Featured Headlines:

US and UK Announce Temporary Suspension of Tariffs on Large Civilian Aircrafts: Update!

FWS Delays Mandatory ACE Filing to June 2021

Millions of Counterfeit Face Masks Seized

APHIS Launches Core Message Set Help Desk for ACE Users

The Container Shipping Outlook Remains Bleak Post Chinese New Year

Air Cargo Capacity Crunch Expected Due to 777 Engine Failure

Upcoming Webinar – Beware the Tides of March

US and UK Announce Temporary Suspension of Tariffs on Large Civilian Aircrafts: Update!

As you may already know, on March 4th, the office of the U.S. Trade Representative (USTR) and United Kingdom (UK) announced a four-month suspension of additional duties on large civilian aircrafts in an effort to resolve one of the longest running World Trade Organization (WTO) disputes.

According to the USTR press release, the UK had already stopped applying retaliatory tariffs associated with the Boeing dispute effective January 1st, 2021. Now, the US has decided to temporarily suspend tariffs on Airbus in an effort to de-escalate the situation and re-open settlement negotiations.

Officials revealed that this decision will “benefit a wide range of industries on both sides of the Atlantic, and allow for focused settlement negotiations to ensure that our aerospace industries can finally see a resolution and focus on COVID recovery and other shared goals.”

Click HERE to read the official USTR press release.

For our Shapiro customers, please keep in mind that we cannot immediately stop claiming the EU Section 301 tariffs; we must wait for the International Trade Commission (ITC) to update the HTS table and send it to US Customs and Border Protection (CBP) for release. This can take several days.

Update: On March 5th, the U.S.and the European Union solidified the March 4th announcement of a four-month suspension of additional duties on large civilian aircrafts on imports into the United States and retaliatory tariffs on imports into the EU; they advised that the suspension will cover all tariffs both on aircraft as well as on non-aircraft products, such as food, wine, and liquor, and will become effective as soon as the internal procedures on both sides are completed.

This will allow the EU and the US to ease the burden on their industries and workers and focus efforts towards resolving these long running disputes at the WTO.

Click HERE to read the March 5th joint EU and US statement.

Please reach out to [email protected] with any questions.

Shapiro will continue to monitor the situation and provide status updates as they become available.

FWS Delays Mandatory ACE Filing to June 2021

In June 2021, products regulated by the Fish and Wildlife Service (FWS) will be required to be submitted in ACE. An earlier March date has been pushed back as FWS finalizes regulations for the requirement.

Submitting FWS data in ACE is an option currently for all ACE filers. This period is an opportunity to become familiar with the process before it becomes mandatory. Filers who are ready to submit the FWS Message Set in ACE are urged to do so.

Please reference the below informational resources available to assist in the transition to ACE:

- FWS Implementation Guide and PGA Message Set Samples.

- FWS and National Customs Brokers and Freight Forwarders Association (NCBFFA) June 2020 FWS ACE Webinar:

If you have any questions about FWS Filings, please reach out to [email protected].

Millions of Counterfeit Face Masks Seized

US Customs and Border Protection (CBP) continues to diligently work to identify counterfeit N95 and surgical masks that protect frontline workers. In January, CBP reported the seizure of 16 million counterfeit face masks in 534 incidents since the beginning of the pandemic.

They also reported the following seizures of other related Personal Protective Equipment (PPE) that did not meet import requirements:

- 177,500+ FDA-prohibited COVID-19 test kits in 409 incidents;

- 37,000 EPA-prohibited anti-virus lanyards in 118 incidents;

- 38,000 FDA-prohibited chloroquine tablets in 224 incidents; and

- 6,000 tablets of antibiotics, such as azithromycin, in 105 incidents.

Counterfeit goods deprive legitimate businesses of revenue; they can also be harmful to US consumers from a health and safety standpoint in this case.

Remember all medical devices that are imported must meet US Customs and Border Protection (CBP) requirements.

CBP has put together the following documents pertaining to counterfeit awareness and the price of importing counterfeit goods:

E-Commerce Counterfeit Awareness Guide for Importers

E-Commerce Counterfeit Awareness Guide for Consumers

How can we help? We encourage any importers with questions related to counterfeit goods to contact the Shapiro Compliance Team.

APHIS Launches Core Message Set Help Desk for ACE Users

As part of the Automated Commercial Environment (ACE) implementation outreach, the US Department of Agriculture’s Animal and Plant Health Inspection Services (APHIS) announced the introduction of its new APHIS Core Message Set Help Desk.

Beginning March 1st, importers, brokers, and filers will be able to contact the Help Desk for assistance when submitting APHIS Core Message Set in the ACE Environment. This service will be available Monday through Friday, 7 am to 11 pm EST. It will review stakeholder message sets, explain error cores and flags, provide disclaim guidance, and answer general message set questions.

With full enforcement of APHIS Core Message Set starting on March 15, 2021, APHIS will expand the APHIS Core Message Set Help Desk hours to Saturdays, 8am to 4pm EST to better serve its users.

The Help Desk can be reached at 1-833-481-2102, and users should select:

- Option 1 for new inquiries;

- Option 2 for existing inquiries with a reference ticket;

- Provide their full Message Set transmission and associated error codes if their inquiry concerns either topic.

Users can also submit APHIS Core Message Set questions by email to [email protected].

You can also visit APHIS’ ACE webpage and the APHIS Core Message Set Questions and Answers for additional information and resources.

For assistance with your APHIS Core Filings, please reach out to [email protected].

Need CTPAT Assistance?

Can’t find enough time to devote to your CTPAT renewal to meet your deadline?

Need assistance with the Minimum Security Criteria (MSC)?

Our compliance team can assist you! We can be your extra pair of hands and eyes to review your portal and ensure you meet your renewal deadline.

Please contact [email protected] for a customized quote.

The Container Shipping Outlook Remains Bleak Post Chinese New Year

In late February, China returned from their Chinese New Year (CNY) holiday and the tradition of removing vessel services or “blanking” sailings appears to have lived on for yet another year. Only this year the reasoning is different. With dwell times in Los Angeles (LA) ports reaching beyond a week’s time, vessels are not able to return and start their next rotation on schedule.

Another effect is that the global “container imbalance” wanes on. “Container imbalance” is a phrase used to represent the uneven distribution of shipping containers on common trade routes. This year a larger-than-normal number of imports have arrived in the US during a much longer-than-normal peak season. This resulted in more empty containers on US shores than abroad — where they are desperately needed.

In February, the United States also suffered severe weather events in the Midwest and Southwest, which prevented the return of containers at rail ramps throughout the regions. Meanwhile, ongoing labor shortages affected trucking capacity and warehouse productivity. Each of these reasons has prevented containers from being cycled back into rotation and each delay has further compounded the crisis.

This problem now echoes around the world because steamship lines are directing more empty containers to the lucrative Asia market, which starves the rest of the world of vital empty equipment. Importers across the globe can expect two main effects. The first is that booking availability is low in countries with a higher ratio of exports to imports. The second is that bookings that are granted in these countries are assessed a “container imbalance surcharge” which then drives up cost. Importers can expect these charges out of China, India, Turkey, and Brazil; however, this list may grow if the situation cannot be remedied.

How can Shapiro help? Should you require any assistance in successfully booking your cargo during this turbulent time or additional information about current rates, please reach out to our Transportation team today.

Air Cargo Capacity Crunch Expected Due to 777 Engine Failure

Airlines are pulling Boeing 777’s (powered by Pratt & Whitney 4000-122 engines) offline after a United Airlines flight from Denver to Honolulu lost one of its engines inflight on February 20th. Luckily, the flight was able to safely land with no reported injuries in the air or on the ground.

The National Transportation and Safety Board (NTSB) found two fractured fan blades among initial inspections prompting Boeing and Pratt & Whitney to organize emergency inspection parameters for these specific engines. The same blades were under a 2019 inspection mandate following a previous incident as well. This affects approximately 69 flying aircraft and 59 stored aircraft around the world.

United Airlines has removed all 24 of its Boeing 777’s from its schedule – which has already been plagued by COVID-19. The airline will shuffle aircraft that had been parked or used to fly cargo-only back to passenger service, which will cause cargo capacity to shift.

Other affected airlines are JAL, Ana, Korean, Asiana. The toll on how long air cargo capacity will be affected by the required inspections and possible subsequent fixes is not yet known.

Upcoming Webinar – Beware the Tides of March

It’s that time of year again…Contract Season! And this one is sure to be unlike any other.

We invite you to join Angela Czajkowski (Shapiro), Robert Burdette (Shapiro) & James Caradonna (M+R) as they take the stage on Thursday, March 18th at 2 PM to discuss the current transportation market while outlining some expectations for the coming year.

During this 60-minute session, our experts will talk about contract expectations, equipment and space considerations, and how to make a plan for your supply chain – followed by a live Q&A.

Click HERE to register.

Our Expert Shapinion

Why China Won the Trade War Super Bowl in 2020

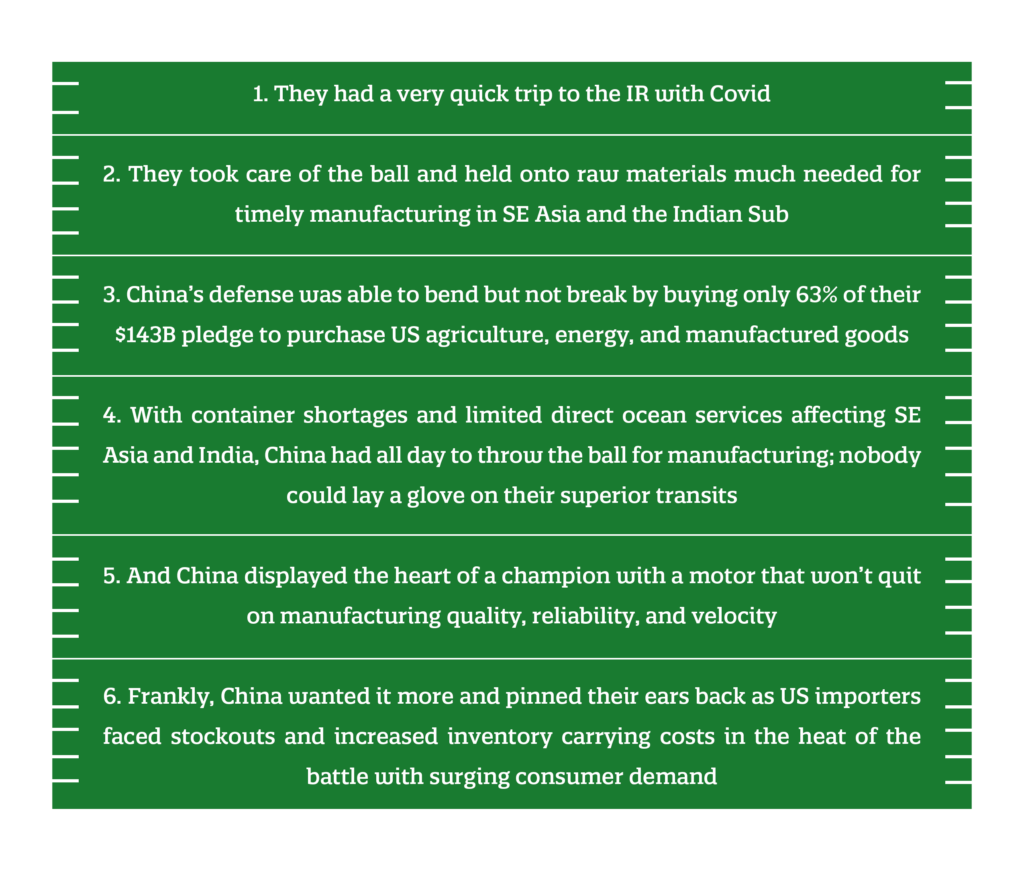

Here are some of the highlights:

To kickoff 2020, the US had just played small mouth football on Section 301 Tariffs in the 2018 endzone and throughout the 2019 season. It seemed to all that they just needed to stick to their game plan: score lots of points on exports to China and build on the 11% reduction in imports from China. After the US left it all on the field in 2019, China’s market share of US imports had fallen a significant 6 points (a touchdown and missed extra point).

Frankly, China’s production offense was facing 3rd down and forever with $370B in US tariffs, the doubling of manufacturing wages since 2009, increased social welfare taxes, and stricter environmental compliance gang tackling their prospects for growth in exports to the US.

At the same time, US made wise draft picks as they marched down the field to diversify sourcing – especially for lower cost and labor-intensive goods. Vietnam has been running downfield while gaining yardage at nearly 20% growth per year. To boot, the Indian Sub-continent has been able to air it out to give the US good hands for their big play offense.

So, how did China win the Game of All Games – the Trade War Super Bowl?

When looking at the second half of 2020, China had a throwback season reminding us all of their glory days as the world’s factory. They have mastered the hurry up offense for speed, agility and quality while being able to milk the clock on total transits and production reliability.

Coach Biden will have to carefully review the US playbook this season; a porous defense is missing targets for US exports while China’s ball control offense on manufacturing will sorely test the grit and toughness of US importers previously dedicated to new sourcing options…Game on!

Interested in reading more articles like this in the future? You can sign-up to receive the next edition of Supply Chain Reactions via our Subscription Center. (And did we mention it’s FREE?!)

Employee of the Month

As previously featured in Shap Talk, Shapiro has been sharing with you the names of employees who have been recognized for their exceptional efforts and contributions to our Company. At Shapiro, we continually work to develop, challenge, and inspire all of our employees to grow individually and with the Company.

This month, we would like to recognize TERESA SPENCER, DOMESTIC SPECIALIST.

Over the past few months, Teresa has been working around the clock because she has so much on her plate. She is in constant communication with her customers – whether it’s over the  weekend, early in the morning or in the evening – to make sure they’re satisfied and have the most up-to-date information. Teresa is there to quickly swoop in any time an explanation is needed, or when her peers need any form of help; she always checks in to make sure everyone is doing okay. She also remembers to follow up on her commitments, which is hugely helpful. At the end of the day, Teresa is a really fantastic member of her team – and we all love working with her. Congratulations, and thank you, Teresa!

weekend, early in the morning or in the evening – to make sure they’re satisfied and have the most up-to-date information. Teresa is there to quickly swoop in any time an explanation is needed, or when her peers need any form of help; she always checks in to make sure everyone is doing okay. She also remembers to follow up on her commitments, which is hugely helpful. At the end of the day, Teresa is a really fantastic member of her team – and we all love working with her. Congratulations, and thank you, Teresa!

We encourage you to provide us with employee feedback! Please email us at [email protected].