Prepare for Increased CBP Fees Effective October 1, 2020Prepare for Increased CBP Fees Effective October 1, 2020

- September 16, 2020

Per our August Shap Talk article, U.S. Customs and Border Protection (CBP) previously announced fee increases adjusted to reflect inflation effective October 1, 2020. These fees will directly affect your Customs entry.

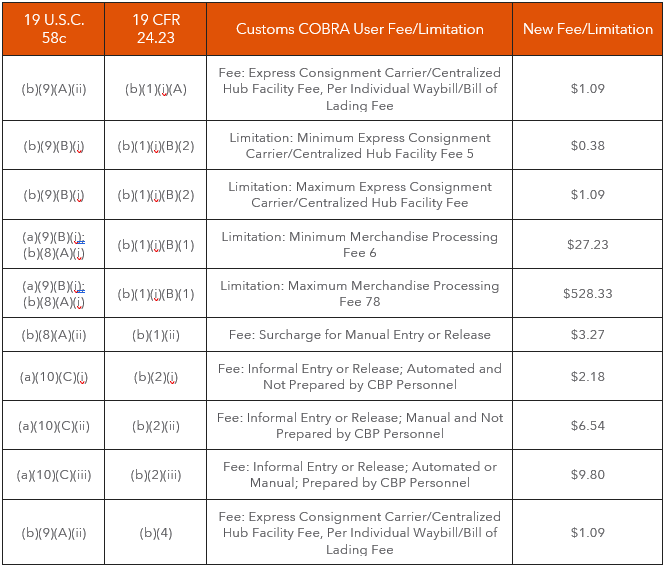

For example, the Merchandise Processing Fee (MPF) limitation for formal entries (class code 499) will increase from $26.79 to $27.23 and the maximum limitation will increase from $519.76 to $528.33; however, the ad valorem rate of 0.3464% will NOT change.

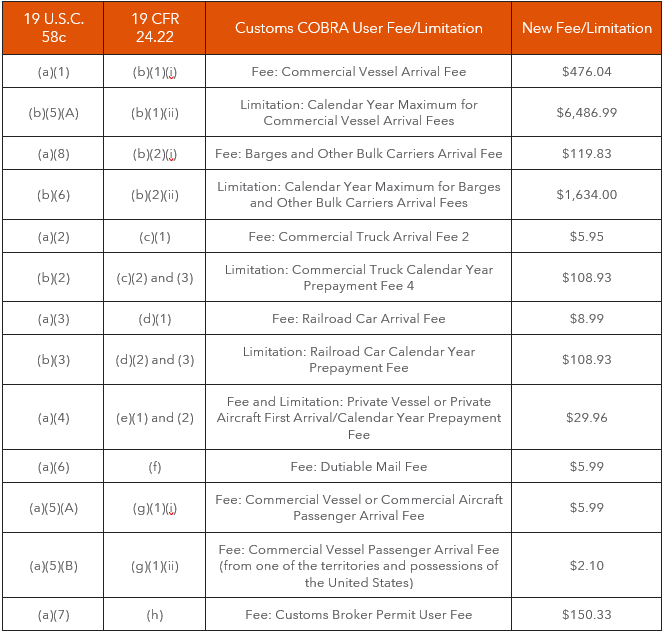

Please reference the tables provided below, as well as the Federal Register Notice published July 29, 2020 (pgs. 45647 and 45648), to gain a better understanding of all increases that will commence on October 1.

TABLE 1 — Customs Cobra User Fees and Limitations Found in 19 CFR 24.22 for Fiscal Year 2021 (adjusted in accordance with the FAST Act)

TABLE 2 — Customs Cobra User Fees and Limitations Found in 19 CFR 24.23 for Fiscal Year 2021 (adjusted in accordance with the FAST Act)

Should you have any questions about these increases, please reach out to [email protected].

Shapiro will continue to monitor the situation and provide updates as they become available.