Featured Headlines:

Air Cargo’s Plot Twists: Peaks, Takeovers, and Border Drama

Charting China’s Dominance: The Mid-Year Port Showdown

Fulfilling Your CTPAT-riotic Duties!

A Not-So-Brief Trump Tariff Corner Update

Europe’s Ports Get Ghosted, Then Flooded

Trains, Trucks, and Trouble: A Cross-Modal Soap Opera

Air Cargo’s Plot Twists: Peaks, Takeovers, and Border Drama

- Geodis: Don’t Count Your Cargo Before It Ships

- Logistics giant Geodis is treading carefully, saying the traditional airfreight surge may be dulled this year by conflicting forces:

- On one hand, tariff anxiety sparked early shipping by U.S. importers trying to beat the buzzer.

- On the other, demand’s getting sleepy as those importers sit on fully stocked warehouses—and wait out the economy.

- Meanwhile, industry consolidation looms large following DSV’s buyout of DB Schenker, which created the world’s largest airfreight forwarder.

- ANA + NCA = A Cargo Marriage Years in the Making

- After two years and eight delays, All Nippon Airways (ANA) finally completed its takeover of Nippon Cargo Airlines (NCA)—creating the 14th largest airline group by tonnage.

- Regulatory reviews (especially in China) slowed the deal, but approvals finally cleared this summer.

- Parent company NYK Line sold NCA, citing margin pressure and a need for deeper investment.

- Even with the deal inked, it’s not all smooth cruising: Q1 international cargo revenue dipped 2%, despite a bump in volume. China-to-U.S. traffic fell, but intra-Asia demand helped cushion the blow.

- Charters Save the Day in Southeast Asia

- When the Cambodia–Thailand border abruptly closed, road freight ground to a halt—and just-in-time manufacturers started sweating bullets.

- Enter: Air Charter Service, which sprang into action with nearly 100 emergency charter flights, hauling over 5,000 tons of cargo between Bangkok, Siem Reap, and Phnom Penh.

- Both inbound and outbound flights flew full.

- Industries avoided production shutdowns by pivoting hard (and fast) to air.

- The verdict? When the roads disappear, charters earn their stripes.

Charting China’s Dominance: The Mid-Year Port Showdown

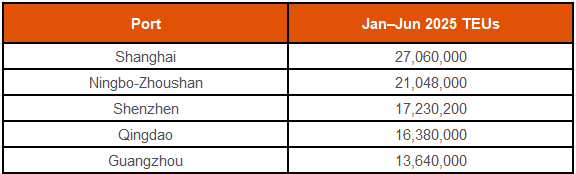

- We’re mixing things up in this edition with a chart (yes, we’re fancy now).

- The first half of 2025 has once again proven that China is the reigning heavyweight of global container trade, with five ports in the TEU top ten tier. If the rest of the world is trying to keep up… well, good luck.

- Here’s how the major Chinese ports stacked up from January to June 2025:

- Shanghai: Still wearing the crown, with Yangshan Terminal humming along and poised to break 50M TEUs again this year. Bow down.

- Ningbo-Zhoushan: Multimodal muscle + digital smarts = a solid silver medal.

- Shenzhen: Riding the tech-export wave, and now riding clean—thanks to a new MoU with Long Beach on decarbonization.

- Qingdao: Home of the fastest cranes in the world. (Seriously—62.62 TEUs/hour per crane.)

- Guangzhou: Rounding out the top 5 with eco-upgrades and enough electric handling gear to make Tesla jealous.

Fulfilling Your CTPAT-riotic Duties!

- Even the most loyal supply chain partners can get tripped up by new tech. CBP has officially launched CTPAT Portal 3.0, and it comes with some new requirements and design changes.

- If you’re locked out or just confused, you’re not alone—and Shapiro’s here to help you stay liberty-aligned and login-ready. Here’s what you need to know…

- New Portal Access:

- The new CTPAT and Trade Compliance (TC) Portal 3.0 can be accessed here:trade.cbp.dhs.gov/ctpat/ctpat-portal-ui

- All users must create a new login.gov account to access the updated system.

- Helpful Instructions:

- Data Migration:

- All your existing data, history, documents, and reports will be automatically transferred to Portal 3.0.

- There’s no need to download or re-upload unless you want to keep personal records.

- Validation Reports:

- New format coming for validation reports created in Portal 3.0.

- Previous reports will remain available as PDFs in your account library.

- Account Structure Update:

- Accounts with multiple security models under a single organization will now be separated back into individual accounts (similar to the original Portal 1.0 structure).

- This will not affect login access—users tied to multiple accounts will simply select the desired account upon logging in.

- Need Tech Support?

- Report bugs or data issues to the CBP Technology Service Desk via [email protected] or by calling 800-927-8729.

- If you’re unable to access your account, contact your Supply Chain Security Specialist or the management team at your assigned CBP field office.

- New Portal Access:

- Feeling lost in the portal shuffle? Shapiro’s compliance team can help you stay compliant, connected, and CTPAT-ready—no oath of allegiance required. Reach us at [email protected] for personalized assistance.

A Not-So-Brief Trump Tariff Corner Update

- U.S., Europe Announce Trade Deal: 7/28/25

- President Trump announced a trade deal with Europe just before the August 1st deadline. Most European goods, including cars, will face a 15% tariff—lower than Trump’s threatened 30%, but higher that the EU’s hoped-for 10%. Aircraft, some chemicals, and pharmaceuticals are exempt.

- The EU has committed to purchasing $750 billion in energy, making $600 billion in investments, and an unspecified amount in military purchases. Specifics and timelines for EU energy and military commitments remain unclear, though both sides described the agreement as historic and powerful.

- Additional Tariffs Announced for Brazil: 7/30/25

- President Trump signed an Executive Order implementing an additional 40% tariff on Brazil, bringing the total tariff amount to 50%.

- Trump Announces Tariffs on Copper: 7/31/25

- On July 30, 2025, President Trump announced a 50% tariff on all imports of semi-finished copper products and intensive copper derivative products, effective 12:01 A.M. ET on August 1. The tariff applies only to the copper content of the imported article and is in addition to any other applicable duties, fees, or charges. No drawback will be available for these duties.

- If a product is also subject to duties under Proclamation 10908 (covering automobiles and automobile parts), only those duties will apply. The non-copper content of the affected articles may still be subject to tariffs under several Executive Orders related to trade deficits, border security, and synthetic opioids.

- The proclamation does not provide a specific list of affected copper products, but a Federal Register or CBP notice is expected soon. Importers of impacted copper products, including high-quality copper scrap, will need to amend entries after importation.

- August 1st Tariffs Beginning to Go Into Effect: 7/31/25

- With the August 1st deadline approaching, the Trump Administration announced a few rate changes. Check out our Shap Flash for the complete list of countries impacted by the tariffs!

- EU Retaliatory Tariffs Delayed: 8/4/25

- The European Union announced a six-month delay on its planned retaliatory tariffs on U.S. goods as both sides work to implement a new trade agreement framework. Although the U.S. will proceed with its 15% tariffs on European goods this week, the move signals a step toward easing trade tensions.

- India Tariffs Double to 50%: 8/6/25

- President Donald Trump revealed an Executive Order hiking tariffs on India from 25% to 50% for buying Russian oil.

- Don’t let another update pass you by! Sign-up to receive our complimentary Shap Flash alerts in real-time—or bookmark our Trump’s Trade Tariff Updates page.

Europe’s Ports Get Ghosted, Then Flooded

- It’s official: weekly cargo capacity into North Europe is acting like your least dependable ex—either ghosting completely or showing up unannounced with baggage. Wow, this bitter metaphor is likely hard won and seems to imply an Elizabeth Taylor exes list length!

- On the Asia–North Europe trade, weekly vessel capacity swings have gone from a manageable 12.3% (2011–2019) to a wildly erratic 29.6% since 2021. That’s like going from a drizzle to a monsoon, with no umbrella. Ports are designed for steady cargo flows—not this new “lumpy” rhythm that’s more whiplash than waltz.

- Meanwhile, Europe’s port party is already off the rails:

- Antwerp: Waiting game stretches up to 3 days.

- Genoa: Clocking in with 3.5-day delays.

- Rotterdam: Rail service partially MIA due to construction; RWG terminal facing 10-day waits and a yard fuller than a Black Friday parking lot.

- Algeciras, Bremerhaven, Le Havre: All running behind schedule, thanks to holiday labor shortages.

- And it’s not just North Europe. The Asia–Mediterranean trade is also deep in chaos, with volatility up to 29.1%, from a chill 13.9% pre-2020.

- Ports were already juggling low water, construction, labor woes, alliance shakeups, and an acute case of Red Sea rash. Now they’ve got to add “cargo capacity mood swings” to the list.

- At this point, we wouldn’t blame terminal operators for needing a stiff drink…off-crane and off-the-clock of course!

Trains, Trucks, and Trouble: A Cross-Modal Soap Opera

- Mega-Rail Merger Rattles the Tracks

- The proposed Union Pacific–Norfolk Southern merger is generating seismic waves across the rail industry. If approved, the combo would create a transcontinental powerhouse with over 50,000 miles of track in 43 states and access to 100 ports—towering over BNSF’s 32,500-mile network.

- The Surface Transportation Board (STB) still has a de facto moratorium on large rail mergers dating back to 2001 (thanks to the BNSF–Canadian National scare). So, regulatory hurdles loom large.

- Union Pacific’s CEO is touting a “more efficient network” for shippers, especially in the Ohio Valley and along the Mississippi, thanks to reduced interchanges and better routing options. But whether the STB plays conductor or derailment crew remains to be seen.

- Truckers Tighten the Belt—and the Bolts

- While railroads are dreaming big, trucking firms are bracing for a long haul of pain. Convinced that the freight slump will stretch into 2026, large carriers are trimming the fat: selling underused assets, cutting costs, and shuffling equipment in response to supply chain snarls and tariff fallout.

- And they’re not wrong to be worried—U.S. imports dipped 11.8% month-over-month from April to May, and were down 6.4% year-over-year in May, per the Global Port Tracker.

- Regulatory Shake-Ups: What’s In, What’s Out

- In: Derek Barrs—President Trump’s nominee to lead the Federal Motor Carrier Safety Administration (FMCSA)—is one step closer to confirmation after sailing through the Senate Commerce Committee. With over 30 years in public safety, he says his leadership style will focus on “collaboration and stakeholder engagement.”

- Out: The FMCSA’s speed limiter mandate. The agency officially abandoned its 2016 and 2022 proposals that would’ve required all trucks over 26,000 pounds to install speed-limiting devices. That long-running rulemaking saga? Finally parked.