Don’t Stack the Deck Against Yourself: How to Avoid Overpaying Section 232 Tariffs

Importing steel or aluminum products—or goods that simply contain them—can feel like a high-stakes card game. The challenge isn’t just getting goods across the table; it’s making sure you’re not betting more than you owe.

Too often, importers misapply Section 232 and IEEPA tariffs, stacking duties where they don’t belong. What should be a straightforward shuffle of percentages turns into an expensive misplay—and Uncle Sam always collects the pot.

The good news? With the right strategy, you can cut the deck cleanly, avoid overpaying, and keep more chips in your hand.

The Hidden Cost of Misclassification

One of the most common ways importers overpay is by stacking tariffs across the entire value of a product instead of just the steel or aluminum portion.

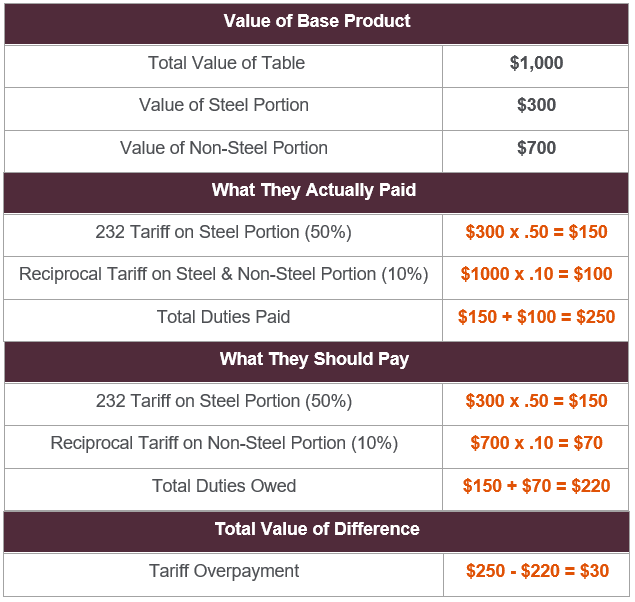

Take a steel table valued at $1,000. Of that, only $300 is the steel frame, while the rest is wood, glass, and other materials.

Unfortunately, like many importers, your company incorrectly applies both a 50% Section 232 tariff on the steel portion and a 10% IEEPA tariff on the entire $1,000 value. That mistake inflates the duty bill to $250 when the correct amount should be just $220.

Here’s how it breaks down when played correctly:

Now imagine a shipment of 1,000 tables—that’s $30,000 ($30 x 1000) paid out unnecessarily. What looks like a minor misstep at the entry line can quickly snowball into a serious drain on your stack.

Derivative HTS Codes and the Surprise Draw

Some products don’t look like obvious tariff risks, but classification rules can slip extra cards into the deck. Derivative HTS codes are one of the most common traps.

Take a shipment of aluminum patio chairs. The importer assumes only raw aluminum products are covered by Section 232. But when the chairs are classified under HTS 9403 (metal furniture), they trigger the duty. What felt like a safe play suddenly comes with a surprise tariff.

Other codes that routinely catch importers include:

- 7610 – Aluminum structures and parts.

- 8306 – Bells, gongs, statuettes of base metal.

- 9403 – Other metal furniture.

- 7326 – Other steel articles.

- 7616 – Other aluminum articles.

These derivative codes are like hidden cards—you don’t realize they’re in play until they take a chunk out of your stack. A proactive classification review is your best bet to avoid losing chips on every hand.

Executive Order 14257: Clarifying Dealer’s Duties

Executive Order 14257 reshuffled the deck by clarifying how Section 232 and reciprocal tariffs should apply—and when they shouldn’t overlap.

Picture an importer bringing in toolkits made up of steel tools and plastic casings. If they file the whole kit as one line, they end up paying both Section 232 and reciprocal tariffs on the full value. That’s tariff stacking at its worst.

EO 14257 changes the game. It directs importers to split duties by content:

- Steel portion → Section 232 duties only.

- Non-steel portion → Reciprocal tariffs only (HTS 9903.01.25).

By filing toolkits this way, importers pay duties on each component correctly instead of stacking tariffs on the whole shipment. For companies moving high volumes, the savings can be substantial.

The rule isn’t a loophole—it’s the dealer spelling out how to play the hand. Those who follow it keep far more chips on their side of the table.

When to Split the Hand on Entry Summaries

The way you file an entry summary is the final move that determines whether you pay too much or just enough. Two common scenarios show the difference between betting blind and playing with strategy.

Scenario 1: Aluminum Value = Total Entered Value (or unknown)

- A cookware importer doesn’t know the aluminum portion of their product and files everything under one line.

- Additional Duties:

- Reciprocal: IEEPA do NOT apply.

- Section 232: Applies to the entire value.

It’s quick and simple—but costly. You’ve essentially bet the whole pot when only part of it was at stake.

Scenario 2: Aluminum Value < Total Value

- A sharper importer of the cookware splits the entry into two separate lines.

- Line 1: Non-Aluminum Content

- HTS Code: Same as aluminum.

- Entered Value: Total value minus aluminum portion.

- Additional Duties:

- Reciprocal: Apply IEEPA, AD/CVD as needed.

- Section 232: Do NOT apply.

- Line 2: Aluminum Content

- HTS Code: Same as Line 1.

- Entered Value: Aluminum value only.

- Additional Duties:

- Reciprocal: IEEPA do NOT apply.

- Section 232: Applies only to this line.

- Report quantity in kg under Chapter 99 HTS.

By filing this way, the duties fall exactly where they belong. Instead of stacking tariffs across the full shipment, the importer pays only what’s owed, keeping thousands in play across multiple entries.

The difference is strategy. Reporting isn’t just compliance—it’s knowing when to split the hand, so you don’t over-bet.

Bottom Line: Play Your Hand Wisely

Section 232 and related tariffs don’t have to be a gamble. Misclassification, derivative codes, and entry line errors are the kinds of missteps that stack the deck against importers. But with careful classification, smart reporting, and an eye on Executive Order 14257, you can keep from over-betting and protect your stack.

The real takeaway? Customs compliance isn’t about luck—it’s about strategy. The importers who win are the ones who know the rules, split their values correctly, and double-check the fine print before they lay their cards down.

Don’t let tariff stacking drain your chips. Review your entries, audit your HTS codes, and make sure you’re paying only what you owe—no more, no less. With the right approach, you’ll always have a stronger hand at the customs table.

Need help auditing your entries or reviewing your HTS codes? A proactive classification review could be the easiest money you save all year. Explore Shapiro’s Classification Advisory Module (CAM) or Connect with our team to see what might be in the cards for you.