More Global Shipping Delays after Suez Canal Saga

Supply Chain Reactions

A Condensed Update For American Shippers

Issue Date: May 26, 2021

Quote of the Issue:

“Here comes the sun, and I say, it’s all right.”

– George Harrison

Who Says the Suez is Done Wrecking Progress for Global Shipping?

ShapLight Focus: An estimated 40% of all global ocean bookings were delayed or rolled in May; although there are no recorded statistics for global delays, this is thought to be the highest rate in history

- In May, the Asia-to-US trade saw 20% of total capacity removed from the marketplace through blank sailings

- The 2M has announced three consecutive weeks of blank sailings on key East Coast and Gulf services for June in an attempt to get their global vessel rotations back in order following the “Suez Hot Mess”

- European exports to the US have quietly increased by 15% YTD in 2021; with all available capacity aimed at Asia to Europe and Asia to North America, prices are expected to rise considerably

- 2021 Steamship Profit Highlights:

- Maersk reported a Q1 net profit of $2.72B; which is 1295% better than Q1 2020

- COSCO reported a $2.39B Q1 profit; this is 3883% better than Q1 2020

- Hapag Lloyd reported an improvement of 1423% Q over Q in 2021 for a total profit of $1.45B

- Just as Los Angeles/Long Beach (LA/LGB) begins to clear backlogs, the port of Oakland is regularly seeing 20+ vessels adrift and 10-15 vessels at anchor

- Speaking of LA/LGB, the port complexes in Southern CaIifornia have averaged 135% more volume in the last 10 months vs. the 10 months prior; based on today’s productivity standards, LA/LGB will maximize their total capacity – 23-25 million TEU/year – by 2027

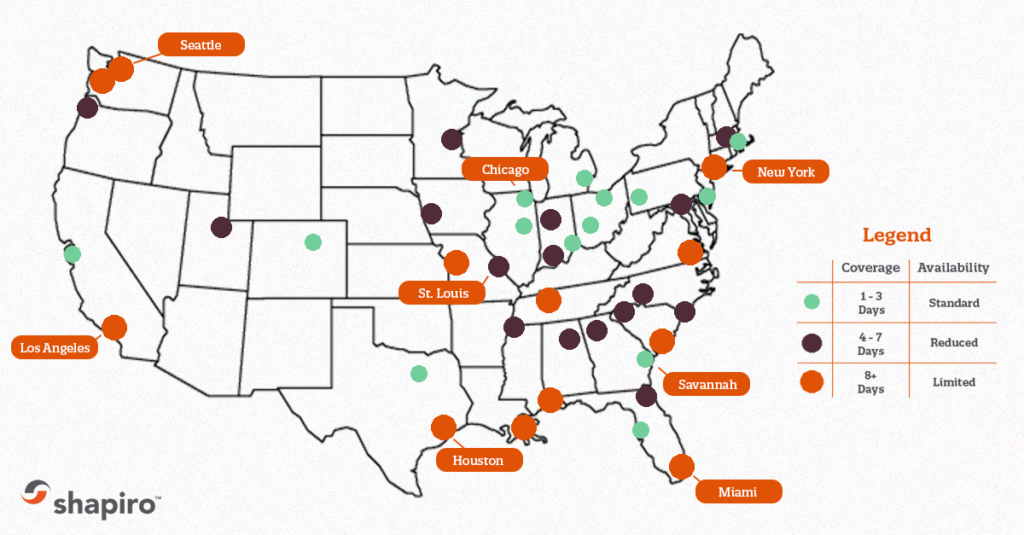

Please note our map of average dwell times throughout US Ports below:

Gov Corner: Importers Await GSP and MTB Renewals

ShapLight Focus: Ron Wyden, The Chairman of the Senate Finance Committee, has announced that he will introduce a bill to renew the Generalized System of Preferences (GSP) program through January 1, 2027 and the Miscellaneous Tariff Bill (MTB) through the end of 2023; though the implementation dates are not yet known, both renewals are expected to be retroactive

- While the trade applauds these long-awaited renewals, the bill is expected to establish new eligibility requirements connected to human rights, environmental protection, women’s economic empowerment, the rule of law, and digital trade; as a result, importers will likely scramble to understand the new mandatory and discretionary criteria rules

- Industry insiders have speculated that the U.S. Trade Representative (USTR) will reopen the exclusion process in 2021, however it is unlikely that full implementation could occur before 2022

- U.S. Customs and Border Protection’s (CBP) protest processing staff continue to be overwhelmed with volume; any reinstatement of Section 301 exclusions will provoke longer periods of administrative delays

- In 2020, CBP processed 27,000 protests covering 72,000 entries; the protest volume has not slowed in 2021

Air Cargo Expected to Generate over $150B in 2021

ShapLight Focus: After 27% revenue growth in 2020, the International Air Transport Association (IATA) expects airlines to improve air cargo profits by an additional 19% in 2021; industry growth from $100B to $150B in two years represents a 50% spike overall, which is some much-needed good news for the beleaguered airline industry

- Look out, world! Airlines in Asia are bracing for a demand surge as Apple eyes an October launch for their new iPhone

- Amazingly, it is estimated that up to 8% of air cargo weight comes from documentation (!); this is perhaps the most compelling reason to push for a paperless environment

- International courier prices have shot up 30%, while realized transits are averaging 200% longer in 2021 compared to 2019

- It’s expected that airlines will push for continued liberalization of traffic rights for foreign airlines; relaxation of regulations has aided global vaccine distribution, which airlines see as a path for improved ecommerce service in the future

- In 2021, IATA expects air cargo to account for 33% of airline revenue; this number is far lower than 2020, but remains very high from a historical perspective

Please note our map of average dwell times throughout US Ports below:

Surface Freight Surge Just Scratches the Surface for Truckers

ShapLight Focus: Drayage firms in Chicago, Dallas, Kansas City, and Memphis are experiencing driver turnover rates of 25%, with driver pay down almost 20% due to dramatically decreased productivity leading to fewer daily turns

- Across the country, dray rates are spiking as firms work to increase driver pay per load; while rail and port congestion are horrific, the dray industry indicates that the lack of chassis and chassis splits are by far the worst problems facing the industry

- Full Truckload (FTL) rates have hit a ten-year high and are now 80% higher than a year ago; the increase in FTL rates also draws drivers from drayage to FTL

- Demand for all trucking modes combined is up 35% in 2021 YTD

- Contract and spot pricing for FTL have been near parity for four months running; while contract shippers are not currently incentivized on price, a shift to more contract purchasing is expected this summer as the market stabilizes

- For April and May, the four largest railroads (CSX, Norfolk Southern, Union Pacific, and BNSF) have experienced approximately 30% volume growth compared to 2020

- The Cass Freight Index – comprised of 50% FTL, 25% LTL (Less Than Truckload), and 25% Other (including drayage) – measures North American trucking activity by number of shipments; analysts expect 2021 to compete with 2018 as the busiest year on record, despite an April dip caused by congestion and decreased industry efficiency

Chart of the Issue:

Ocean Freight Import Rate Trend Charts

Ocean Import FAK Rates to US West Coast (per 40’):

Ocean Import FAK Rates to US East Coast (per 40’):

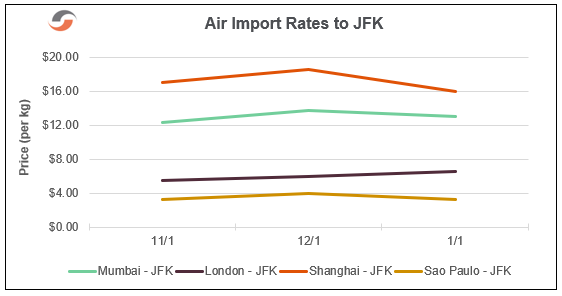

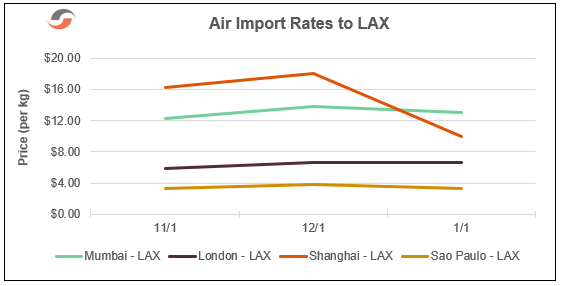

Air Rate Trends

Our Expert Shapinion

In 1950, the Magic 8 Ball hit shelves for the first time in the United States; this makes the magical icosahedron six years older than the era of cargo containerization.

How many of us predicted that we would ALL buy appliances, furniture, and exercise bikes?! How many of us foresaw the Empire State Building blocking the Suez Canal?!

How many of us thought we would EVER pay $10,000 to move $15,000 worth of goods?!

Nobody. Nadie. Niemand. Personne. Méiyǒu rén.

At that rate, we might as well use a Magic 8 Ball to predict the coming freight realities in 2021 and 2022. Hey, that’s not a bad idea… I mean it is filled with blue liquid like the ocean!

Oh, and before any of you market prognosticators scoff, 328 million Magic 8 Balls have been sold since 1950. That’s one for every US citizen – come on, we know you have one in the back of that brand new dresser, wardrobe, or filing cabinet…!

Question #1: Will the NITL Succeed in Reforming the Shipping Act?

Context: The National Industrial Transportation League (NITL) has submitted several proposed reforms to the Shipping Act of 1984 to better protect importers on demurrage/detention, booking commitments, equipment availability, and a clear process to file carrier complaints. Not surprisingly, the World Shipping Council (WSC), which represents the steamship industry (an industry well-protected by antitrust immunity) said, “…there is no legislative policy that can change the systemic physical challenges caused by the COVID-19 cargo crunch.”

2 Shakes of the Magic 8 Ball: 1. Don’t count on it. 2. My sources say no.

Question #2: Will My Service Contracts Provide Me with Enough Allocation?

Context: In 2020, most importers were essentially abandoned by ocean carriers if they did not agree to the infamous “mutually agreed” PSS (peak season surcharge). For 2021 contract negotiations, the vast majority of deals are openly subject to PSS, and the carriers trimmed MQC (minimum quantity commitment) for unfavorable lanes and cargoes.

2 Shakes of the Magic 8 Ball: 1. Reply hazy, try again. 2. Ask again later.

Question #3: Will I Be Paying Close to FAK Levels on My Service Contracts?

Context: Pundits estimate that 50% of the current market is moving on “premium” rate levels, with the rest of the market split between contracts and FAK (Freight All Kinds). This will put tremendous pressure on the PSS clauses of most contracts, and we have already seen FAK spike in May.

2 Shakes of the Magic 8 Ball: 1. Signs point to yes. 2. It is decidedly so.

Question #4: Can I At Least Expect a Return to Normal Drayage?

Context: Dray turns are down 25-50% across the country thanks to equipment scarcity, port congestion, and splits. Dray turns “drive” driver pay. At the same time, the FTL business is booming in volume and rates; watch those draymen RUN to the FTL side of the house!

2 Shakes of the Magic 8 Ball: 1. My reply is no. 2. My reply is no!

Question #5: Will there be Labor Trouble in LA/LGB within Months?

Context: Dray turns are down 25-50% across the country thanks to equipment scarcity, port congestion, and splits. Dray turns “drive” driver pay. At the same time, the FTL business is booming in volume and rates; watch those draymen RUN to the FTL side of the house!

2 Shakes of the Magic 8 Ball: 1. You may rely on it 2. Without a doubt.

Question #6: But Airfreight Rates Will Finally Come Down…Right?!

Context: YTD 2021 airfreight demand is about 16% higher than 2019, while passenger belly capacity is very slowly increasing. At the same time, the industry has only increased cargo flights by 2.74% in a year. Oh, and here comes the next iPhone in October!

2 Shakes of the Magic 8 Ball: 1. Outlook not so good. 2. Very doubtful.

Question #7: Will China Continue to Rebound for US Import Share?

Context: Despite tremendous tariff and freight cost headwinds, China got back to 2018 import volumes to the US in 2020. With cargo backlogs and pandemic-related production problems in many other countries, China is poised to be a go-to production location for years to come.

2 Shakes of the Magic 8 Ball: Yes, definitely. 2. Outlook good.

Question #8: Will US Shippers Fare Better on Freight Budgets in 2021?

Context: Despite tremendous tariff and freight cost headwinds, China got back to 2018 import volumes to the US in 2020. With cargo backlogs and pandemic-related production problems in many other countries, China is poised to be a go-to production location for years to come.

2 Shakes of the Magic 8 Ball: Yes, definitely. 2. Outlook good.

Shap Fact of the Issue:

In 2020, Americans set a record by giving $471B to many diverse charities. While full data will not be available until April, many financial observers expect the US to shatter this record once all data is collected for 2021.

The leadership and staff of Shapiro understand the personal and business anxiety each of you is experiencing. We want nothing but safety today and a return to normalcy tomorrow for you and your families. Please reach out to us if you have any questions—or if we can assist you in any way.