission?

Connect with our team to deploy your digital supply chain strategy.

The U.S. is once again turning up the heat in the trade world—and this time, it’s targeting countries that continue to buy Russian energy.

In a move that could reshape global shipping and energy supply chains, President Donald Trump has floated the idea of secondary tariffs—penalties that would be placed on countries that continue doing business with Russia by importing oil, gas, or refined fuel products. While the threat is serious, it’s also uncertain—especially given Trump’s habit of reversing course on tariffs when political or economic pressure builds.

Still, even the suggestion of secondary tariffs has the potential to disrupt global trade. Here’s what it could mean, and how key Russian energy buyers might respond.

A Closer Look at the Countries in the Crosshairs

China

China is the largest buyer of Russian oil and gas by a long shot—and it’s unlikely to change that anytime soon. Russian crude offers China both a reliable energy source and a steep discount, helping offset rising global oil prices. Additionally, China has built dedicated infrastructure, like the Power of Siberia pipeline, that deepens its long-term reliance on Russian energy. While the U.S. may threaten tariffs, China is playing the long game.

Just recently, Trump backed off a plan to impose major tariffs on Chinese goods, reportedly due to pressure from U.S. tech and defense sectors that depend on Chinese rare earth metals. That reversal sent a clear message to Beijing: the U.S. may bark, but it doesn’t always bite—especially when it risks domestic supply chains. China is expected to call Washington’s bluff once again and continue business as usual with Moscow.

India

India has significantly increased its Russian oil imports since 2022, capitalizing on discounted prices. The country has been vocal about its energy needs, asserting that national interest comes first. While India maintains strong ties with the U.S., it’s unlikely to completely walk away from cheap Russian crude. However, it may try to soften its exposure—perhaps by reducing public purchases, using intermediaries, or shifting more trade to private refiners to avoid direct links that could trigger U.S. penalties. If secondary tariffs are strictly enforced, India may look to work around them rather than abandon the trade entirely.

Turkey

Turkey has managed to maintain diplomatic relations with both the West and Russia throughout the Ukraine conflict. It continues to import Russian energy and has become a key hub for gas transit to Europe. At the same time, Turkey is heavily dependent on U.S. and EU markets for trade. If secondary tariffs begin to bite, Turkey may pivot toward gray-zone tactics—such as blending fuels, re-exporting through third countries, or shifting trade to smaller, state-linked firms that carry less reputational risk. Ankara’s decision will likely balance economic needs with its desire to stay in Washington’s good graces.

United Arab Emirates (UAE)

The UAE has emerged as a re-export center for Russian fuel products, especially diesel. It plays an opportunistic role—buying cheap Russian energy and selling it onward at market prices. While the UAE has shown some willingness to align with Western partners on global issues, it also values its energy trade flexibility. If the U.S. were to threaten sanctions or penalties, the UAE might tweak the structure of its trade (e.g., changing ownership structures or routes), but it’s unlikely to cut ties with Russian suppliers altogether unless the penalties become overwhelming.

European Union (EU)

The EU has reduced its direct reliance on Russian energy since the war in Ukraine began—but it hasn’t eliminated it. Some member states still receive pipeline gas, LNG, and refined products, either directly or through complex third-country transactions. Eastern European nations, in particular, remain dependent on Russian energy for both cost and accessibility reasons. That said, EU leaders have shown willingness to cooperate with the U.S., at least politically. If secondary tariffs are enforced, the EU may speed up its transition away from Russian fuel, but it likely won’t happen overnight. The economic burden—especially in winter months—may delay full compliance, creating a fragmented response across member states.

The Bigger Question: Will Anyone Actually Take Action?

A big part of the uncertainty around secondary tariffs comes down to credibility. Countries are watching closely to see whether the U.S. actually enforces these penalties—or backs off under pressure. Trump has a long track record of threatening tariffs and then reversing course. In 2019, he imposed tariffs on Mexico, only to drop them days later. He’s done the same with China multiple times, most recently scaling back plans due to the U.S.’s reliance on rare earth elements used in defense and tech manufacturing.

Because of this, many countries may choose to wait it out rather than make dramatic changes to their buying habits. The threat alone can disrupt markets, but without real enforcement, few nations are likely to abandon cheap Russian energy.

How This Impacts Global Shipping and Logistics

Even without full enforcement, secondary tariff threats can send shockwaves through shipping and logistics:

- Energy cargo routes may shift to less obvious channels, increasing costs and complexity.

- “Shadow fleet” tankers could see more demand as companies try to hide Russian ties.

- Customs inspections and port delays may rise for shipments suspected of Russian origin.

- Freight forwarders and customs brokers will face more pressure to verify the true origin of goods.

- Insurance and compliance risks may grow, especially for trade involving petroleum-based products.

For shippers, importers, and logistics providers, the key is informed, proactive action.

Final Thoughts

Whether or not secondary tariffs on Russian energy become a reality, the message is clear: the intersection of politics and trade continues to disrupt global shipping, energy flows, and supply chains.

For now, countries like China, India, Turkey, and others may continue their current course—betting that the U.S. won’t follow through. But if enforcement kicks in, expect big changes in how energy is moved, priced, and documented.

In global trade, one thing remains certain: uncertainty itself is a major cost—and those who plan ahead will be in the best position to adapt.

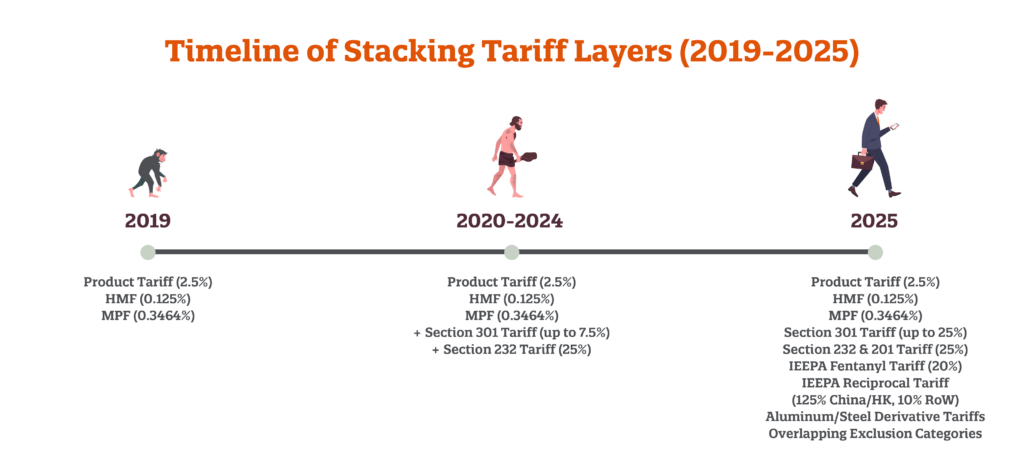

Customs compliance isn’t extinct—but it might feel like it evolved straight out of the Jurassic. Back in the pre-2019 era, import entries were simple creatures. Predictable. Manageable. No strange mutations to track or hidden fees lurking in the tall grass of government notices.

Then came the tariff asteroid.

Between trade wars, retaliatory duties, and a growing jungle of exclusions, the once-basic customs entry has evolved into a multi-headed classification beast. And in 2025? It’s officially a full-blown customs ecosystem.

Let’s dig into how we got here—and what it means for today’s importers.

The Entry Line Evolution: From Simple to Stacked

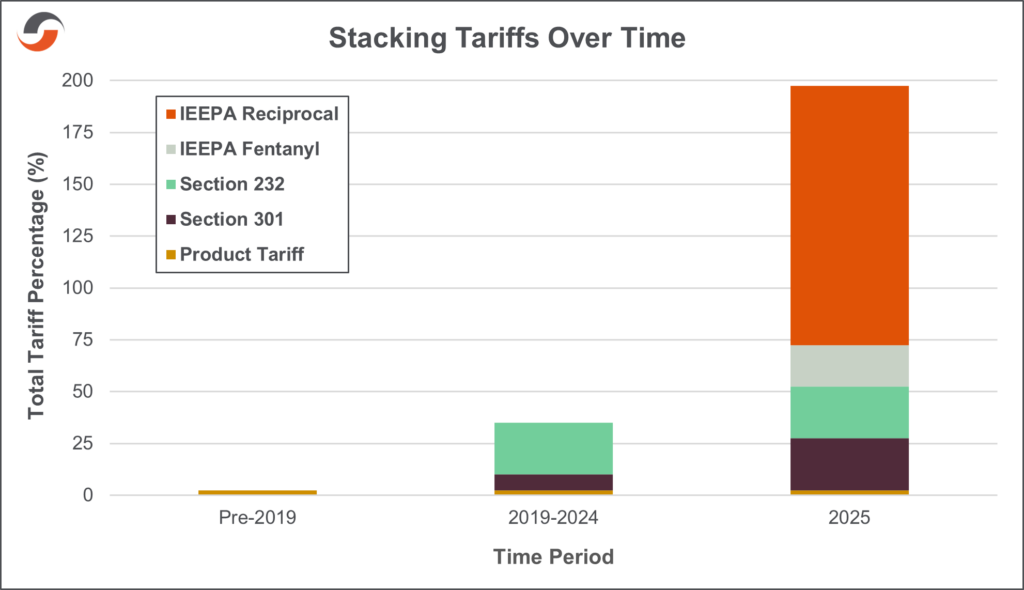

Once upon a customs era, a single entry was fairly simple and straightforward. But that’s certainly not the case today. Let’s take a look at how entry lines have evolved throughout three distinct stages: Pre-Covid (2019), Covid (2020-2024), and Post-Covid (2025).

2019: Predictable and Pared Down

Total duties on a $13,000 item? Roughly $377. Easy to predict. Easy to budget.

2020-2024: Layers Begin to Build

- Product Tariff: Still 2.5%

- HMF + MPF: Still present

- Section 301 Tariff: Up to 25%

- Section 232 Tariff: 25%

- Exclusion Programs: Intermittent and inconsistent

The numbers weren’t always overwhelming, but the tracking certainly was.

2025: Welcome to Uncharted Tariff-tory

- Product Tariff: Still 2.5%

- HMF + MPF: Still applied

- Section 301 Tariff: 25%

- Section 232 & 201 Tariffs: 25%

- Exclusion Programs: Overlapping, reinstated, expired…and ever-changing

- IEEPA Fentanyl Tariff: 20% (China/HK)

- IEEPA Reciprocal Tariffs: 125% (China/HK), 10% (Rest of World) (temporarily paused…for now)

- Aluminum/Steel Derivative Duties: Active

Here’s a real-world example from a recent entry:

- Product Tariff: 25%

- IEEPA Reciprocal Tariff: 20%

- China 301 Tariff: 25%

Total duties on a $13,000 item now? Over $8,000. Difficult to swallow. Difficult to pay.

Charting the Stack: How Duties Have Grown

Just look at how tariff layers have compounded over time:

It’s not just about the rates—it’s about how they’re applied. In 2025, duty exposure is driven by:

- Country of origin

- Applicable tariff authorities

- Current (or expired) exclusion status

Even basic goods can carry up to five different tariffs—each with its own filing rules, audit risks, and time limits.

What This Means for Importers

Tariff stacking isn’t just a budgeting issue—it’s a compliance hazard. With more layers come more opportunities to misclassify, miscalculate, or misstep.

And regulators? They’ve evolved too. Automated flags, audit triggers, and post-summary correction programs mean small errors can become big liabilities.

This isn’t the time to go it alone.

Survival Tips for the Modern Explorer

Here’s how to navigate this customs jungle without getting fossilized:

- Map Your Classifications. HTS codes now tie into multiple duty programs. Accuracy is everything.

- Know Your Exclusions. Many are temporary or reinstated without fanfare.

- Study Country of Origins. One product, two countries = two very different duty paths.

- Work with a Broker Who Speaks Tariff-ese. The language is complicated. Make sure your partner is fluent.

Need Help Charting Tariff-tory?

Since 1915, Shapiro has helped importers evolve with the trade landscape. From single shipments to complex, multi-program tariff strategies, we’ve got the tools—and the team—to help you stay compliant, cost-effective, and confident.

Don’t let entry lines turn into land-before-time-mines. Let’s decode your duties before they bite the dust.

Let’s be real—customs bonds probably aren’t dominating your weekend barbecue conversations. But if you’re in the business of international shipping and logistics, especially in today’s tariff-happy trade climate, your bond isn’t just a formality, it’s a critical part of your import strategy.

Understanding the strength (and limits) of your customs bond could be the difference between smooth sailing and a costly supply chain snafu.

What Is a Customs Bond, Really? (And Why Should You Care?)

Think of your customs bond like a backstage pass to the import world. It’s a financial guarantee to U.S. Customs and Border Protection (CBP) that duties, taxes, and fees will get paid—even if things go sideways. No bond, no entry. And if your bond’s too small? Delays, denials, and expensive detours could be in your future.

When Tariffs Rise, So Should Your Customs Bond Awareness

Tariffs have been sprouting like weeds since the Trump-era trade shifts—and each spike in duty liability puts new pressure on your bond limits. If your coverage isn’t keeping pace, you might receive a “bond insufficiency” notice from CBP (which is the compliance world’s equivalent of a nasty parking ticket).

The good news? Right now, there’s a 90-day pause on reciprocal tariffs from most countries (sorry, Chinese importers, still no relief there). This is your chance to proactively review your bond before things heat up again.

Stronger Bonds = Stronger Compliance

High tariffs don’t just impact your margins—they attract more CBP attention. That makes cutting corners risky business. Misclassifying goods, misstating values, or downplaying country of origin may seem like shortcuts, but they come with serious consequences. A well-structured customs bond helps keep your trade practices clean and accountable, while shielding your operation from the fallout of non-compliance.

Continuous Bonds Aren’t Forever—But Their Risk Can Linger

Here’s where things get interesting: continuous bonds automatically renew each year but carry liabilities that hang around until all entries from the bond year are liquidated (typically within 314 days). It’s not exactly a “forever” situation, but it’s long enough to leave you exposed if you’re not watching the calendar. Understanding this timeline gives you better control over your customs risk—and helps avoid surprises.

Stacking Exposure: The Double-Dip You Don’t Want

When a bond renews before previous entries liquidate, you’re looking at “stacking exposure”—a risk-layer cake that no one ordered. This means you’re potentially liable under multiple customs bond periods at once, which could trigger the need for additional collateral. Pro tip: securing a slightly higher bond from the outset can often be more cost-effective than having your cash tied up post-renewal.

Time to Strengthen the Bond

Managing your customs bond shouldn’t feel like decoding a spy thriller. That’s where Shapiro’s compliance specialists come in. We’re here to help you build a stronger bond—one that keeps you covered, compliant, and confidently on course through the complexities of CBP regulations and shifting tariffs.

Ready to reinforce your customs bond and protect your supply chain?

Let’s talk today: [email protected].

Helpful Links:

The Name is Bonds, Customs Bonds

Ah, tariffs—the economic equivalent of a schoolyard “keep away” game, but with more paperwork and fewer scraped knees. Following President Donald Trump’s inauguration in January, the US and its global pals have been hard at work (and play) tossing tariffs around like hot potatoes.

This post breaks down the tariff rollercoaster of 2025 thus far; and covers the following topic areas: Section 232 (Steel & Aluminum), Automobiles & Parts, De Minimis, Reciprocal (Global, China), Technology & Pharmaceuticals, Digital Service Tax, and Venezuelan Oil. Whether you’re a policy nerd or just trying to figure out if your imported coffee grinder is about to cost 49% more, you’re in the right place.

Steel and Aluminum: The Heavy Metal Showdown

Action:

- February 10, 2025: President Trump imposed a 25% tariff on all imported steel and aluminum. This was a blanket measure: no exemptions, just raw economic power chords.

Reactions:

- Canada: Retaliated with 25% tariffs on $20.8B of U.S. goods by March 4.

- EU: Followed with tariffs on $28.33B of U.S. exports, effective April 1.

Current Status:

- Tariffs are in full effect and expected to remain. With other metals (like copper and rare earths) under review, more may be added soon.

Automobiles and Parts: The Bumper-to-Bumper Brawl

Action:

- March 26, 2025: The U.S. imposed a 25% tariff on imported passenger vehicles and light trucks, plus parts like engines and transmissions.

Reactions:

- Canada: On April 9, Canada fired back with a 25% tariff on non-USMCA-compliant U.S. vehicles. Auto parts were spared (for now).

Current Status:

- These tariffs are live, but automakers are lobbying hard. Talks on carve-outs for electric vehicles and shared platforms are ongoing.

De Minimis No More: Bye-Bye Freebies

Action:

- April 8, 2025: The U.S. will eliminate the $800 de minimis threshold for imports from China effective May 2—meaning no more duty-free small packages.

Current Status:

- Implementation expected May 2. US Customs is preparing for higher volume inspections, and Chinese e-commerce giants are bracing for a cost hike.

Liberation Day Tariffs: The Blanket Approach

Action:

- April 2, 2025: On “Liberation Day,” The U.S. introduced a 10% tariff on imports from all trade partners (100+ countries) effective April 5, while others would receive higher rates beginning April 9.

- The full list of country-specific rates can be found in Annex I.

- Note: Previously tariffed goods and critical minerals not produced in the US are exempt.

Reactions:

- US: On April 9, President Trump reversed course and announced a 90-day postponement of the country-specific reciprocal tariffs to allow more time for trade negotiations. During the pause, all countries, other than China, will still be subjected to the lower baseline tariff of 10%.

- EU: Initially announced retaliatory tariffs on specific US goods beginning April 15; but elected to postpone the implementation because of the 90-day pause.

Current Status:

- Country-specific reciprocal tariff rates have been postponed until July 9 for all countries—other than China. During this time, all products imported into the US will be subject to a lower baseline rate of 10%.

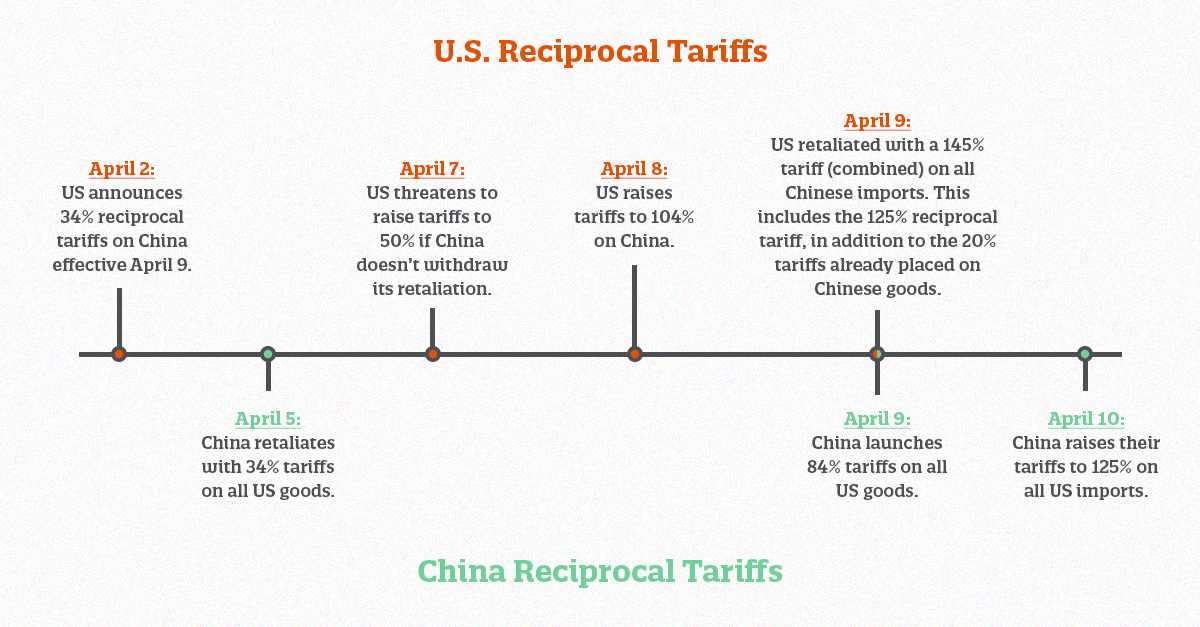

The Empire Strikes Back: China Retaliates

Most of the duties applied to products from China have already been covered elsewhere in this blog. However, we decided to create a separate section to review the escalating U.S.-China trade war.

U.S.-China:

As tensions and retaliations continue to escalate between the US and China, it’s important to understand exactly what tariffs apply to Chinese products and how they are calculated.

Section 301: Tariffs imposed on Chinese goods addressing unfair trade practices.

- Originally put into effect during Trump’s first term (7.5% and 25%).

- Most exclusions are set to end on 5/31/25, unless extended by the current administration.

De Minimis:

- April 2: US announced the elimination of de minimis treatment for imports from China and Hong Kong beginning May 2—an action threatened by President Trump earlier this year.

International Emergency Economic Powers Act (IEEPA): Duties imposed to target fentanyl precursors and rectify trade imbalances (reciprocal).

- Fentanyl:

- March 4: US imposes 20% tariffs on goods from China and Hong Kong.

- Reciprocal Tariffs: U.S.-China (April):

Current Status:

- Trump postponed reciprocal tariffs an additional 90 days for every country besides China. US-China tariffs are escalating rapidly, with no talks scheduled yet.

Tech and Pharma: The Looming Cloud

Action:

- February 14, 2025: The White House floated 25% tariffs on pharma, semiconductors, and foreign-made EVs. It hasn’t happened yet—but it’s not off the table.

Current Status:

- Not enacted—yet. These remain high-risk categories, especially if China or the EU escalate digital or industrial policy tensions.

Digital Services Taxes: A Cyber Spat Brewing

Action:

- February 21, 2025: The U.S. launched a Section 301 investigation into France, Austria, the UK, and others over their digital services taxes (DST) targeting U.S. tech giants.

Current Status:

- Still in the investigation phase. A ruling could trigger targeted tech-related tariffs by late spring or summer.

Venezuelan Oil: The Slippery Slope

Action:

- March 24, 2025: A 25% tariff was slapped on imports from any country buying Venezuelan oil—a geopolitical move more than an economic one.

Executive Order:

Current Status:

- Active and politically charged. Countries sourcing from Venezuela are under pressure. This may intensify if Maduro ramps up exports.

The Trade Horizon: What’s Next for Tariffs?

It’s only April, but 2025 is already shaping up to be the most tariff-packed year on record. US officials have gone broad and bold; but China continues to pushback. As for the rest of the world, countries are stuck in the middle—anxiously awaiting Trump’s next announcement. As international trade spins out beneath a complicated web, global supply chains are left in turmoil. With reciprocal tariffs, digital taxes, pharmaceuticals, and semiconductors still on the table, the next few weeks will undoubtedly bring even more calamity.

But one thing is for certain: we are all in the same boat! Shapiro will continue to follow the twists and turns of Trump’s tariffs; and will post all future updates to our Tariff News webpages. For now, all we can do is sit back and ride out the storm together.

Welcome to the exciting and educational game show, “Is it THIS or is it VAT?!” There have been rumblings of confusion when it comes to all of the taxes and levies floating around so hold onto your cargo containers as we set sail on a TAX-travagant adventure!

Meet Our Contestants:

Before we jump into the rounds, let’s meet our contestants—each representing different taxes and levies commonly encountered in global trade. Get ready to know them better, so you can keep your shipments sailing smoothly!

VAT (Value Added Tax)

VAT arrives confidently, reminding us it’s a tax collected at every stage of production and distribution, right down to the final sale. It’s like the freight forwarder of taxes—guiding the goods through every stop in the supply chain. Value Added Tax is especially popular in European Union countries and many other nations globally, including Canada, Australia, and India.

Tariffs

Tariffs step forward with protective gear, emphasizing that they’re specifically taxes on imported goods, designed to shield domestic businesses from foreign competition or the boost of government subsidies. Collected at the border, tariffs are a customs checkpoint specialty, often used strategically in trade negotiations worldwide.

Customs Duties

Customs Duties swagger in with international flair. Similar to tariffs but broader, these duties can apply to both imports and exports, calculated based on the goods’ total customs value, including cost, freight, and insurance. Customs duties play a significant role in regulating international trade across nearly every country.

Excise Tax

Excise Tax enters the game specifically targeting particular goods like alcohol, tobacco, or fuel. This tax is often embedded directly into the product price, acting like the hidden handling fees of the tax world. Excise taxes are common globally, used widely in the U.S., U.K., and throughout Asia to influence consumer behavior and generate revenue.

Sales Tax

Sales Tax makes its case clear and simple, collected only once at the point of final sale, typically governed by local jurisdictions. It’s like the straightforward local delivery service of taxes, primarily found in the United States and parts of Canada.

Round 1: VAT vs. Tariffs

VAT applies throughout every step of production and sale, making it more complex but also providing opportunities for businesses to reclaim some tax paid. Tariffs, on the other hand, are simpler and apply strictly at the border to imported goods. They aim primarily to protect domestic industries or influence international trade policies.

Who Wins?

VAT is more complex and embedded throughout business operations, while tariffs excel at protecting domestic markets by imposing clear, straightforward costs on imports.

Round 2: VAT vs. Customs Duties

VAT is primarily domestic, impacting the pricing and financial planning of businesses throughout the supply chain, often reclaimable by businesses. Customs duties differ significantly because they focus strictly on international trade, calculated on the comprehensive value of imported or exported goods. Customs duties serve more as regulatory tools for trade balance rather than consumption taxes.

Who Wins?

Customs Duties are versatile, managing trade flows across borders. VAT’s strength is internal, managing economic activity within national borders.

Round 3: VAT vs. Excise Tax

VAT covers nearly all goods and services, applying broadly across various sectors of the economy, whereas excise tax is highly specialized and selective, targeting specific goods such as tobacco, alcohol, and gasoline. Excise taxes aim to curb consumption of certain products or generate revenue specifically from targeted goods, unlike VAT’s broad economic focus.

Who Wins?

Excise Tax captures the niche product-specific tax segment clearly, while VAT remains the universal player affecting a broader array of products and services.

Final Bonus Round: VAT vs. Sales Tax

Sales tax is relatively straightforward—collected only once, at the final retail sale, and easy to understand and manage at the point of sale. VAT, however, applies incrementally throughout the entire production and distribution process, requiring more detailed accounting and providing potential tax credit benefits for businesses.

Who Wins?

Sales Tax wins on simplicity and ease of implementation, while VAT triumphs due to its comprehensive economic influence and built-in mechanisms for reclaiming taxes within business operations.

And Today’s Big Takeaway Is…

Navigating taxes in international logistics doesn’t need to feel like guessing container weights at the port. Whether you’re dealing with VAT, tariffs, customs duties, excise tax, or sales tax, clarity is your strongest asset.

Thanks for joining another thrilling episode of “Is it THIS or is it VAT!” Stay tax-savvy, and remember—knowing your taxes keeps your business sailing smoothly across international waters!

When it comes to ocean freight, it can be easy to observe the competitive nature of shipping rates, service loops and trade lanes and label it market share dog-eat-dog. However, the shifting landscape has affected most ocean carriers in similar ways—which has led to a paradoxical emergence of alliances between carriers.

Shipping alliances are an essential facet of international logistics, promoting efficiency in a complex global trade environment. As these alliances evolve, understanding their background, structure, and implications becomes crucial for stakeholders in the shipping industry.

First, let’s dissect the basic alliance science—or as we like to call it…. Astro-logistics!

Astro-Logistics: The Basic Science Behind the Alliance

What are ocean shipping alliances?

Shipping alliances are collaborations among various shipping lines that enable them to operate collectively on specific routes. By pooling resources, these alliances can optimize vessel usage, reduce costs, and offer more competitive services.

The primary benefits of shipping alliances include stabilized freight rates, increased capacity management, and enhanced operational efficiencies. They enable carriers to share costs, minimize redundancies, and provide customers with a wider range of services.

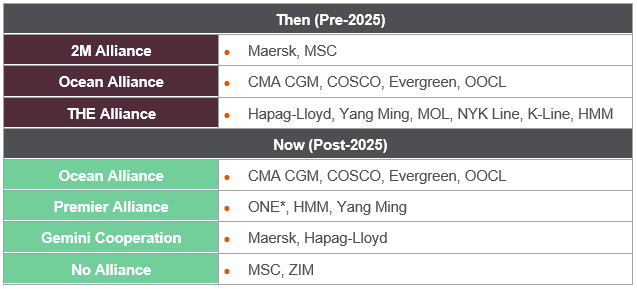

Carrier Compatibility Charts: Then & Now

Here is a “berth chart” containing a brief overview of the recent major shipping alliances from their origins, evolutions, and a brief introduction to the new alliance structures entering the market this year. We will review each one individually in the next section.

*Ocean Network Express (ONE) is a consolidated partnership of K-Line, NYK, and MOL, former members of THE Alliance.

Shipping Alliance Cosmologies: Key Changes in 2025

Now that we’ve laid the foundation, it’s time to align our planets and delve a little deeper. With the 2025-26 contract season on the horizon, it’s important to take the time to retrograde back and refamiliarize yourself with the various shipping alliances between carriers—both past and present. That way, you and your business will be in the right cosmic position, armed with the information and data needed to ensure a diversified and well-rounded variety of options available in the upcoming year.

The Dissolution of the 2M Alliance

The 2M Alliance, formed in 2015 by Mediterranean Shipping Company (MSC) and Maersk, was designed to optimize transpacific shipping routes and facilitate global trade. However, this alliance is set to dissolve in 2025, potentially leading to significant shifts in the market. The dissolution of the 2M Alliance may result in short-term volatility in freight rates. Both MSC and Maersk are likely to establish independent pricing models, influencing the overall market dynamics.

The decision to dissolve the partnership was primarily driven by Maersk’s shift towards an integrated logistics model, which focuses on providing end-to-end supply chain solutions, while MSC is concentrating on expanding its fleet and pursuing independent operations. Additionally, increasing market competition and regulatory scrutiny have prompted carriers to reconsider traditional alliances, favoring more flexible partnerships instead. As a result, both Maersk and MSC now have greater operational flexibility, allowing them to tailor their services without the constraints of an alliance.

Ocean Alliance Remains Unaltered

The Ocean Alliance (OA)—which includes CMA CGM, Evergreen Line, COSCO Shipping and OOCL (a subsidiary of COSCO)—was established in 2017. Last year, it extended its contract agreement through 2027 and then again to 2032. The Ocean Alliance continues to emphasize the Asia-Europe and Trans-Pacific trade lanes, solidifying its presence as a major player in these critical markets.

Members of the alliance are also boosting their fleets and expanding their service offerings, pooling more vessels and enhancing their overall portfolios. This collaboration leads to greater market stability, as shippers can rely on long-term partnerships that offer more predictable rates and routes. Unlike the Gemini Cooperation, Ocean Alliance is increasing their number of direct port calls.

THE Alliance Reemerges as Premier Alliance

Founded in 2017, THE Alliance initially included Hapag-Lloyd, Yang Ming, Hyundai Merchant Marine (HMM), Mitsui O.S.K. Lines (MOL), K-Line and NYK Line. Hapag-Lloyd will exit the alliance in 2025, marking a pivotal change in its structure. While the bulk of the existing membership will remain moving forward, the group will enter the network under a new name in 2025: The Premier Alliance (PA). The newly dubbed Premier Alliance includes Yang Ming, HMM, and Ocean Network Express (O.N.E.)—which combines NYK Line, MOL and K-Line.

The members of the Premier Alliance will focus on major East-West trade routes, linking Asia with the US West Coast, US East Coast, the Mediterranean, Northern Europe, and the Middle East. Additionally, the group announced a slot exchange agreement with MSC for nine Asia-Europe services, as MSC chooses where to operate independently and where to combine forces.

The Debut of Gemini Cooperation

The highly anticipated Gemini Cooperation (GC), set to launch in 2025, forges a new partnership between behemoths Maersk and Hapag-Lloyd. After jumping ship (literally) from their respective alliances, the duo will join forces to address key concerns for global shippers. Their network aims to improve service and transit reliability by using the hub and spoke method to offer better schedule integrity, streamline operations by optimizing port rotations and reduce congestion.

Fewer ports of call also allow the Gemini to emphasize the use of Maersk-owned terminals; this will allow the alliance to mitigate costs while commanding priority loading/unloading services.

Both companies are also heavily investing in digital freight solutions, enhancing cargo tracking and logistics management for a more seamless experience for customers.

The Independents

Lastly, MSC, previously part of the 2M Alliance, along with ZIM, will operate independently in 2025. The free agents will offer a new range of market options and ignite the carrier-shipper competition overall. MSC is now the largest carrier on planet Earth; watch out!

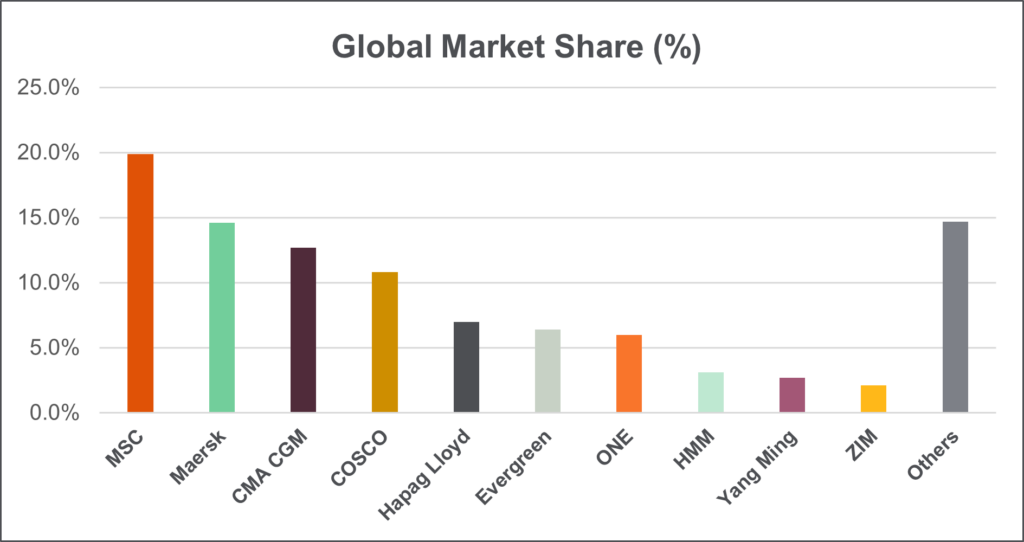

Reading Between the Shipping Lines

Now that you know the science behind the alliance, as well as some of the partnership changes set to re-balance the market in 2025—let’s talk about what this might mean for you.

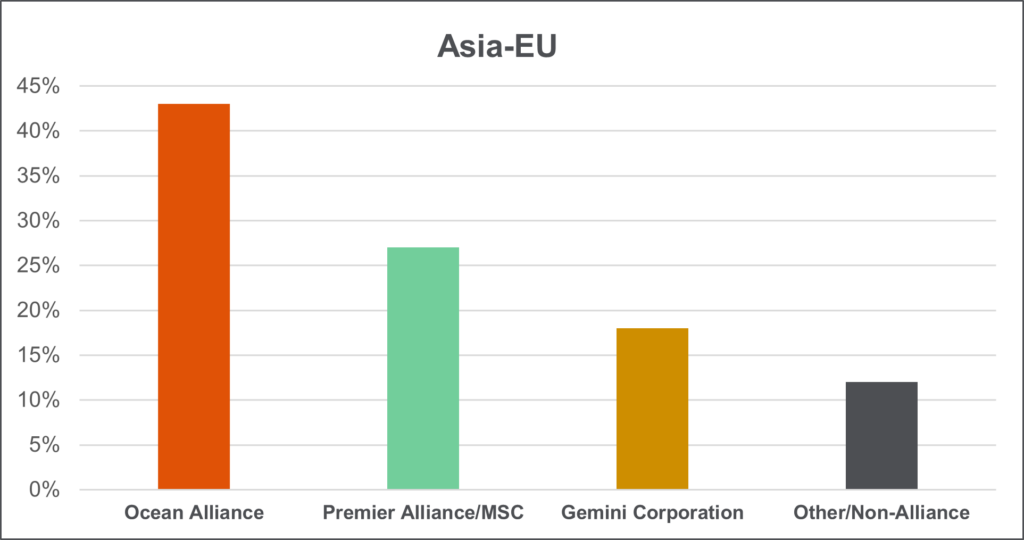

Carrier Constellations: Tracking the Market Shares

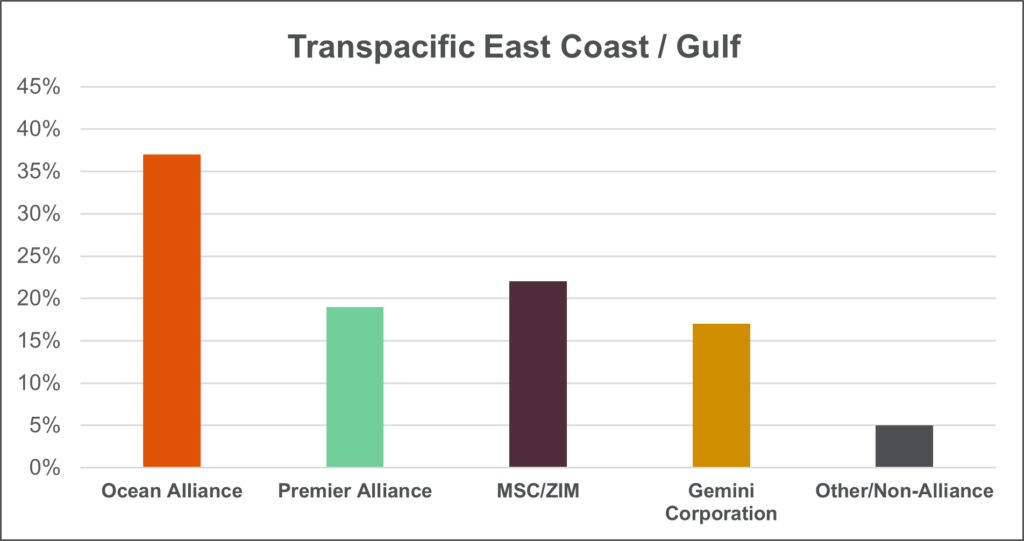

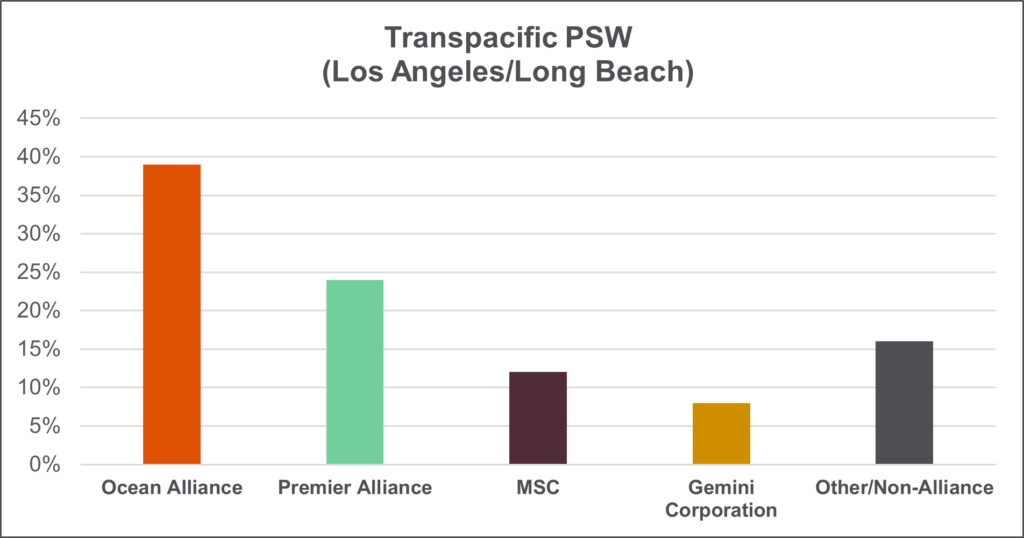

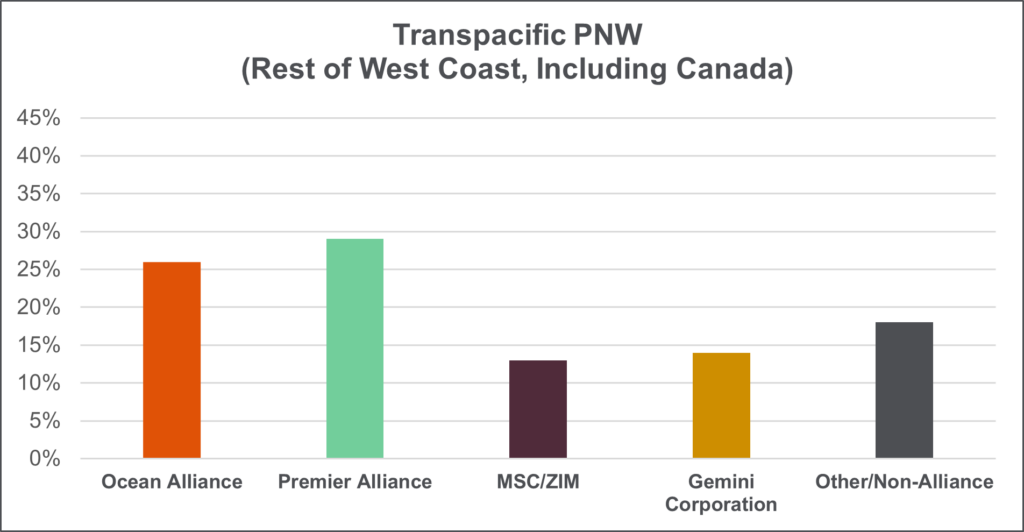

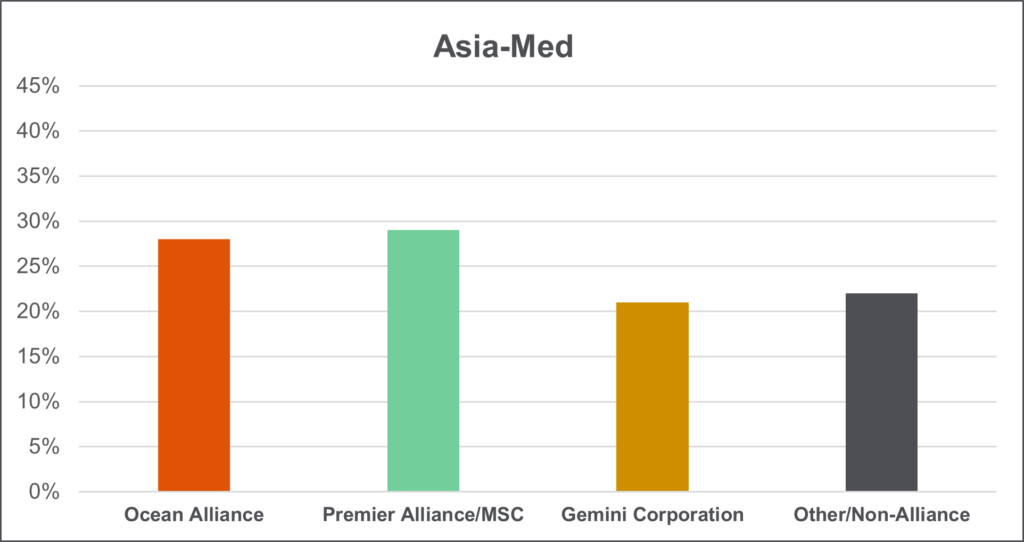

Between the shifting alliance structures and service changes, global supply chains need to take a hard look at the new playing field. We thought it might help to break down the carrier market shares in more relative terms. The following charts depict the market share of each alliance by trade lane.

Alliance Alignment: Signs of the Trade

Finding Your Perfect Contract Match

Matchmaker, matchmaker; make me a [contract] match! Here are a few things to consider when perfecting your contract methodology in the upcoming season:

- Contract Renegotiations. The emergence of new partnerships will necessitate renegotiations of contracts. Shippers may need to explore alternative route options due to increased contract costs, with reports indicating transpacific carrier contracts could rise by up to 20% for 2025-26. This uncertainty might render shippers hesitant to commit, particularly with the looming questions regarding global trade and tariffs.

- Access to All Alliances (and MSC!). With an abundance of capacity from new vessels and the eventual return to Suez use, most pundits expect a buyer’s market in 2025. As Gemini focuses on transit predictability, they are cutting direct service calls. As MSC makes use of their massive collection of vessels, they will likely do the opposite. Our other friends, Premier and Ocean, are well-positioned to offer a solid blend of service versatility and reliability. In today’s game, bigger shippers need to combine BCO contracts with solid NVO options in case the FAK market crashes and in case back-up options are needed in peaks. Smaller shippers can typically gain access to all alliances by choosing the right forwarder/NVO (we know one that starts with the letter S!).

- Leverage Logistics Technology. Alliances like Gemini and Ocean are placing an enhanced emphasis on digitalization and operational efficiency. Supply chain managers should leverage these tech-driven logistics solutions to optimize their operations. Shapiro has spent the greater part of this decade working to enhance our existing logistics technology. After some initial experimentation, we are set to launch our new Shapiro 360 product, to help make our customers’ technological dreams come true.

Avoiding Potential Horror-scopes

In navigating the future of international shipping, staying informed about alliance changes is essential for industry stakeholders. It is prudent to diversify partnerships to ensure that portfolios include multiple carrier contracts, protecting against potential limitations in options—after all, you don’t want to be tied to a single star in a vast constellation of opportunities. Additionally, contract strategy adaptations to incorporate flexible terms will be vital to respond to fluctuating market conditions and prepare shippers for potential rate increases soon. By adopting a proactive approach, companies can align their star carriers to position themselves favorably in a changing global trade environment.

And there you have it…you are officially an Astro-logistics-ist. Congratulations!

US Customs and Border Protection (CBP) recently announced proposed changes to the de minimis import process. If you’re involved in international shipping or global trade, you simply must slow down and pay attention! But don’t worry… we’re here to break it all down for you in a way that’s as easy as 1-2-3…or, better yet, 3-2-1.

What is the De Minimis Import Process?

Let’s start with the basics. In international trade, “de minimis” refers to the threshold value of goods under which no duties or taxes are applied at the border. Historically, it has made importing small-value goods easier and faster.

The Customs Administrative Act of 1938 amended the Tariff Act of 1930 by adding section 321 and establishing the administrative exemption at $1 in order to limit the ‘‘expense and inconvenience’’ of collecting duty when ‘‘disproportionate to the amount of such duty.’’ The value of these shipments was deemed to be so minimal that they were not subject to the same formal customs entry procedures and extensive data requirements as higher-value shipments entering the United States.

Congress has since raised the value of the administrative exemption to $5 in 1978, $200 in 1993, and most recently, to $800 in 2016. Translation: Goods valued under $800 can enter the United States without the need for formal customs clearance or payment of duties. For perspective, $800 is higher than 99.9% of the rest of planet Earth (the EU is about $150, for example).

Why is CBP Proposing Changes?

The de minimis threshold is an important part of customs clearance. As currently implemented, the de minimis program extinguishes not just standard import duties on eligible items, but duties imposed under Sections 201 and 301 of the Trade Act of 1974 and Section 232 of the Trade Expansion Act of 1962. Despite its prevalence over the past few decades, there are several reasons why de minimis is under “de microscope” now. The biggest factors? E-Commerce (looking at you Temu and Shein) and Congress.

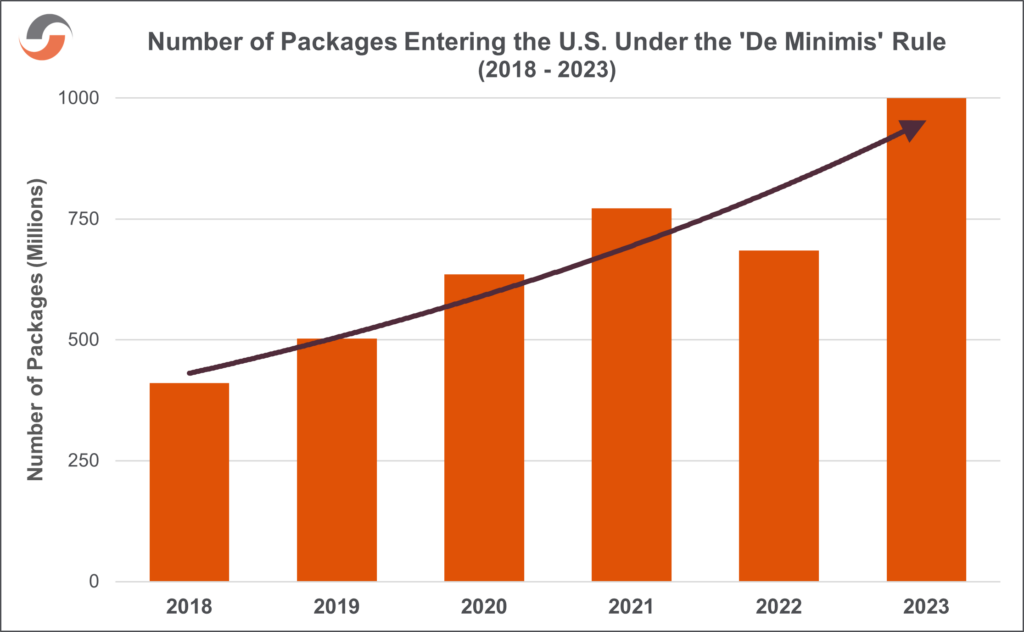

Increasing Volume of Low-Value Shipments

With the boom in e-commerce, there’s been a surge in the number of low-value shipments entering the U.S. In 2013, 140 million shipments utilized the exemption. Just a decade later, that number has spiked significantly—and now encompasses over one billion shipments (that’s a more than 700% gain!). The current process wasn’t designed to handle this volume, so CBP is looking for ways to streamline and manage these imports more effectively.

CBP estimates 77% of shipments claiming the exemption in fiscal year 2023 would have been assessed for additional duties under Section 201, 232 or 301 tariffs if they had not received de minimis treatment.

Concerns About Compliance and Security

Then there are the twin troubles of compliance and security. Policymakers have expressed significant alarm over the potential for the exemption to facilitate unlawful shipments of narcotics (including fentanyl), dangerous merchandise, counterfeits, and products made with forced labor. Raising de minimis/changing the rules should strengthen national security, protect domestic industries and address “discriminatory or unreasonable practices that restrict or burden U.S. commerce,” according to the proposal. Specifically, they shine a bright spotlight on the e-commerce industry–which is particularly vulnerable to imports from China claiming that exemption.

CBP also needs to ensure that all goods entering the country, regardless of value, comply with U.S. regulations. By revisiting the de minimis import process, CBP aims to tighten security measures without creating unnecessary bottlenecks in the shipping process.

What are the Proposed Changes?

This month, government officials released two proposals to introduce potential changes to certain products subject to the de minimis treatment when entering the US. If implemented, these would eliminate the ability for goods valued below $800 covered by Section 201, 301, and 232 duties from eligibility for entry (without an entry!).

It would also create two methods for entering de minimis shipments: the “basic entry process” and the “enhanced entry process.” Shipments claiming the exemption will be required to provide tariff classification numbers under both entry processes, allowing CBP to better determine whether the merchandise is eligible for de minimis treatment or not.

While these awaiting final approval, here is a quick review of what they might entail.

Track #1: The Basic Entry Process

The basic entry process maintains the existing entry process for de minimis shipments with some modifications to the data required to be provided to CBP, such as requiring the name and address of the person claiming an administrative exemption and the final person to whom the merchandise is delivered. CBP will also require the ten-digit classification of the goods under the Harmonized Tariff Schedule of the United States (HTSUS).

The “basic entry process” will be required for bona fide gifts and will be available for all other low-value shipments unless they are shipped through international/U.S. mail, or are goods regulated by agencies other than CBP (such as pharmaceuticals).

Track #2: The Enhanced Entry Process

The enhanced entry process, which will be optional for goods other than mail importations and products regulated by other agencies, would require the submission of data to CBP about the contents, origin, and destination of the shipments prior to the arrival of the goods in the United States. The required time frame to file for an enhanced entry would vary by mode (e.g., air, ocean, land) of transportation by which the goods arrive to the United States.

Additionally, for all shipments made under the enhanced entry process, the following additional data would be required to be transmitted for all shipments:

- Clearance tracing identification number

- Country(s) of origin and export

- 10-digit HTSUS classifications for the merchandise seeking to be entered

- One or more of the following:

- URL to the marketplace’s product listing

- Product picture

- Product identifier

- Shipment x-ray or other security screening report number verifying completion of foreign security scanning of the shipment

- Seller and purchaser names and addresses

- Advertised retail product description

- Marketplace name and website or phone number

- Any other data and documents required by other government agencies

Enhanced Data Collection, Technology and Automation

CBP is also considering enhanced data collection requirements for de minimis shipments. This could involve collecting more detailed information about the shipper, receiver, and the nature of the goods being shipped. Enhanced data collection would aid in risk assessment and help ensure that imported goods comply with U.S. laws.

To manage the increased volume of low-value shipments, CBP is looking into improving technology and automation within the customs clearance process. This could mean faster processing times and improved efficiency, reducing the burden on both CBP and importers.

How These Changes Might Impact You

If you’re in the shipping or global trade industry, you’re probably wondering how these changes might affect your operations.

Potential for Increased Costs

One of the most immediate impacts could be an increase in costs. CBP’s proposal said its “main estimates” find that consumers will bear the full price of increased tariffs stemming from the rule change.” The primary costs of the proposed rule are consumer surplus losses resulting from increased duties and possibly increased processing fees, resulting in higher prices for imported goods paid by U.S. consumers on imported goods.”

A lower de minimis threshold might mean more shipments require formal customs clearance, which can be more costly and time-consuming. Enhanced data collection could also require additional resources and technological investments.

Changes in Shipping Strategies

They could also impact your shipping strategies. You might need to adjust how you handle low-value shipments, perhaps by consolidating shipments to reduce the number of entries or by reevaluating your supply chain to ensure compliance.

Eliminating the exemption for goods subject to Section 201, 232 and 301 tariffs would likely incentivize importers to consolidate orders into bulk shipments, as they would no longer be concerned about exceeding the $800 de minimis threshold. This shift in behavior would benefit CBP, as multiple identical items could be reviewed by officers simultaneously.

Greater Focus on Compliance

With enhanced data collection and tighter security measures, compliance will be more important than ever. Ensuring that your shipments comply with U.S. regulations will be key to avoiding delays and penalties.

Preparing for the Future

The recent announcements marked the final efforts in the Biden-Harris administration’s response to the evolving landscape of international trade. While the changes are designed to improve security and compliance, they also present challenges for those in the shipping and global trade industries. While these changes are still in the proposal stage, it’s never too early to start preparing.

Here are just a few of the ways that you can start to prepare for what’s to come:

- Submit a Comment. CBP is inviting interested persons to submit comments related to the economic impact of removing eligibility for goods subject to Section 301, Section 232, and Section 201 duties; the deadlines for filing under the enhanced entry process; and the practicability of the new information requirements across both the proposed basic and enhanced entry processes.

- Please refer to the below for important details regarding comment submissions and related deadlines.

- All submissions received must include the agency name and docket number for this rulemaking.

- All comments must be submitted via the Federal eRulemaking Portal; and will be posted as is accordingly (including any personal details provided).

- Please refer to the below for important details regarding comment submissions and related deadlines.

| FR Notice | Docket No. | Publication Date | Comments Due | |

| Proposal 1 | 2025-00551 | USCBP-2025-0002 | 1/14/25 | 3/17/25 |

| Proposal 2 | 2025-01074 | USCBP-2025-0003 | 1/21/25 | 3/24/25 |

- Stay Informed. Keep up-to-date with the latest news from CBP and other regulatory bodies. Understanding the nuances of the proposed changes will help you better prepare for their potential impact.

- Evaluate Your Supply Chain. Take a close look at your supply chain and identify any areas where you might need to make adjustments. This could involve working more closely with your logistics partners or investing in technology to enhance compliance.

- Train Your Team. Ensure that your team is well-versed in compliance and customs clearance procedures. Providing regular training and updates will ensure that everyone is on the same page and ready to handle any changes that come their way.

By staying informed, evaluating your supply chain, and focusing on compliance, you can navigate these changes effectively and continue to thrive in the ever-changing world of international trade. Keep an eye on further announcements, as these changes could soon become a reality!

Additional Resources:

- Unpacking Temu’s Tariff Dodging: The De Minimis Deluge Shadowing Forced Labor

- Common Terminology: Government Sponsored Security/Compliance Programs & Initiatives

- Shapiro’s Regulatory Compliance and Consulting Services

Tricks of the Trade: Why Shippers Need Cargo Insurance

Shipments in transit are subjected to numerous perils; goods may be damaged in a storm or fire, stolen by ghosts in the night, involved in a collision, or just plain mishandled, much like the ill-fated journey in “Deliverance.” To help protect against financial loss or another frightful travesty, shippers should consider obtaining Shipper’s Interest Cargo Insurance.

Many folks mistakenly believe that standard carrier insurance will protect their shipments, but this is not always the case. Carriers do not pay claims unless they directly cause or contribute to the loss. Even when carriers are legally liable for loss or damage, the amount they will pay is limited based on the mode of transport, leaving shippers vulnerable to the lurking dangers of the logistics world—where the only thing scarier than a horror movie is an uninsured shipment!

Ocean Freight

The Carriage of Goods by Sea Act (COGSA) governs carrier liability for goods shipped via ocean to/from the United States. Recovery is limited to $500 per customary freight unit, and only when the carrier is negligent. A “freight unit” can vary from one container to one pallet.

International Air Freight

For air carriers, two liability conventions exist:

- Warsaw Convention: Limits liability to $9.07 per pound or $20 per kilogram.

- Montreal Convention: Used in the United States, this convention changes the limitation to 22 Special Drawing Rights (SDRs), or about $30 per kilogram.

Domestic Shipping

Many domestic air, intrastate road carriers, and warehouse operators limit their liability to $0.50 per pound or $50 per shipment, based on their bill of lading or warehouse receipt. Interstate truckers are governed by the Carmack Amendment, which dictates full value but allows limitations of liability in bills of lading, tariffs, or contracts. Some carriers will also have inadequate or no liability insurance and may be unable to fund a loss out of pocket.

Trick-or-Trade: Declared Value vs. Cargo Insurance

Declaring value to a carrier is not the same as having Cargo Insurance. In order to submit a claim against a carrier, the shipper must prove that the cargo was damaged while in the carrier’s care, custody, or control. The carrier then has multiple defenses to prove they weren’t liable, making recovery extremely difficult. Cargo Insurance provides protection without having to prove carrier liability. This is particularly important in instances where a loss is attributable to an “Act of God,” which seems to be a regular occurrence in recent years.

| Examples of Claims | Description of Loss | Declared Value for Carriage | Cargo Insurance |

| Lightning Strikes a Truck | While a trucker was en route, the truck was struck by lightning, causing a fire and resulting in a total loss of the cargo. | Even if a value is declared, there would be no automatic right or recovery because the trucker did not act negligently. The loss was considered an “Act of God.” | This type of claim would be paid under “All-Risk” Cargo Insurance coverage. |

| Heavy Weather at Sea | Several days after an ocean vessel left the port, it ran into heavy weather. A large wave hit the vessel, and containers were washed overboard. | “Heavy Weather” is excluded under COGSA. The ocean carrier would deny liability, and no payment would be forthcoming. | This type of claim would be covered by “All-Risk” Cargo Insurance, as well as With Average (WA) coverage. |

The Haunting Truth: Why Cargo Insurance is Essential

Cargo Insurance not only covers loss or damage but also protects against General Average, pays for the costs to minimize a loss (lawsuit and labor), and pays for damage inspection (survey). Carriers have limited liability and are provided legal defenses that can absolve them of responsibility entirely. Cargo Insurance pays covered claims without the need to prove fault.

What is General Average?

Before we answer our own question, a history lesson! The concept of General Average began when sailing the oceans blue was a very hazardous journey in smallish “sailboats.” When there wasn’t a shipowner to be found to move valuable goods, the risks of those voyages had to be shared by shipper merchants and vessel owners. Despite the relative safety of today’s commercial flotilla, though a vessel a day still sinks (!), General Average is alive and well and has been since the Greeks and the Romans ruled the Earth,

General Average is a principle incorporated into virtually all ocean bills of lading. It is used when a voluntary sacrifice is made to save the vessel, cargo, or crew from a common peril (e.g., jettison of cargo to extinguish a fire or maintain balance in a storm). All shippers on-board contribute to the loss based on their cargo’s value. If the cargo isn’t insured, it won’t be released until the shipper posts a guarantee (cash, bank guarantee, or bond). If the cargo is insured, the insurance company will handle all arrangements on the shipper’s behalf.

For a more in-depth look at General Average check out our blog.

Cargo Theft

Estimates of cargo theft in the United States range from 15 to 35 billion dollars (USD) annually. Officials estimate that nearly 80% of cargo thefts involve employee collusion. Drivers are often paid to leave their truck unattended at a specific place and time.

Statistics:

- Within 24 hours of theft: The goods are already delivered to an alternate location. Thieves are no longer in possession of the merchandise.

- Within 48 hours of theft: Cargo is split into about five consignments and distributed.

- Within 72 hours of theft: Goods are being marketed and sold.

Spooktacular Cargo Insurance Coverage Options

Shapiro offers comprehensive “All-Risk” coverage for cargo in transit, including Free of Particular Average (FPA) and With Average (WA) alternatives.

“All Risk”

Provides the broadest form of protection available. Goods are covered for loss or damage without the need to prove liability. An easy way to remember “All-Risk” coverage is “everything is covered, except what is excluded.” Typical exclusions include improper packing, inherent vice, or rejection of goods by Customs.

Free of Particular Average (FPA)

Offers less protection than “All-Risk” coverage but is a good option for commodities like used goods, waste materials, and scrap metal. A good way to remember FPA coverage is “the only covered losses are specifically named.” Perils covered under FPA include sinking, collision, General Average, fire, and washing overboard, to name a few.

With Average (WA)

Extends FPA to cover heavy weather. Many shippers choose to add theft, pilferage, and non-delivery to WA and FPA.

In a nod to the season, we wanted to end on a “ghoul” note. If you or your business have fallen into one of the perilous pitfalls mentioned above—or simply avoid them all together—consider “trick-or-trading” in your Cargo Insurance provider for Shapiro!

Additional Resources: