Evolutionary Lines: Entering the New Classification Era

Customs compliance isn’t extinct—but it might feel like it evolved straight out of the Jurassic. Back in the pre-2019 era, import entries were simple creatures. Predictable. Manageable. No strange mutations to track or hidden fees lurking in the tall grass of government notices.

Then came the tariff asteroid.

Between trade wars, retaliatory duties, and a growing jungle of exclusions, the once-basic customs entry has evolved into a multi-headed classification beast. And in 2025? It’s officially a full-blown customs ecosystem.

Let’s dig into how we got here—and what it means for today’s importers.

The Entry Line Evolution: From Simple to Stacked

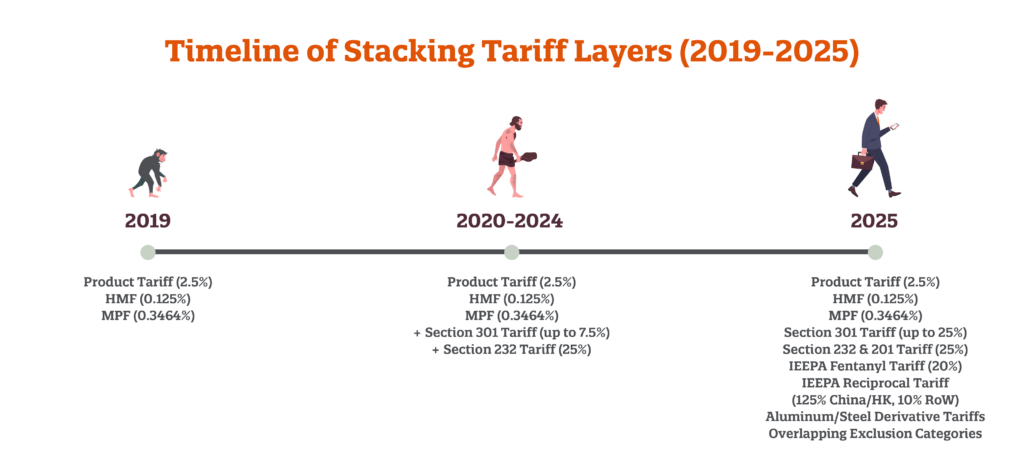

Once upon a customs era, a single entry was fairly simple and straightforward. But that’s certainly not the case today. Let’s take a look at how entry lines have evolved throughout three distinct stages: Pre-Covid (2019), Covid (2020-2024), and Post-Covid (2025).

2019: Predictable and Pared Down

Total duties on a $13,000 item? Roughly $377. Easy to predict. Easy to budget.

2020-2024: Layers Begin to Build

- Product Tariff: Still 2.5%

- HMF + MPF: Still present

- Section 301 Tariff: Up to 25%

- Section 232 Tariff: 25%

- Exclusion Programs: Intermittent and inconsistent

The numbers weren’t always overwhelming, but the tracking certainly was.

2025: Welcome to Uncharted Tariff-tory

- Product Tariff: Still 2.5%

- HMF + MPF: Still applied

- Section 301 Tariff: 25%

- Section 232 & 201 Tariffs: 25%

- Exclusion Programs: Overlapping, reinstated, expired…and ever-changing

- IEEPA Fentanyl Tariff: 20% (China/HK)

- IEEPA Reciprocal Tariffs: 125% (China/HK), 10% (Rest of World) (temporarily paused…for now)

- Aluminum/Steel Derivative Duties: Active

Here’s a real-world example from a recent entry:

- Product Tariff: 25%

- IEEPA Reciprocal Tariff: 20%

- China 301 Tariff: 25%

Total duties on a $13,000 item now? Over $8,000. Difficult to swallow. Difficult to pay.

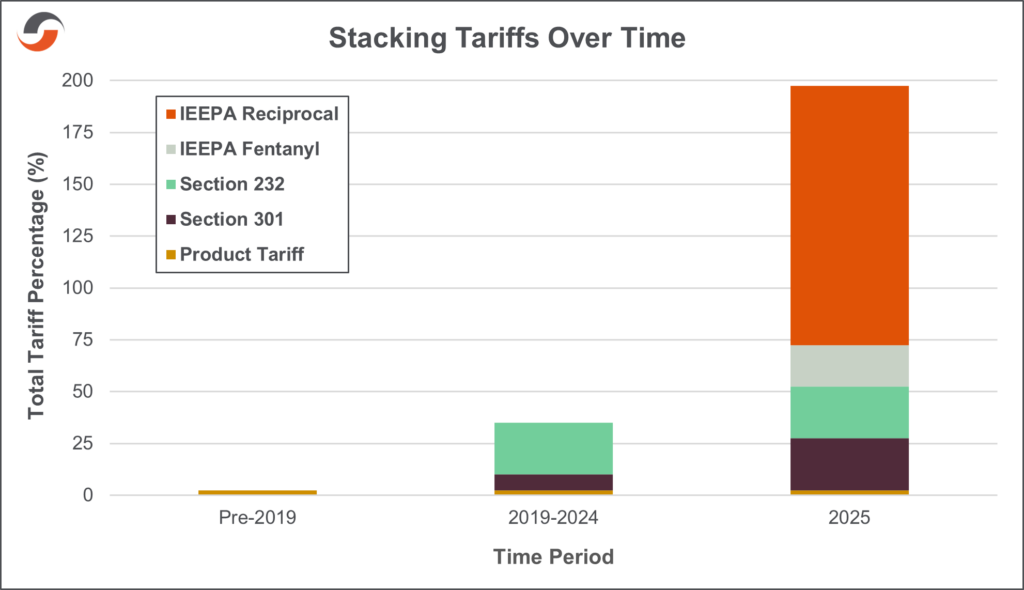

Charting the Stack: How Duties Have Grown

Just look at how tariff layers have compounded over time:

It’s not just about the rates—it’s about how they’re applied. In 2025, duty exposure is driven by:

- Country of origin

- Applicable tariff authorities

- Current (or expired) exclusion status

Even basic goods can carry up to five different tariffs—each with its own filing rules, audit risks, and time limits.

What This Means for Importers

Tariff stacking isn’t just a budgeting issue—it’s a compliance hazard. With more layers come more opportunities to misclassify, miscalculate, or misstep.

And regulators? They’ve evolved too. Automated flags, audit triggers, and post-summary correction programs mean small errors can become big liabilities.

This isn’t the time to go it alone.

Survival Tips for the Modern Explorer

Here’s how to navigate this customs jungle without getting fossilized:

- Map Your Classifications. HTS codes now tie into multiple duty programs. Accuracy is everything.

- Know Your Exclusions. Many are temporary or reinstated without fanfare.

- Study Country of Origins. One product, two countries = two very different duty paths.

- Work with a Broker Who Speaks Tariff-ese. The language is complicated. Make sure your partner is fluent.

Need Help Charting Tariff-tory?

Since 1915, Shapiro has helped importers evolve with the trade landscape. From single shipments to complex, multi-program tariff strategies, we’ve got the tools—and the team—to help you stay compliant, cost-effective, and confident.

Don’t let entry lines turn into land-before-time-mines. Let’s decode your duties before they bite the dust.