A Salute to Workers in the Physical Supply Chain

Supply Chain Reactions

A Condensed Update For American Shippers

Issue Date: September 7, 2021

Quote of the Issue:

“Pleasure in the job puts perfection in the work.”

– Aristotle

Ocean Supply Chain’s so Darn Freaky, It’s Hurting our GDP

ShapLight Focus: The US economy grew 6.5% in Q2 2021, but that figure fell well short of economists’ predictions of 8% growth due to supply chain backlogs

- A single COVID case at Ningbo’s Meishan Terminal led to a complete closure of the complex, thereby reducing total cargo flow from the world’s 3rd largest port by about 20% for more than a week

- Please note the average number of vessels at anchor this week for the following US ports:

- Los Angeles: 46

- Oakland: 15

- Savannah: 21

- Seattle: 10

- Operational blank sailings are back up to 50,000 TEUs per week for Asia to the US; while shippers are screaming bloody murder, ocean carriers point to US ports’ inability to handle current volumes

- It is estimated that a full 25% of ocean capacity is being lost to shipping delays

- The average transit time from Shanghai to Chicago via Los Angeles – normally 35 days – has reached 73 days

- COVID-19 outbreaks, lockdowns, and shelter-in-place orders for Vietnam, Malaysia, and Indonesia have rendered close to 50% of factories and their production inoperative

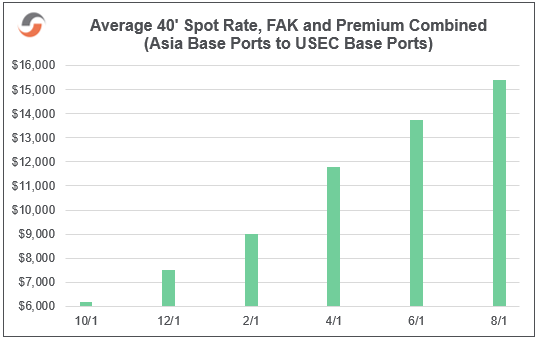

- Current actual ocean import rates (defined as contracts + FAK + premium surcharges) from Asia to US are now 700-800% above their 5-year averages

Please note our chart of the issue:

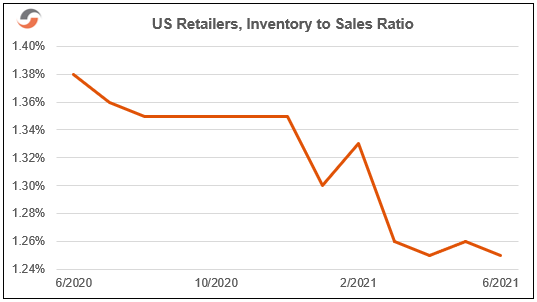

- The question haunting us all: “when will this freight market be at least closer to normal?” Please note the US retail inventory to sales ratio and realize that this freaky madness will certainly continue well into 2022; the spike in import demand is FAR from over, gang

Senate Approves a $550B Increase in US Infrastructure Spending

ShapLight Focus: The $550B includes: $110B for roads and bridges, $66B for rail infrastructure, $25B for airports, $17B for ocean ports, and $15B for electric vehicles; in total, 42.4% of the new spending is earmarked for vital US transportation improvements:

- Cosco Shipping and Mediterranean Shipping Co (MSC) have rejected high profile accusations from a US importer (MCS Industries) that they failed to fulfill contract obligations and colluded on pricing while also declaring that the US Federal Maritime Commission (FMC) does not have legal purview over the matter; the trade is watching this case closely, though the FMC will not make its final decision until late 2022 or early 2023

- Forced labor remains a high priority issue for Customs and Border Protection (CBP), and they have issued close to 700 Withhold Release Orders (WRO) since October 2020 for shipments from China; in comparison, a total of 17 WROs were issued for China from January 1994 to September 2020

- Many importers are still waiting for the Generalized System of Preferences (GSP) and the Miscellaneous Trade Bill (MTB) to be renewed by Congress; both essential trade bills have been expired since the end of 2020

Supply Reduction Helps Airlines’ Profit Production

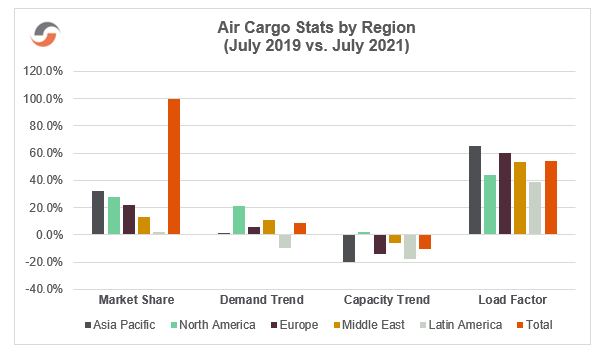

ShapLight Focus: For the first half of 2021, airline cargo revenues are up almost 80% vs. 2019 (a better comparison than COVID-tainted 2020 results) as limited air cargo capacity commands higher rates; the aggregate number of chargeable kilos is almost exactly equal for the same period – 2021 vs. 2019 – but the continued diminishment of passenger flight belly space provides at least some off-set to lost passenger revenues

- In 2020, Memphis passed Hong Kong as the busiest cargo airport on the planet after loading and unloading 4.6 million metrics tons of cargo

- The airline industry expects an Apple “airlift” from China in the next two weeks

- Apple’s massive project comes at just the wrong time for Shanghai’s Pudong Airport as they address a COVID-19 outbreak; several airlines are diverting cargo and flights to Beijing, Guangzhou, Shenzhen, and Zhengzhou

- Current prospects for airline cargo profits remained very positive in July with global demand up 8.6% and global supply down 10.3% vs. 2019

Please note our chart of regional air cargo trends for July 2021 vs July 2019:

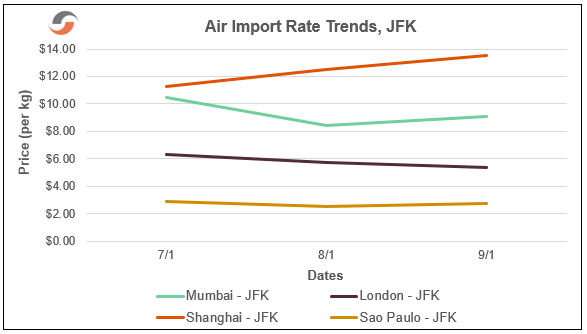

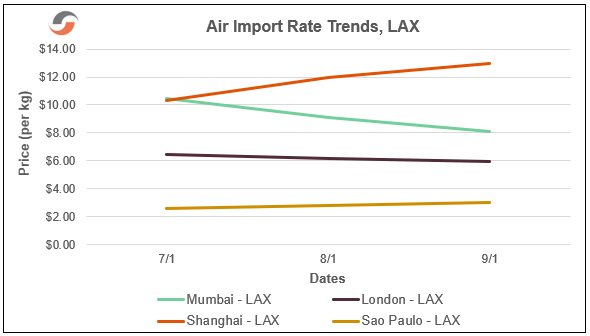

Please note the following three-month airfreight rate trend charts:

Domestic Freight Infrastructure All Choked Up

ShapLight Focus: West Coast containerized cargo now takes 14-24 days to get from vessels to trains with Oakland (14-day average), Seattle (18-day average), and LA/LGB (24-day average) all struggling with massive congestion

- With an overall truck power scarcity crisis across the US, especially in the drayage sector, it is disappointing to learn that the number of valid US commercial driver’s licenses (CDLs) have decreased since 2019

- While only 6.7% of US trucking jobs are held by females today, it is encouraging that a portion of the money inside the $550B infrastructure package is allocated to study female recruitment in trucking

- The trade was shocked when the Union Pacific Railroad (UP) cancelled service from Los Angeles to Chicago for a week; the railroad industry has hinted that extreme route changes may be executed in the future to improve overall efficiency

- The state of Georgia has extended hours of service limits for truckers due to a surge in COVID-19 cases putting renewed pressure on local supply chains

- Despite sharp criticism for the number of vessels at anchor, the ports of Los Angeles and Long Beach are operating at 160-170% of historical productivity; while this may sound like good news, it only underscores the continuing cargo pressures on dray providers, warehouses, and railroads

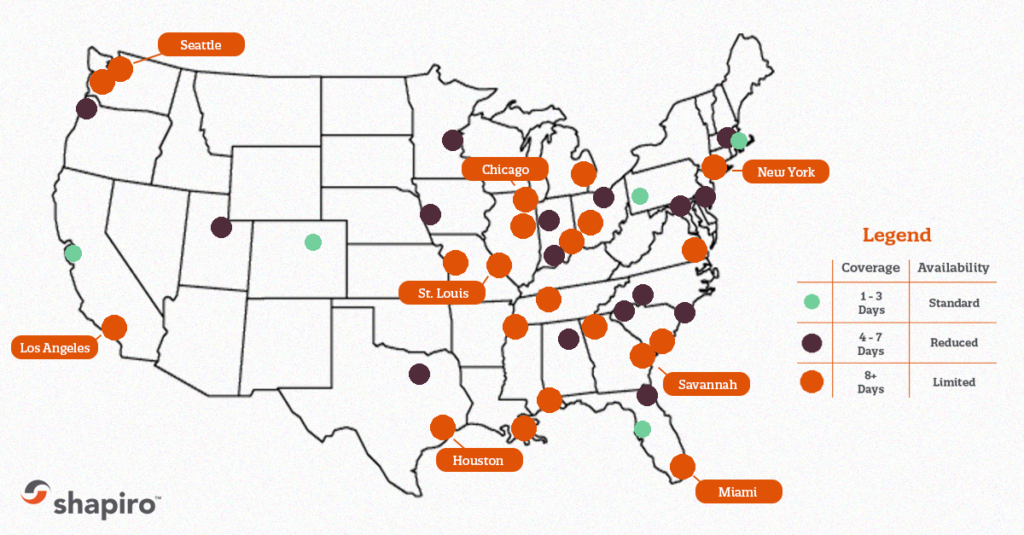

Please note our ‘Orange Crush’ Map of US Drayage Backlogs:

Import Freight Rate Trend Charts

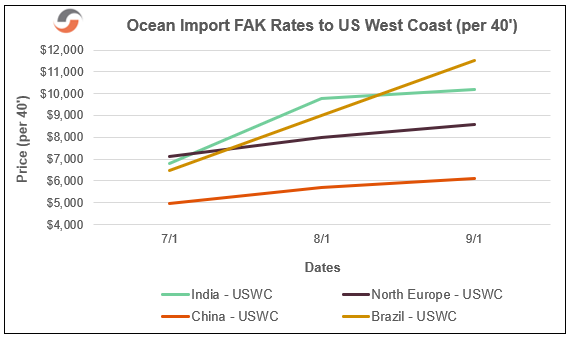

Ocean Import FAK Rates to US West Coast (per 40’):

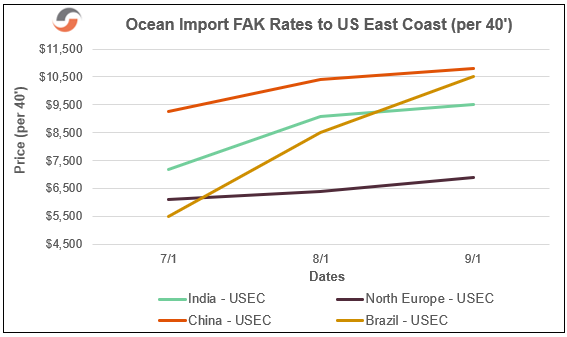

Ocean Import FAK Rates to US East Coast (per 40’):

Our Expert Shapinion

On Labor Day, we at Shapiro pay tribute to all of you in the international supply chain. We know you have all said, “make the ride stop!” more than a few hundred times since 2020.

For this issue, however, we will single out a few of the most dangerous and sometimes most thankless jobs in the physical supply chain. We’d like you to imagine you are listening directly to the voices and stories of three individuals— the Seafarer, the Drayman, and the Longshoreman.

The Seafarer

I got into this profession to see the world and live a life of adventure despite the very modest wages. Yes, my 1.7M brothers and sister sailors on 50,000 merchant ships risk our lives with typhoons, hurricanes, pirates, and the incredible weight and force of potentially shifting containers and cargo. That said, we also enjoy the sunshine and the pure beauty of the ocean while visiting exotic lands, cultures, and peoples. And, our crewmates – though most typically from the Philippines or China – are a true melting pot of the people of the Earth.

The job requires bravery, agility, and finesse, and ships sail 24 hours a day, 7-days-a-week. We work long shifts every day while on a 3-month contract (typically), but then we (typically) have a long period of rest at home or in some new exotic port. That is until COVID-19 hit.

Today, many of us do not get relief after 3 months. Replacement crews may be sick or in quarantine; foreign ports often do not allow us off our vessel. The average seafarer is now working 6-month cycles or longer. With fatigue comes mistakes and physical danger.

A heartbreaking 200,000 seafarers are classified as “abandoned” by unscrupulous ship owners. These ship owners would not be the famous steamship line names you know well, but there is a huge network of feeder vessels, bulk ships, and other key assets in the global supply chain. The saddest moment for me personally was when we docked at my home port, and I was not permitted to enter the country amid COVID concerns. I couldn’t make it to my favorite nephew’s wedding, nor my grandmother’s funeral.

What bothers seafarers the most is that 90% of world trade depends on us, and we do not feel respected. We are not considered essential workers because we are in an “out of sight, out of mind” profession, and governments do not prioritize our health and well-being. We are all but forgotten. Only 2.5% of us are vaccinated, and the world should be very worried about the availability of trained and skilled labor for seafarers, both officers and ratings. After all, many of us must leave our beloved profession after our deep personal suffering in 2020 and into 2021.

The Drayman

Like the average American trucker, I am a 55-year-old man, and I’ve been driving for over 20 years. Fortunately for me, I own my rig and it meets local pollution standards. I can tell you that a whole bunch of truckers are on lease-to-own programs or drive company-owned assets. While most trucking companies out there are honest and fair, that isn’t always the case. I’ve heard horror stories about guys getting fired near the end of a lease-to-own and losing the truck investment and the job in one fell swoop.

Like seafarers, most of us got into this business for the potential of freedom and travel. There is just nothing quite as beautiful as a sunrise or sunset on the open road. Also, the drayage industry attracts recent immigrants to a high degree, and I have friends from every Central American country and a bunch from Eastern Europe, too. I wish there were more women in the business, but we are a colorful bunch of hard workers with crazy true stories of the road.

Despite the hours and time away from my family, I was doing okay until 2020. First, the business completely dried up, and I had to deplete my savings. Then, the business came back…and came back, and came back; now, we have gone from a complete drought to a flood of work. You’d think this is a good thing for my fellow dray truckers and myself. Here’s the rub: we dray guys count on port turns for our income, and we get an hourly pittance for time spent fetching chassis and empties. Port and rail congestion has my industry averaging 50% of our typical turns, and what we all call “equipment control” ain’t controlled at all.

Frankly, I see ocean carriers, forwarders, and even retailers making a killing in the cargo surge, and, despite huge rate hikes, I can’t make the turns per day to keep my income where I need it. During COVID, I can’t find a place to eat or even a bathroom for God’s sake! And, every state, every port, and every loading dock has different rules and interpretations of COVID protocol. If it sounds like I am whining, I’m not done yet! We also get stuck fighting about demurrage and per diem when carriers won’t even allow me to bring home the empty or chassis or both.

So, I mentioned that I am 55, and that is the industry average. Women are only 6.7% of the power picture in drayage. Recent immigration policies have slowed the potential employment pool. Maybe recruiting returning military vets will help, but we are in a driver supply crisis. By the end of 2021, they estimate that we will have a shortage of truck drivers of 100,000!

Fewer commercial driver’s licenses are in place today than in 2019. Why is that? Because people can find better pay, less aggravation, and jobs that get them home every night… that’s why. Even guys like me who won’t leave the dray business can be picky on routes these days. I can limit my interstate moves and get home more. At the end of the day, nobody seems too worried about the dray business. Hell, I struggle to get a delivery ticket signed at warehouses in under 30 mins. Why would that be?

The Longshoreman

Some of you won’t be happy with Shapiro for including me. Look, let’s get this out in the open right here. Longshoreman and stevedores are a controversial population in the US supply chain, and we know it. But we aren’t the ones buying a new fridge or sofa or treadmill; you consumers are doing that! And we aren’t the ones building bigger and bigger vessels without any real consideration of land-side infrastructure and realities; you ocean carriers are doing that!

What we see and endure is all but invisible. In 2020, we had to work with skeleton crews as COVID swept through our ranks, and many back-ups just lack the experience and training to be as effective as a veteran like me. As the demand for imports surges (and surges), we have less room to operate on port, and that is a good recipe for accidents. Oh, and don’t get me started about people on cell phones on the port; you dray guys can’t make your turns, so you are calling dispatch, but I need you to look up and see those stop signs and dock workers in front of you!

COVID also forced us to social distance, test regularly, and sometimes quarantine. Our operations have been perfected and tested for decades, and now we are playing a new game entirely. At the end of the day, we are not happy to see 40 vessels outside LA or 20 outside Savannah, but a closer look reveals port productivity stats of 150% or higher compared to historical averages. And the faster we work, the more dangerous it gets, people. Also, as we utilize our cranes and equipment more during the surge, it breaks down and needs maintenance much more often. So, even the highly automated Rotterdam is struggling badly during COVID.

We are all closely watching the ILWU negotiations as we head into 2022, but it is just too easy to blame longshoremen and our unions for port congestion. The US system was not built for this kind of demand, and the ocean vessels are not hitting ports when they say they will, and the warehouses/truckers/railroads can’t even move what we do off-load. We feel like the last guy holding the bag, and that makes us vulnerable to criticism and blame.

Happy Labor Day, All!

We at Shapiro thank our “eyewitnesses,” and we thank all of you for taking a moment to think about those in the line of fire along the physical supply chain. We may all have opinions, political and otherwise, but I’m pretty sure that we all realize that it takes all of us to keep the cargo and the economy moving, no matter the size of the hill or mountain in front of us.

Shap Fact of the Issue:

Before 1980, the US Federal Government never spent more than $550B in a budget year; however, the announced $550B US infrastructure increase will be far less than 10% of government spending in the next fiscal budget.

The leadership and staff of Shapiro understand the personal and business anxiety each of you is experiencing. We want nothing but safety and a return to normalcy for you and your families. Please reach out to us if you have any questions—or if we can assist you in any way.