Commercial Invoice: Your Shipment’s Passport

A commercial invoice is one of the most important documents in international trade. It acts as a customs declaration, a proof of sale, and a financial record for both the seller and the buyer. Without a properly prepared commercial invoice, your shipment may be delayed, misclassified, or even held at the border. For importers and exporters working with a freight forwarder or customs broker, a complete and accurate invoice ensures smooth clearance through U.S. Customs and other international agencies.

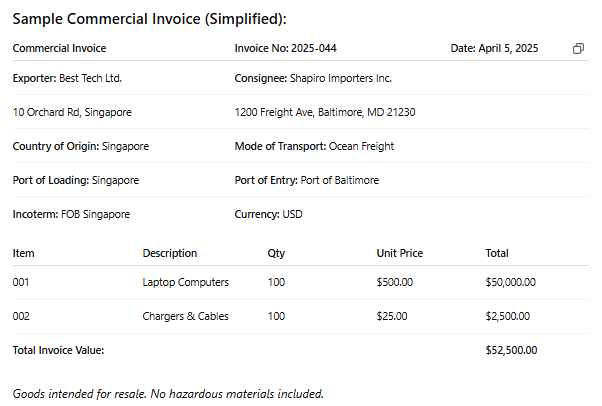

This document is typically prepared by the exporter or seller and accompanies goods as they travel across borders. It outlines key information about the shipment, including the value of the goods, country of origin, Incoterms, and product descriptions that customs officials use to assess duties and confirm compliance.

What to Include On a Commercial Invoice

Every international shipment should have a commercial invoice that includes the following:

- Names and addresses of the exporter (seller) and importer (buyer)

- Invoice number and date of issuance

- Complete description of the goods (including quantity, weight, and part numbers)

- Unit price and total value for each item

- Currency used for the transaction

- Country of origin of the goods

- Incoterms (e.g., FOB, CIF, DDP) that define responsibilities and cost-sharing

- Shipping details: method of transport, port of loading, and port of entry

- Harmonized Tariff Schedule (HTS) or HS codes, if available

Why Is a Commercial Invoice Important?

A commercial invoice is not just a formality—it is a legal and financial document that customs agencies rely on to determine the correct duties, taxes, and admissibility of your goods. It also helps your freight forwarder, 3PL provider, and customs broker plan ahead and avoid unnecessary delays. When properly prepared, it can speed up the clearance process, support trade finance requirements, and reduce the risk of penalties or audits.

For U.S. imports, U.S. Customs and Border Protection (CBP) often uses the commercial invoice to determine the declared value and applicable tariffs. For exports, the commercial invoice is critical for export compliance and filing through AES (Automated Export System).

Get It Right the First Time

An incomplete or inaccurate commercial invoice is one of the most common reasons for shipment delays at customs. Vague descriptions, missing HTS codes, or mismatched values can trigger customs exams and costly storage fees. At Shapiro, we help importers and exporters ensure that their documentation is compliant, complete, and clear—before the goods even reach the port.

Need help reviewing your commercial invoice? Our documentation experts are just a call away.