Freight Forecasting: When FAK Levels Drop Below Contract Rates

In logistics, the forecast can flip quickly. One moment, your long-term contracts are the rain jacket shielding you from volatile spot swings. The next, FAK (Freight All Kinds) spot rates plunge below contracted levels, leaving importers and exporters wondering if they dressed for the wrong weather.

When FAK undercuts contracts, it’s more than an awkward price gap — it’s a clear barometer of oversupply, shifting demand, and brewing turbulence in shipper–carrier relationships. Let’s check the freight radar, aka “freight-ar,” together.

When Spot Rates Dip Below the Contract Clouds

For importers and exporters, the first raindrop felt is often rate regret. Watching competitors scoop up bargain spot rates while you pay sky-high contract premiums feels like being caught in a downpour without a raincoat.

But the forecast affects more than just costs:

- Carrier credibility gets soaked. Long-term contracts, supposedly built on trust and volume, lose value fast when spot deals undercut them. For some carriers, honoring contracts while selling cheaper FAK space creates a perception of unfairness that can erode loyalty.

- Market turbulence. Forwarders and BCOs start pushing for index-linked adjustments, midterm renegotiations, or even rerouting cargo to cheaper carriers. A retailer shipping furniture ahead of peak season, for instance, may divert discretionary containers away from contracted lines in search of immediate savings.

- Opportunistic forecasting. Shippers begin reallocating discretionary freight to the spot market, reserving contracts only for space guarantees. This weakens volume commitments, which in turn disrupts carriers’ network planning.

- Budgeting headaches. Finance teams that built annual cost projections on fixed rates now face pressure to justify why they’re paying above-market prices.

When FAK dips, both sides of the table can feel the change in pressure—and both must quickly decide whether to hold firm or bend with the weather.

Stormy Conditions on the Freight Rate Horizon

Like most weather systems, a freight rate drop doesn’t appear out of nowhere. The barometer often falls in response to a mix of these conditions:

- Overcapacity floods the market. New megaships or sudden capacity shifts outpace demand. Empty slots = fire-sale FAK rates.

- Demand cools off. Seasonal lulls, macroeconomic dips, or cautious inventory strategies leave carriers competing harder for cargo. Think of big-box importers pulling back Q4 orders, the ripple hits the entire market.

- Rate wars erupt. Alliances chasing market share bring the thunder; FAK becomes the weapon, undercutting contract floors to lure volume.

- Blank sailings misfire. Cutting capacity to push rates higher sometimes backfires. If demand doesn’t return, carriers are left discounting heavily, with spot rates falling even lower than before.

- Shifting trade currents. Tariffs, geopolitical changes, or new sourcing patterns reroute flows, leaving traditional lanes oversupplied. A shift from China to Southeast Asia, for example, can suddenly leave Transpacific contracts looking mismatched.

- Contract psychology. Once enough shippers feel burned, the pressure builds for rebates, future concessions, or loyalty credits—which further complicates negotiations.

Each of these fronts lowers the pressure in the freight market; and when the pressure drops, so do FAK rates.

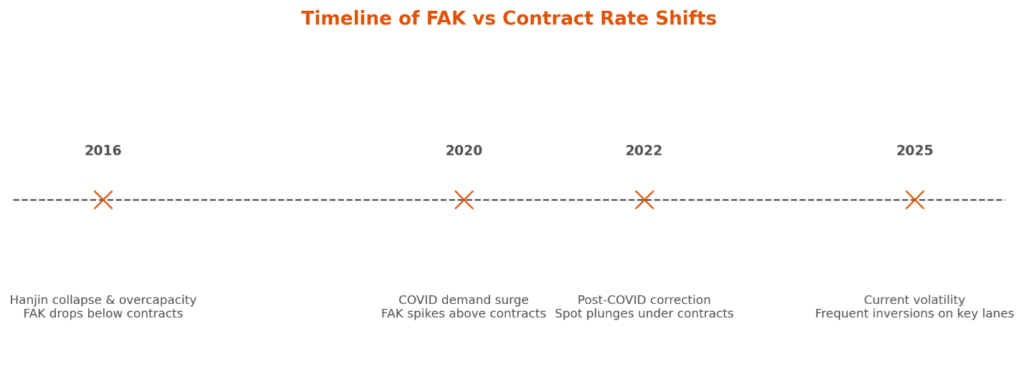

A Look Back: Historical Freight Forecasts

Rate inversions between FAK and contract levels aren’t new. In fact, they’re considered regular weather systems in ocean freight. Here’s a few notable milestones in recent years:

- Hanjin Collapse & Overcapacity (2016): A glut of megaships met soft demand; Hanjin’s bankruptcy highlighted how quickly contracts can look overpriced as spot (FAK) sinks.

- COVID Demand Surge (2020): An unprecedented consumer boom pushed FAK far above contracts; carriers favored spot liftings.

- Post-COVID Correction (2022): The pendulum swung back; spot crashed under expensive annual contracts, fueling “rate regret.”

- Current Volatility (2025): Frequent, lane-specific inversions keep both sides balancing stability vs. flexibility.

How to Stay Dry in Shifting Shipping Conditions

No shipper can stop the rain, but you can gear up for it:

- Pack a rain jacket with vents. Contracts bring stability, but clauses for rate reviews, floating index ties, or “escape hatches” can keep you from overheating when markets fall.

- Mix your wardrobe. Balance long-term contracts with flexible spot bookings. Think of it as layering—a solid jacket with boots ready for puddles. Some shippers hedge by committing 60–70% of cargo under contracts while leaving the rest flexible.

- Check the radar often. Monitor carrier announcements, blank sailing schedules, and alliance strategies. These are your market barometers, showing when storms are forming.

- Factor in hidden weather. Lower spot rates may look sunny, but they can come with rolled cargo, reduced service levels, or higher detention/demurrage exposure. Stability has its own value.

Most importantly, remember: strong partnerships with forwarders like Shapiro are like weather alerts—they’ll give you the earliest signals and the flexibility to respond quickly.

Be sure to sign up for our free subscriptions to stay in the loop with the latest news!

Keep an Eye on the Freight Rate Radar

When FAK rates slide under contracted levels, it’s not just drizzle, it’s a market signal flashing oversupply and soft demand. Frustrating? Absolutely. But it’s also a chance to reposition.

Shippers who balance contract stability with spot-market agility, while keeping one eye on the rate radar, are the ones best positioned to capture savings and keep their supply chains steady through the squalls.

Want a clearer forecast without chasing every cloud? Check out Shapiro’s Shipping Rate Trends page—your real-time rate barometer, minus the stormy spreadsheets.