Section 232 Tariffs

September 30, 2025

Section 232 Tariffs on Wood Products Announced

On Sept. 29, President Trump issued a proclamation under Section 232 imposing new tariffs on lumber, furniture, cabinets, and other wood products effective October 14, 2025, as outlined below:

– 10% global tariff on softwood lumber

– 25% global tariff on certain upholstered furniture, rising to 30% January 1, 2026

– 25% global tariff on kitchen cabinets/vanities, rising to 50% January 1, 2026

One important thing to note: All tariff provisions under Chapter 44 of the USHTS are being removed from Annex II of Executive Order 14257 for any shipments arriving to the U.S. on or after October 14th (there is no in-transit exclusion for this). This means any lumber products previously excluded from Annex II of Executive Order 14257 will be subject to reciprocal tariffs moving forward, if the product is not specifically identified in the Executive Order.

U.S. Trade “Partners” will receive more favorable treatment that reflects the terms of their trade deals, as defined below:

– UK is capped at 10%

– EU and Japan are capped at 15% combined MFN + 232 rate

– Other countries may face reciprocal tariffs if they are not under special treatment

The Commerce Department’s Section 232 report concluded that imports threaten U.S. national security by weakening domestic mill capacity, eroding competitiveness, and risking shortages for defense and critical infrastructure needs. Wood products are deemed essential for munitions, missile-defense systems, housing, transport, and the power grid.

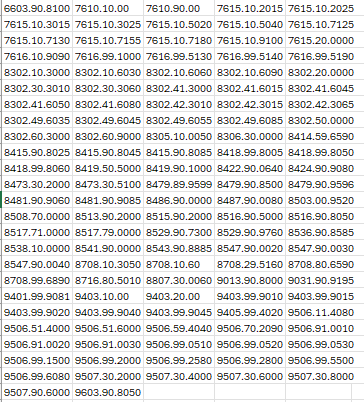

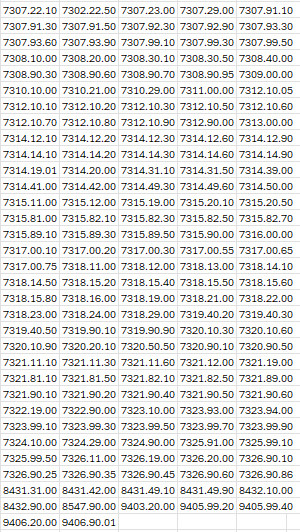

The proclamation annex lists tariff subheadings covered. The administration also warned of potential additional tariffs to prevent circumvention and mentioned that countries negotiating with the U.S. may secure alternatives.

March 27, 2025

Tariffs Update: New Auto and Parts Duties Under Section 232

A new proclamation imposes a 25% tariff on specified automobiles and certain auto parts, in addition to existing duties. Here’s what you need to know:

- Scope and Timing: The tariffs apply to passenger vehicles (including sedans, SUVs, CUVs, minivans, cargo vans, and light trucks), as well as key automobile parts such as engines, transmissions, powertrains, and electrical components. Tariffs on automobiles take effect April 3 at 12:01 a.m. ET, while those on auto parts will begin no later than May 3, per an upcoming Federal Register notice. The full list of affected products will be defined in ANNEX I, which is pending release.

- USMCA-Originating Imports: Vehicles that qualify under the USMCA may be partially exempt, with the 25% tariff applying only to non-U.S. content, provided accurate documentation is submitted. If CBP determines that the declared non-U.S. content is overstated, the full value of the vehicle will be subject to the 25% tariff retroactively to April 3 for all entries of the same model by the same importer. For USMCA-eligible parts, tariffs will be delayed until Commerce establishes a process to apply duties specifically to non-U.S. content.

- Expansion Process for Additional Parts: By June 24, 2025, the Secretary of Commerce must establish a process for adding more parts to the Section 232 list upon request from domestic producers or industry groups. Requests must show that rising imports pose a national security risk. After submission, Commerce will consult with USITC and CBP, issue a determination within 60 days, and publish a Federal Register notice within 14 days. Newly added parts will face tariffs the day after publication.

- What’s Next: Expect additional Federal Register notices detailing affected products. President Trump also signaled possible future tariffs on lumber, pharmaceuticals, and computer chips during press remarks.

Steel and Aluminum Update

August 18, 2025

Effective August 18 at 12:01 a.m. ET, the department of Commerce has officially expanded the scope of Section 232 by adding new aluminum and steel derivative products to Annex I of the HTSUS. Importers should take immediate note of the following changes:

Aluminum Products (CSMS #65936615):

– Added under Proclamation 10895.

– New Products classified under subdivisions (j/k/r/s) of U.S. Note 19 are now subject to duties.

– Tariff rates range from 50% ad valorem (general) to 25% (UK-specific), with some exemptions at 0% for U.S.-processed products.

Steel Products (CSMS #65936570):

– Added under Proclamation 10896.

– New products classified under subdivisions (m/n/t/u) of U.S. Note 16 are now subject to duties.

– Tariff rates include 50% ad valorem (general) and 25% (UK-specific), with certain exemptions at 0% for U.S.-melted and poured products.

– Importers should consult the official Section 232 FAQs for critical details, including:

– Reporting country of melt and pour

– Steel/aluminum content valuation

– Reporting rules for goods subject to both steel and aluminum duties

Additional Notes:

– Russian aluminum duties remain at 200% (HTS 9903.85.67 / 9903.85.68).

– Reciprocal tariffs under EO 14257 apply to non-steel/aluminum content.

– No drawback is available for these duties.

– Foreign Trade Zone (FTZ) admissions remain restricted to “privileged foreign status.”

February 18, 2025

On Friday, February 14th, the official annex lists (containing all the specific HTS codes) were made available for steel and aluminum. The full list of codes can be found below in links to the official Federal Register Memos.

As a reminder, this renders all previous aluminum and steel agreements with trading partners invalid, effective March 12th. No exclusions or exemptions will be issued. However, if you have a current exclusion, it will be effective until the expiration date or until the volume has been exhausted.

February 13, 2025

Starting March 12, 2025, a 25% tariff will apply to all steel and aluminum imports, including specified derivative products. Additionally, an expanded list of derivative products will also be subject to tariffs. However, these tariffs will only take effect once the Secretary of Commerce confirms that an efficient system is in place to process and collect duties. As soon as the updated Annex listing the expanded derivative products is available we will share an update.

Key Details:

- Steel Tariffs: If a derivative steel product listed in the Annex is not classified under Chapter 73 of the HTSUS, the 25% tariff will apply only to the steel content of that product.

- Aluminum Tariffs: If a derivative aluminum product listed in the Annex is not classified under Chapter 76 of the HTSUS, the 25% tariff will apply only to the aluminum content of that product.

- Russian Aluminum: Any aluminum product or derivative made from primary aluminum of Russian origin will face a 200% tariff. (Primary aluminum refers to newly produced aluminum extracted from alumina via the Hall-Heroult process.)

- Exemptions for U.S. Steel & Aluminum: If a derivative steel product is made from steel melted and poured in the U.S., and certification is provided to CBP, it will not be subject to additional tariffs—regardless of where it was processed. The same applies to aluminum derivative products if CBP is given the necessary documentation. Guidance on required documentation will be published soon.

Trade Agreements & Exclusions:

- All previous trade agreements covering steel and aluminum imports with Argentina, Australia, Brazil, Canada, the EU, Japan, Mexico, South Korea, Ukraine, the UAE, and the UK will be terminated on March 12.

- Steel & Derivatives from Turkey: Imports will be subject to a 50% tariff.

- No More Exclusions: Effective February 11, 2025, no new exclusions or exemptions will be granted. Existing exclusions will remain valid only until their expiration date or until the approved volume is exhausted—whichever comes first.

Additional Changes:

- Adding More Products to the Tariff List: The Commerce Department has 90 days to establish a process for adding additional products to the Annex. U.S. steel and aluminum producers (or their industry associations) can petition to include more products, and Commerce will issue a decision within 60 days of a request.

- No Duty Drawback: These tariffs cannot be refunded through duty drawback claims.

- Strict Enforcement & Penalties:

- CBP will prioritize reviewing steel and aluminum classifications. If misclassification is found to avoid tariffs, penalties will be issued without mitigation.

- For aluminum misclassification, CBP will enforce maximum monetary penalties allowed by law.

- Foreign Trade Zones (FTZ): Any steel or aluminum product (or derivative) entering a foreign trade zone on or after 12:01 AM, March 12, 2025, must be admitted as "privileged foreign status" unless it qualifies for "domestic status"—meaning it will be subject to duties upon entry for consumption.

Looking for Help with Tariffs?

Check out our Tariff Consulting Services to see how Shapiro can help you get ahead of the game and stay prepared for any upcoming tariffs!